M&E shifts to encouraging, relating to the real world

Between the pandemic and M&E heavy hitters/wanna bes racing to capture their unfair share of the new consumer entertainment pot of gold, people at every level have been busy refreshing their resumes.

You can almost smell the fear, smell the blood.

Theaters are struggling with their reopening and talking hot/heavy to remain relevant.

Content producers/aggregators are checking their cellphone directories to see if numbers are still active.

Studios and networks wonder if they’re coming to the streaming table to eat or be eaten.

Agents simply wonder WTF.

Even the Hollywood Hills sign wonders how long before its lights go out.

Even the Hollywood Hills sign wonders how long before its lights go out.

No, the industry isn’t struggling financially.

PwC reported recently that the US entertainment market would surpass $825B this year including global content creators, multichannel video programming distributors, digital stores and streaming platforms.

In total, they represent more than a third of the global content industry revenue encompassing AVOD (ad-supported), SVOD (subscription) and D2C.

Over the past year, the major entertainment conglomerates – Disney, Warner Media, ViacomCBS, Comcast/NBCUniversal – as well studios/networks around the globe have undergone significant restructuring to address the changing market and consumer demands.

It’s easy to point the finger of blame for the upheaval because things had rules guys understood (it was basically a guy’s game) with agents, producers, directors, studio heads, actors ruling the glamour hood “peacefully” parceling out scripts/workload to the indie crews and prepping content for theaters and TV channels.

When they needed tools to make projects look better and be more profitable, they called on Silicon Valley techies.

Google dabbled in content with YouTube and Zuck had Facebook copy the DIY entertainment scheme.

They, and a few others, were great at attracting eyeballs and selling ads … that’s about it.

But with the two firm’s direct connection with consumers, tech companies saw a new opportunity.

Tired of renting content and licking envelopes, Netflix moved to take content direct to subscribers over the internet and then control its complete ecosystem – content production, distribution and customer relationships.

In the far north (Seattle), Bezos figured Amazon customers wanted more than packages delivered to their doorstep, so the company started Amazon Prime and bought IMDb.

In “a few years,” Netflix has attracted roughly 190M around the globe, thanks to a heavy investment in content and international relationships.

Amazon Prime soon said 150M free package folks were also video subscribers to its expanding visual story library.

Even before the beginning of 2020, the entertainment majors realized people were willing to abandon appointment TV for anytime, anyplace, ad-free viewing.

They wanted “their” industry back!

The slam down of the pandemic, dwindling pay TV numbers and the closure of theaters changed the nicety of a change to a necessity.

Taking a page from the Netflix book, M&E players saw a new way to streamline the global entertainment infrastructure (content creation/development/distribution) to a bundle-weary direct audience.

At the same time, the players had to openly/aggressively address the industry’s issues of diversity, inclusion … head on.

New organizations and new focus could accomplish both.

Long-time executives were fired, stepped down (fired), retired (fired); organization charts were shredded; new/different people/talents were onboarded.

To reduce massive overhead debt and non-core departments; activities were sold off, shuttered or spun out to fend for themselves.

The message(s) were clear – change or be changed – not just in the US, the largest entertainment market, but also in China (second largest) and every region around the globe.

Almost overnight, the streaming industry suddenly became crowded – very crowded – with participants that include ViacomCBS, CBS All Access, Paramount +, Disney +, Hulu, ESPN +, WarnerMedia/HBO All Access/HBO Max, Youku, Comcast/NBCUniversal, Pluto TV, Tubi, iQiyi, Amazon, BritBox, Netflix, Apple TV +, Tencent Video, Hotstar (Disney), Voot, ALTBalaji, Mubi, Acorn, Starzplay, Jawwy, OSN, Shadid, Telemundo, and hundreds of small to mid-size streaming services … everywhere!

The demand around the globe is as insatiable as it is varied.

Last year, Disney was perhaps the first entertainment conglomerate to make the streaming shift, putting all of its content and attention on streaming media and entertainment.

With its share of staff departures, CEO Bob Chapek has assembled an international team and given it the decision power to shape the company’s future.

In less than a year, the “easy going” Mouse House had transformed into a savvy streaming service with a content library that includes Disney, ABC, Pixar, Marvel, Star wars, FX, Hulu and more to compete with its tech counterparts – Netflix, Amazon.

So far, by focusing on the long game moving idled tentpoles to its Disney+, Hulu and ESPN Plus services; it has executed flawlessly with more than 100M global subscribers, surpassing its initial goal of 45M by 2024.

Disney isn’t alone in shedding yesterday’s Hollywood-hidden problems to focus on becoming entertainment businesses.

Saddled with more than $153B long-term debt to acquire WarnerMedia and other content assets, AT&T underwent major executive changes – John Stankey as AT&T CEO and Hulu’s Jason Kilar as WarnerMedia’s CEO.

It hasn’t been easy to simultaneously slim down and beef up their entertainment divisions (including cable TV and film) into a “gotta-have,” profitable streaming source.

The new entity, HBO Max, has seen modest growth compared to its cable linear channel and free/subscription competition.

At the same time, the company’s parent is investing heavily in its home/mobile 5G infrastructure.

Comcast/NBCUniversal is unique in that it’s the largest cable service provider (including its addition of Sky satellite TV, broadband and mobile service).

While cable TV bundles are dwindling in the US, they are expected to be slightly above 1B subscriptions globally by 2025 (thanks to sports, news).

In addition, the Internet backbone service is remarkably profitable and is expected to grow as people choose their new entertainment source(s).

Bundle, no bundle they provide the last mile to your screen.

Comcast’s NBCUniversal (renamed Peacock) undertook a major reorganization to focus on streaming service and content with a range of customer pricing including ad-supported, ad subsidy and subscription.

The company has an established family of broadcast networks – NBC, USA, Bravo, and international as well as sporting contracts which can deliver major advertising revenues.

ViacomCBS is both the oldest and youngest player in the streaming industry having launched its subscription service in 2014 and after the long-anticipated merger of the two, shuffled people and products to relaunch/relabel itself as Paramount +.

Behind the camera, the company has been realigning its core properties – BET, Nickelodeon, CBS, MTV, Showtime and other international entities – to expand its global streaming penetration.

At the same time, the company’s ad-supported PlutoTV (30M subscribers) has been growing in Europe and Latin America with more than 250 channels and thousands of movies.

Attracting folks with free/subsidy content isn’t easy.

But what about Asia?

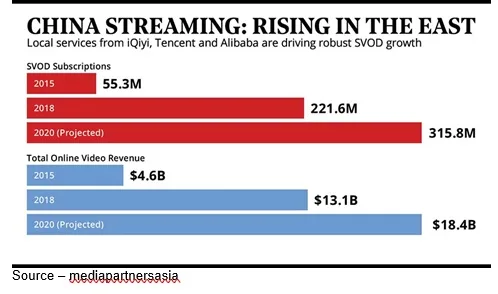

China’s streaming content market is viewed with lust by nearly every A/SVOD service because it is both massive (320M subscribers) and has a market estimated to be worth more than $18B. Its market is shared primarily by iQiyi, Tencent Video, Youku and is “protected” by the Chinese government.

It is projected to grow at a CAGR of 5.4 percent to be a $70B industry by 2024.

Known to relish free content, OTT streamers have seen a growth of 60-80 percent this year with Indian subscribers by serving up original content, acquiring shows/films and offering more flexible pricing packages.

Mobile and home screens have enabled Disney/Hotstar to sign up more than 63M subscribers, Netflix more than 11M and Amazon more than 14M in what is quickly becoming the Asia Pacific’s second largest subscription TV market.

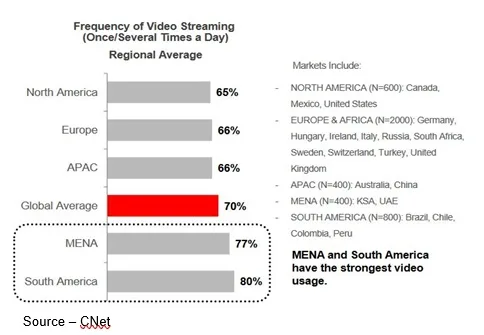

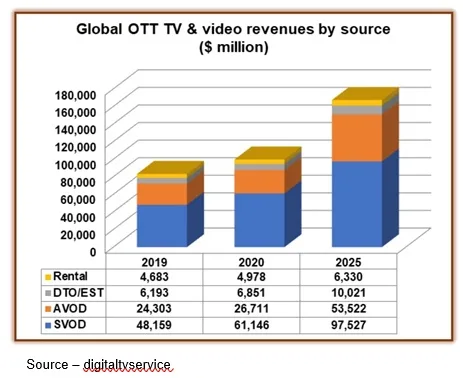

Streaming is rapidly becoming the new norm for entertainment according to Digital TV Research.

Revenues doubled the 2019 ($83B) amount with an estimated $16B added this year.

SVOD dominates the market with more than $98B projected by 2025 (58 percent of the market total).

AVOD is becoming a credible viewing option for people who are willing to watch three to four minutes of ads an hour for their entertainment. Free content viewing is expected to grow to more than $54B by 2025.

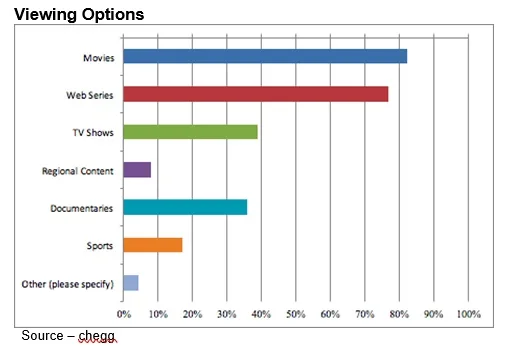

Streaming is now taking a major portion of household entertainment time with Netflix, Disney +, Amazon, Hulu and YouTube accounting for about 75 percent of the viewing hours as others face the long tail of viewer reach.

According to Comscore, now that the “newness” has worn off anytime/anyplace/any screen entertainment, consumers have narrowed their entertainment budget to four SVOD services and supplemented it with one (or rotating) AVOD service.

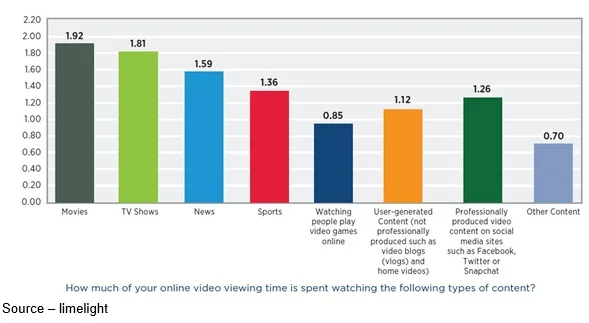

Original programming, variety, mobility and ease of locating desired content continue to be the most important selection criteria for staying with or replacing a streaming service.

That means services growth will continue to require a significant investment in acquiring and producing new and unique content from filmmakers around the globe.

But as Edward R. Murrow observed, the flickering tube can do so much more than simply entertain, amuse and insulate when he said, “This instrument can teach, it can illuminate; yes, and it can even inspire. But it can do so only to the extent that humans are determined to use it to those ends.”

But as Edward R. Murrow observed, the flickering tube can do so much more than simply entertain, amuse and insulate when he said, “This instrument can teach, it can illuminate; yes, and it can even inspire. But it can do so only to the extent that humans are determined to use it to those ends.”

That can only be achieved by the M&E industry strongly committing to diversity and inclusion throughout the ecosystem, leading by example and making it become the natural order of things.

# # #

Andy Marken – [email protected] – is an author of more than 700 articles on management, marketing, communications, industry trends in media & entertainment, consumer electronics, software and applications. An internationally recognized marketing/communications consultant with a broad range of technical and industry expertise especially in storage, storage management and film/video production fields; he has an extended range of relationships with business, industry trade press, online media and industry analysts/consultants.