Content Needs to Be Easier to Find

We miss our cable bundle.

Yes, it’s great that the major monthly bill is gone – replaced by our cable company internet cost and individual SVOD/AVOD services; but instead of one ridiculous price increase for 900 channels we never watched and 4-5 we periodically watched, our entertainment budget now goes up incrementally.

Netflix Co-CEOs Ted Sarandos and Reed Hastingss started it with a monthly increase in the U.S. to help fund the flow of new, unique content and their salary increases (Hastings’ earnings boosted to $34M this year and Sandandos’ to $40M).

Amazon shortly followed suit because…they could. Cripes they handle 65 percent of the ecommerce which includes shipping, video, audio, books, stuff.

We don’t care what they make or Disney’s Chapek or Discovery’s Zaslav or Apple’s Cook or Amazon’s Jassy or any of the streaming industry’s bosses, just wish they’d do a better job of timing salary and price increase announcements … it hurts!

All of the streaming services are growing, and their bosses probably deserve rewards for their guidance.

According to Statista, there are more than 450M SVOD households this year (109M plus in the U.S.). They’re all targets of the big services:

- Netflix – 220M,

- Disney+ – 120M plus,

- Amazon Prime – 190M plus,

- WarnerBros/Discovery – 74/43M together soon,

- Hulu/ESPN+ – 43/20M and really part of Disney,

- Peacock – 54M and owned by cabler Comcast

- Sleeper Apple TV+ – 20M

- Plus, about 2,000 local, regional, specialty services.

After the success of the first anytime, anyplace, any screen providers; all of the rest have followed similar formulas.

The formula was to offer people a constantly changing list of new, different, exciting films/shows they can watch as much and as long as they want and keep them in your pipe.

It worked … until it didn’t.

Folks kept paying for more pipes to view great content that was only available from a single source until it got to the point that you had no idea what was available in which pipe.

The SVOD organizations have been working hard to sign more people for their content, especially in North America where it’s estimated that 85 percent of households have a subscription service.

Even with regionally adjusted pricing, people in Latin America and Asia Pacific are more intent on using the free or low-cost ad-supported services. India’s Hotstar (owned by Disney) has 300M users but only 47M paid subscribers.

China’s iQiyi has over 500M viewers but only 100M paid subscribers.

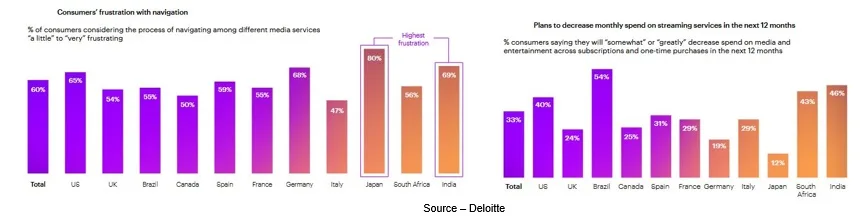

The frustration of being able to find content they want to watch as people search across their services (4-5 per household per Parks Associates) combined the “slight” monthly cost increase of the services has stimulated people to again take control of their entertainment budget.

Deloitte has projected that streaming services will face a 30 percent churn this year as people drop/add film/show sources.

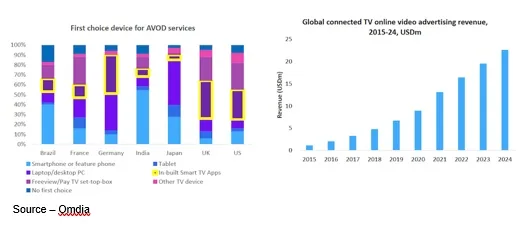

Replacing a subscription service for a free/ad-supported provider is an appealing price to pay (a few minutes of watching ads for an hour of streaming entertainment.)

The big difference is that SVOD’s measure their success on the number of subscribers they acquire/retain, while ad-supported services focus on overall revenue from their services.

Stacking (using multiple AVOD/SVOD services to watch a variety of content) has continued to grow as providers have continued to flood their pipes with more good/excellent content to capture and retain more eyeballs, but the consumer’s challenge has increased the frustration of being able to quickly find a specific movie/show.

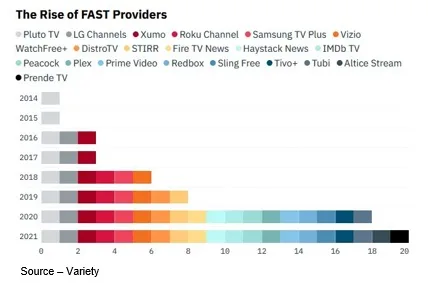

Over the past two years, the world of free ad-supported streaming TV has changed radically as a young service option has come to the forefront, FAST (free ad-supported streaming TV).

FAST is essentially no different from watching a TV network on your old pay-tv bundle. FAST services include ViacomCBS’ Pluto, Amazon’s IMDB TV, Fox, NBCUniversal’s Peacock, Comcast Xfiniti’s Xumo, Tubi, Roku and a growing number of new services.

The services lay out their channels on an EPG (electronic programming grid) similar to that provided by linear TV services. So, if you choose a film/show at the posted time, you can watch it from the beginning.

If you choose the title later, it’s kinda half-FAST and you’ll come in while it’s in progress.

At the end of last year, more than 20 percent of U.S. households were using FAST services, more than double the year prior as people began to find there was a fast, economic and reliable solution to their content search frustration.

While FAST has increased in popularity, consumers have also become increasingly demanding, wanting more than vintage films and expecting a wider range and catalog of content to choose from.

MVPDs (multichannel video programming distributors) are embracing FAST to retain and increase ad-sales revenue they previously earned from people watching pay-tv.

You may have noticed when you visited the big box stores, most of the TV manufacturers (Samsung, LG, Vizio) also promoted their “fast, easy-to-connect/use” built-in streaming service as well as the availability of connected devices from your broadband service providers (Comcast Flex and Altice Stream)

FAST has moved from a service dominated by start-ups to one with added opportunity for media/entertainment firms. It’s a nice added service for them plus an even nicer boost to their bottom line.

In addition to keeping subscribers engaged with single titles and platforms, services need to enhance the consumers’ experience with content and the service’s interface, improving overall value.

All of the streaming services have to focus on areas that will drive and maintain engagement while reducing churn.

Deloitte projects that this year, 150M plus subscribers will cancel/switch services worldwide, a churn rate of 30 percent plus per market. They estimate that 80 percent of U.S. SVOD households will add/drop services as they are attracted by more expensive tentpole content.

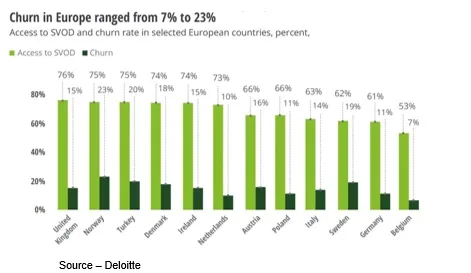

European churn will continue to be below 25 percent as people move from one subscription to another and/or seek less expensive ad-supported offerings.

Global TV, video subscription and online advertising will continue to grow in the years ahead with OTT being a major part of that growth.

According to Deloitte, SVOD is approaching maturity around the world as consumer spending and ad revenues reach $123B this year.

The cost to maintain and increase profitability will become increasingly difficult as people settle into a new routine of normalcy which will include returning to the office, going out for entertainment and changing their in-home entertainment habits.

To sustain their streaming growth momentum, the majors (Netflix, Amazon, Disney, WarnerBros/Discovery, Paramount, Apple) need more programming volume with a greater mix of genres to appeal to the broadest demographics possible.

Simply stealing subscribers from competitors – swapping market share – won’t be viable because the services will only be moving dollars from one pocket to another.

In other words, the market struggle will get dirty.

In other words, the market struggle will get dirty.

Beyond simply focusing on new content, the majors will focus on capturing IP (intellectual property) by carrying out large-scale vertical integration–acquiring established, proven content production organizations.

Organizations like A24, Columbia, Gaumont, Castlerock, Sony, New Line, Dharma, Toho, Enoki, Rok, Silverbird and hundreds of other seasoned video creative organizations will be likely targets for major streamers as well as merger partners as they join forces to expand their strength and reach in the industry.

In addition, we’ve had a glimpse of the broader potential for streaming services as they move to become an even more important and integrated part of people’s day-to-day activities beyond a movie or TV show.

Netflix surprised and perplexed Wall Street and investors by making its first outside acquisition with the purchase of independent game developer Night School Studio.

For a change, they took a lesson from two of their competitors – Amazon and Apple – both of which have found video games to be an immensely profitable business; something that Tencent, Sony, Activision, EA, Microsoft, Nintendo, Ubisoft and other game publishers have known for years.

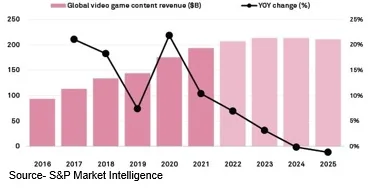

Friends of ours, Jon and Mark (both avid gamers and industry experts), noted that video games aren’t just games but a very serious and profitable industry that generated more than $180B last year.

While Netflix is just beginning to dip its toe into the game market, video games (computer, console, mobile) have been a major profit center for Amazon and Apple and were a key component in Apple achieving a market value of $3T this past year.

There are more than 3.2B male and female gamers in every age group worldwide. The category is so popular that a number of successful streaming films/shows have been based on video games including Resident Evil, Pokemon, Sonic the Hedgehog, Mortal Kombat, Tomb Raider and a treasure trove of animi projects.

The increased value proposition and increased engagement for subscribers can stimulate more market penetration, enhanced ARPU (average revenue per unit), reduce churn and extend subscriber retention.

One of the keys to a game’s success is understanding the player and designing the game to meet the wants/needs of the player. Netflix certainly has a rich database of present/past subscriber information to deliver satisfaction.

At the same time, Disney and WarnerBros also have a rich library of game potential IP they can draw upon from Marvel, Pixar, DC and similar film/show resources.

There are plenty of opportunities for large and small OTT platforms to grow their viewer subscription bases with new, unique content. There are also added opportunities to increase the range of services provided to reduce customer acquisition cost and increase subscriber retention.

“That’s what I’ve always said the world needs,” Lomax said to Taw in The War Wagon, “… more simple understanding to bring people together!”

“That’s what I’ve always said the world needs,” Lomax said to Taw in The War Wagon, “… more simple understanding to bring people together!”

And if that doesn’t work, there’s always the M&A route to become a major – and profitable – regional or global streaming video content/distributor.

# # #

Andy Marken – [email protected] – is an author of more than 700 articles on management, marketing, communications, industry trends in media & entertainment, consumer electronics, software and applications. Internationally recognized marketing/communications consultant with a broad range of technical and industry expertise especially in storage, storage management and film/video production fields. Extended range of relationships with business, industry trade press, online media and industry analysts/consultants.