Media & Entertainment Has Become the New Wild West

Change is taking place in every corner of the M&E industry.

It would be nice if we could blame the chaos on FAANG (Facebook, Amazon, Apple, Netflix, Google) and BAT (Baidu, Alibaba, Tencent), but it’s not that simple.

Suddenly, we have an embarrassment of riches – content, channels, screens, audience – and no one is certain how to make money off it.

But everyone is sure the direction they’re taking is the right one.

We just found out:

- 8B Devices WW are video-capable of streaming video

- 2B people WW have Internet Access

- TV households will reach 1.68B WW by 2021

- SVOD households will rise to 383M WW by 2021

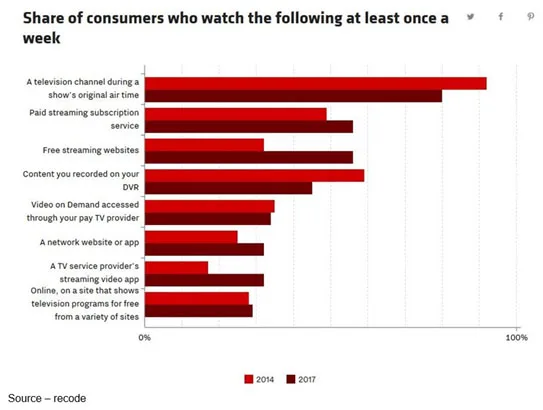

- 75 percent of people stream content several times a week

- 40 percent of the terrestrial TV ratings drop is attributed to Netflix, Amazon, Hulu

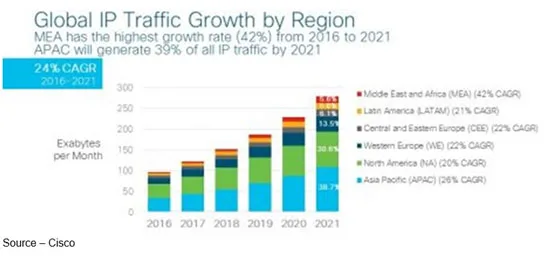

- By 2019 80 percent of WW Internet traffic will be video

- TV and OTT (over the top) are becoming synonymous

- Consumers can identify shows, not networks

- A more segmented, personalized TV and video landscape is emerging

The only way to accurately describe the state of today’s M&E industry is to reread the opening line to Charles Dickens, “Tale of Two Cities” (1859):

It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair, we had everything before us, we had nothing before us, we were all going direct to Heaven, we were all going direct the other way—in short, the period was so far like the present period, that some of its noisiest authorities insisted on its being received, for good or for evil, in the superlative degree of comparison only.

New entrants to the industry are coming out of the woodwork. Consolidation is taking place around the globe.

No matter how content is distributed/consumed today, it’s rapidly migrating to IP (internet protocol) distribution and becoming simply TV.

Participants that survive (producers, service/infrastructure providers) must move to provide an end-to-end solution that will seamlessly provide appointment TV and IP-delivered OTT into an experience that meets each consumer’s expectation.

People aren’t ditching their cable/satellite TV providers as much some in the OTT industry would like you to believe.

Allan McLennan, CEO of PADEM Media Group, emphasized that the industry is in the midst of a seismic shift.

“The smart operators are making changes now,” he noted, “and will be providing new services that will capitalize on the volume of content that is being created today. They are busy building out aggregated services that will deliver the depth and length of content consumers are coming to expect.

“Consumers aren’t waiting for the networks and service providers to deliver,” he added. They are already putting together their own bundles and, in some cases, cutting back their terrestrial bundles and adding OTT offerings to meet their specific needs. The winners will be services that can provide an aggregation of each viewers personalized content via managed services across multiple platforms.”

Even though Comcast’s president Dave Watson has been known to say, “the economics of an out-of-footprint OTT TV service don’t hunt.”

Like the major cable companies around the globe, Comcast has gotten super creative (responsive) with their bundles including TV (full or smaller bundles), internet and phone at a single reduced price.

But you’ve had your cable contract for so damn long why bother changing when they’re now starting to be more accommodating?

In addition, they’re including extras that are “almost” free–especially when you consider you also get a DVR (digital video recorder) service; and in many instances in addition to live TV, they increasingly consort with the enemy giving you direct access to OTT channels like Netflix, Amazon Prime and Hulu Direct.

After all, Business is Business. Done and Done!

While AT&T has a lot of hurdles to jump in its effort to acquire Time Warner, Comcast’s bid for U.K.-based Sky could pave the way for them expand with a global entertainment footprint plus give them proprietary and valuable content.

The Comcast/Sky union could easily roll out skinny bundle OTT programming in Europe and eventually globally to include Premier League soccer, Universal, Disney films, HBO, NBCU and have a pretty decent channel people would/could find appealing.

Of course, there is nothing clear cut or assured about merger as AT&T, Time Warner and Broadcom will tell you.

The dog may not hunt … even if it wants to!

But, the new business model will enable them to do what Netflix has perfected; leverage data intelligence and AI to make better business, strategic decisions by understanding viewers’ habits and make recommendations that will keep folks happy.

How happy? Well on a decent day, Netflix’s 100M plus worldwide subscribers streamed 140M hours of video a day.

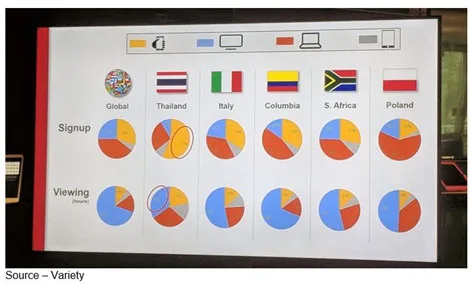

While mobile suppliers/services love touting that millennials and younger prefer watching their content on their smartphones, Netflix users don’t bare the “facts” out.

They may sign up for viewing on a smartphone, tablet, computer or TV; but usually the big screen is where the content ends up being consumed.

Scott Mirer, VP for device partner ecosystems at Netflix, noted that about 20 percent get their video fix on the phone and 50 percent will use them sometime during the month. But for day-in, day-out or serious binge viewing – 3-5 segments at one callous-driven sitting – it’s the TV.

While Netflix is known for its multi-million-dollar film and episodic purchases, they’re really the global internet TV firm that everyone wants to be. They approach the productions and distribution with the worldwide audience in mind.

But even before the productions, Netflix built out its own CDN (content delivery network), offering their premium service through more than 80 TV operators as well as strategically installing caching servers to ISPs (internet service providers) to offload their streaming data.

Like Akamai, Amazon’s AWS, Swarmify and others, the Netflix CDN distributes traffic to ensure consumers stream their HD and 4K content smoothly to every device nearly everywhere on the planet (except China, Syria and North Korea).

The heart of Netflix’s rapid success is their use of analytics to understand what folks want to watch better than they do themselves.

Of course, a cool secret like that is too good for any one company, so their algorithmic recommendations and personalized queues have been widely copied and are standard procedure for digital media distribution.

While getting what you want, when you want it and where you want it is important, nothing really beats free!

That means ad-supported content; but even that is changing, because with data analytics networks can be more precise in serving up ads that really are of interest to the viewer.

In addition, networks want to capture ad dollars away from Google’s and Facebook’s stuffing machines.

TruTV, NBCU and Fox have finally figured out that stuffing content with ads doesn’t make a lot of sense; especially if you could offer ad pods all wrapped in data analytics, so the ads are aligned with the content and the audience.

Then they would be more valuable to everyone concerned – the viewer, the advertiser and the network.

Will it work?

According to Nielsen, TruTV is only one of three top 30 networks to grow for two consecutive years. The decreased ad load has increased viewership and nearly 100 percent marketing renewal rate.

In addition, Hulu offers content in two flavors – subscriber and ad-supported.

Nearly 70 percent of Hulu’s 54M viewers use the ad-supported tier where commercial breaks are limited.

Which is probably why Amazon will be rolling out its own ad-supported channel along with Amazon Prime.

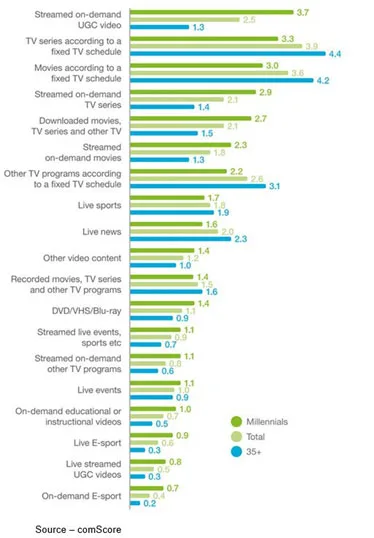

Deloitte’s Dr. Jeff Loucks pointed out that millennials were the first generation to embrace streaming media and watching video content on smartphones,

While Comcast and the other cable companies were hoping this was only a passing phase and they’d “outgrow it,” their parents took the hint and are watching their TV shows, movies, sports on any device, anywhere, anytime.

They’ve even found binge viewing is kinda’ cool.

“The M&E industry in a whirlwind of growth,” McLennan emphasized. “And by 2022, we’ll start to see DTC (direct to consumer) as the new norm.

“The intensity of the available content is really a normal, natural evolution,” he said. “But the viewing and engagement is shifting due to the overwhelming volume of content being made available.

“The viewer now knows he or she can migrate the content to where it’s most convenient,” he continued, “Yes to their phone or tablet and when they’re back home, they can shift to the big screen. It’s a new definition of TV that won’t be defined by demographics or age. It’s just my TV.”

Monco looked at the new viewer and said, “I guess I better leave before you go and lose your temper!”

# # #