Service Bundles Can’t Get Between the Content, Viewer

We don’t care what you say, a well-executed con is a beautiful thing.

You know, like in The Sting and Catch Me If You Can.

A poorly executed con is sad.

A good con person knows they’re a con and are conning.

A bad con person fumbles through the con. Sometimes they don’t even realize they’re really doing it or that they’re doing it so badly.

For example:

- Cut your cord and sign up for 100s of TV channels, 1000s of movies with YouTube TV for only $70

- AT&T/Warner/HBO bundle over 5G

Make them into movies and they won’t even rate one Rotten Tomato!

The storylines are weak. Not even Quentin Tarantino or Spike Lee could save ‘em.

But then, some folks just like a bad con.

Born Online

A company born online should know better…even when you cut the cable, you don’t really cut the cable.

You need a pipe to deliver the content to your screen (Internet service) and that’s usually around $30 in the US.

So, you cut your cable bundle to save money, knowing there were tons of channels you didn’t watch/wouldn’t watch.

But YouTube TV tells you they’ll give you tons of channels, shows and movies. Then they raise their price because they added even more channels for you.

Or, as they said, We at YouTube TV license content from our content providers to then provide to you. When content prices increase, the overall cost of streaming goes up for everyone.

Gee that’s an…I don’t give a crap reason!

Wait, they’re YouTube, part of Google, so they already know everything about us (and probably more).

They should know we didn’t want those channels since we cut the cable bundle to save money and access stuff we actually watch.

Then there are the real ad-supported services (and there are hundreds). But right now, we only use two of them – Pluto, Tubi.

However, let’s be fair:

- YouTube TV has roughly 2M suckers (ooppss subscribers), 2B “regular” monthly YouTube users and is owned by an ad/data company

- Viacom’s Pluto TV has 22M and is owned by a content company, Tubi has 25M and is also owned by a content company

- Even though Google is global, YouTube TV tells you how to set up a VPN (virtual private network) to watch stuff outside the US

- Pluto and Tubi are both expanding internationally, negotiating government/channel deals

- YouTube TV has 85 channels + movies, Pluto has 200 channels + movies, Tubi has “a bunch” of channels + movies

- YouTube TV ads are pretty similar to YouTube ads … there

- Pluto and Tubi ads are infrequent and … short

- All three need an internet connection

- YouTube TV is $70 with ads

- Pluto, Tubi cost…

We’re not against subscriptions.

We have four that are nothing but content.

We’re not against ads – love ‘em actually.

And we like the idea that they underwrite the cost of our content for the privilege of peeking at our data and appearing on our screen.

The data stuff is important – ethically used – and don’t kid yourself…everyone does it!

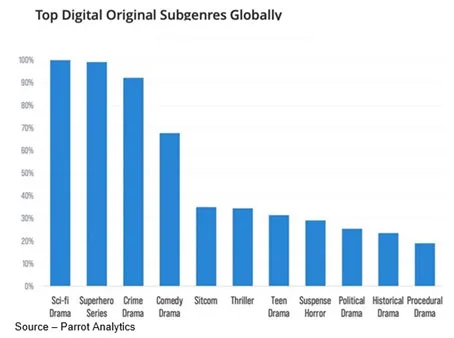

Our/your data lets services like Netflix, Disney +, Amazon Prime, Apple TV +, Tencent, Hotstar, Zoot, Pooq, Hooq, Alibaba, OSN Go, Icflix and others develop/acquire and offer content that we’ll probably want to watch (or maybe should).

The data – combined with experience, others’ advice and a gut feeling – makes it easier for folks to bet huge sums of money on a show’s success or failure.

Data collected by folks like Pluto and Tubi help them suggest shows and ensure you receive ads on products/service you’re interested in (or should be) so, you watch instead of hitting the refrigerator.

For both services, the idea is stickiness — keep you entertained — so you don’t click, flick to someone else’s service.

And don’t think of today’s streaming ads as being like your old pay-tv stuff. Streaming ads are shorter (usually 5-30 seconds) and far fewer (3-10 minutes of ads/hr.), not the pay-tv 20 minute/hr. block.

Yes, it’s a convoluted storyline and you’ll fall asleep before the movie ends.

Born the Line

Ever since it was broken up in 1984 because it was too big, AT&T bosses seem to have had one focus – get all of the marbles plus back in the jar.

Being a wired, wireless POTS (plain old telephone service) was profitable but dull so they bought a bunch of ISPs (internet service providers).

Still dull, they added a vMVPD (virtual multichannel video programming distributor) called DishTV for $48.5B, which is going nowhere fast.

To add glamour, AT&T decided to jump into the deep end of the entertainment pool and snapped up Times Warner, adding $85B to its debt load.

Don’t forget it still wants to be a big MVNO (mobile virtual network operator), which means a huge investment in 5G technology.

AT&T jumped to the head of the pack by showing folks that their phones were already using 5Ge (eventually).

As former FCC Chairman Michael Powell recently said in expressing skepticism over the wireless industry’s hype, “5G is 25 percent technology, 75 percent marketing.”

While there are a few 5G hotspots in the US, telcos around the globe are building out their 5G infrastructure but backhauls – everything between the cell site and mobile core – are predominantly 4G LTE.

And the network is no faster than its weakest link (4G or…) so…

It’s really all about latency and high-speed connectivity, which is important when your car is whizzing down the road at 65mph plus or you’re busy playing games.

Not sure how much faster we can watch our shows, but the story will make another sad con person movie!

While the truth is elusive, and make-believe steals the show, filmmakers and visual storytellers know they have to weave a tale that resonates with the audience.

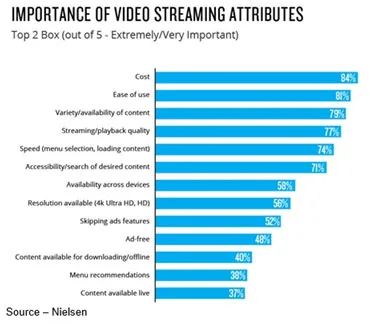

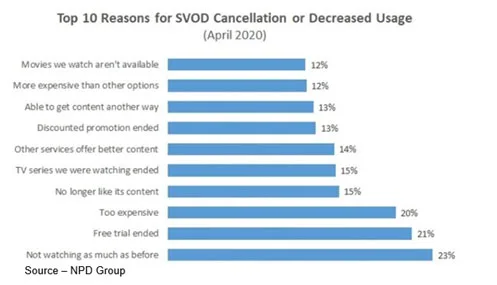

Not surprising is the fact that the first thing that catches the viewers’ eyes is cost.

Remember, they began cord-cutting and moved to streaming to get away from the all-or-nothing world and rationalized the move on price.

Next up was the “right” content people wanted to watch in their living room and on all of their screens.

Netflix set the benchmark here on original content with a rich library of content and the ability and commitment to make an initial and ongoing investment in delivering that content.

To satisfy the varied entertainment hunger of the “new” audience, Amazon Prime; Disney +; Apple TV +; CBS All Access and hundreds of local, regional services around the globe set up their enticingly priced D2C content offerings.

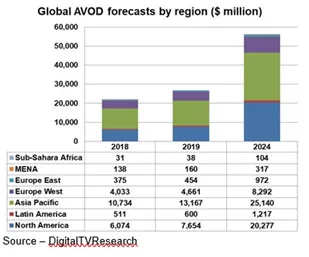

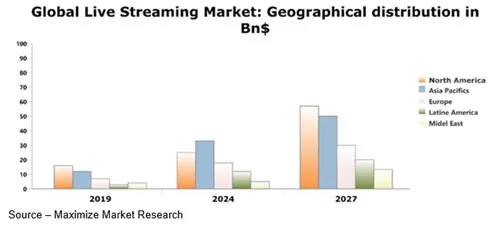

While OTT may have gotten its start in the US, it is far from being an American market.

Grand View Research projects the global streaming market will be worth $184.2B by 2027, a CAGR of 20.4 percent over this year and more than 1,239M viewers by 2023.

Digital TV Research projects there will be more than 417M APAC subscribers in five years with 269M in China and 45M in India.

China’s Tencent, IQiyi and Youku Tudou, along with Netflix and Disney+, will be the dominant viewing platforms.

Hotstar (Disney) is the most subscribed OTT service in India followed by Netflix, Sony LIV, Olly Plus, Amazon Prime, Voot. Eros Now and other Bollywood services.

While the average streaming household is willing to subscribe to more than one service, it is becoming increasingly apparent that their subscription ceiling will be four and the price in the US is $50-$60 per month.

If a new, appealing service comes along, people may expand their SVOD budget; but more than likely, they will cancel an existing service contributing to the market’s churn (cancel/don’t renew), which rose to 40 percent during the first quarter of this year.

With a constant stream of customer-interest shows/movies, Netflix has been able to minimize cancellations to about 11 percent of their subscription base (we told you that data was valuable), so they have been able to focus on new users around the globe.

Disney with its globally recognizable IP, rapid international expansion, ability to bundle Hulu and ESPN+ in the US and eye-watering set of cross-ecosystem marketing strategies provides a pleasant companion streaming service for consumers almost everywhere.

To increase their growth in international markets, both services are aggressively adding local content (which appeal globally) and expanding their dubbing and subscripting visual stories.

As Susanne Daniels, YouTube’s global head of original content said, “Unless you have sports or iconic Disney titles, people don’t realize how hard it is to build an OTT service.”

She noted that it is extraordinarily difficult and requires deep resources.

You know, a lot like Comcast and the other cable companies have done.

Brian Roberts, Comcast CEO, has already pivoted to a broadband-centric service company with fiber and cable to more than 58M homes/businesses in the US in 39 states as well as Sky, Europe’s largest cable service.

The company’s entertainment arm, NBCUniversal, has also rolled out subscription and free versions of the Peacock streaming service; and yes, with fewer ads – five minutes per hour.

Oh yeah, according to Pew Research, they’ll still offer their cable bundle service because 59 percent of Americans still use their cable connection for watching TV and 35 percent still like some normalcy in their lives like day/time news/shows.

Entertainment options will continue to proliferate, even as they become more individualized, because of the improvement of personal data analysis and utilization.

Entertainment options will continue to proliferate, even as they become more individualized, because of the improvement of personal data analysis and utilization.

At that point, services will take a back seat to the content you’re interested in–even when you don’t know you’re interested.

The winners will be the organizations that watch and listen to the viewer instead of focusing on themselves.

Ultimately, the consumer will arrive at the same conclusion as Adrienne Hunt in If Beale Street Could Talk and will say, “I can believe you’re that malicious, but I cannot believe you’re that stupid.”

# # #

Andy Marken – [email protected] – is an author of more than 600 articles on management, marketing, communications and industry trends in media & entertainment, as well as consumer electronics, software and applications. An internationally recognized marketing/communications consultant with a broad range of technical and industry expertise in storage, storage management and film/video production fields; he has an extended range of relationships with business, industry trade press, online media and industry analysts/consultants.