People Don’t Want 1,000s of Channels, They Want Quality

Someone recently wrote that despite what Bill Gates said years ago, content isn’t king evidenced by the fact that A&T is looking to buy Times Warner and Comcast bought NBC Universal.

The author said obviously, distribution is the new king.

Are you s***ing me?

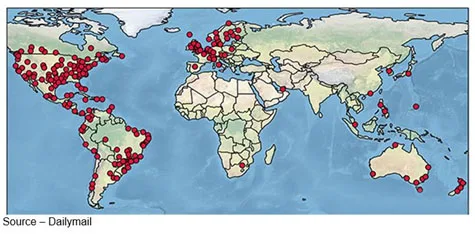

The estimated 90M people around the globe who stole the premiere of HBO’s Game of Thorns – US -15M, UK – 6.2M, Germany – 4.8m, India – 4.3m, Indonesia – 4.2m, Philippines – 4m, Canada – 3m, France – 2m and Turkey – 2m – didn’t care about the pipes…they came for the show.

The estimated 90M people around the globe who stole (streamed) the premiere of HBO’s Game of Thrones (US -15M, UK – 6.2M, Germany – 4.8m, India – 4.3m, Indonesia – 4.2m, Philippines – 4m, Canada – 3m, France – 2m and Turkey – 2m) didn’t care about the pipes … they came for the show.

Even Pornhub reported that their traffic took a hit because of the show.

Guess people can tell good entertainment.

It would be great if we could pinpoint one important tipping point for the M&E (media & entertainment) industry, but we can’t.

Actually, Gates and the author are both right because content is queen … not some lowly king!

And she’s a no-BS ruler. If your pipe isn’t offering her creativity, no one wants a thing to do with you.

To figure that out, more than 50,000 M&E executives from the four corners of the globe will trudge through 15 halls to visit 1,700 exhibitors, sit through 100s of sessions and will connect with people they only halfway like or trust at IBC.

Then, while cable companies around the globe are putting on a great face while saying people really still prefer their fixed day, fixed time schedules; they also see the new cloud OTT (over the top) services chipping away at their customer base.

Taking no chances, they’re offering OTT content and connections as well.

Even the legacy providers are quietly offering streaming options.

It’s a glorious day!

Right now, they all watch the elephant in the room, Netflix, as it surpasses 100M streaming subscribers.

But at the same time, Netflix knows it’s all about the content, reaching as many folks as possible and signing distribution agreements with Sky, Canal, and other traditional carriers around the globe.

The Netflix team doesn’t really care how you clamor for and consume their content, as long as you get access to it the way you want it – fast and flicker free.

Through someone’s cable or OTT service, they’ve built out a global video server farm so if you want to watch House of Cards, Orange is the New Black or any of the content they pay to have produced, you get it … BAM!

Obviously, Bezos and Amazon Prime have an advantage here as well since they have AWS cloud server farms just about everywhere and conveniently on the edge too.

Of course, there are viable competitors too – Hulu, Vimeo, Tencent, Alibaba, CanalPlay, Sky TV, Maxdome, Hotstar and others nipping at their heels.

Netflix and Amazon don’t mind the new SVOD (subscription) services and emerging AVOD (ad-supported) players because with the steady stream of content they produce, they almost have a level playing field with that leaves networks seeking new opportunities to expand their viewer reach.

But curiously, they seem to have drawn a line in the sand when it comes to competing with the kids who have grown up on the Web – YouTube, Facebook Live, Instagram and Twitter Periscope.

Social media folks may have billions of users but they know the world is going video (Zuck said that a few years ago) and they want the viewing eyeballs as well. They’re playing with their options — subscriptions, ad supported service or deals with stations/networks — to become the preferred access point for the always-on generation

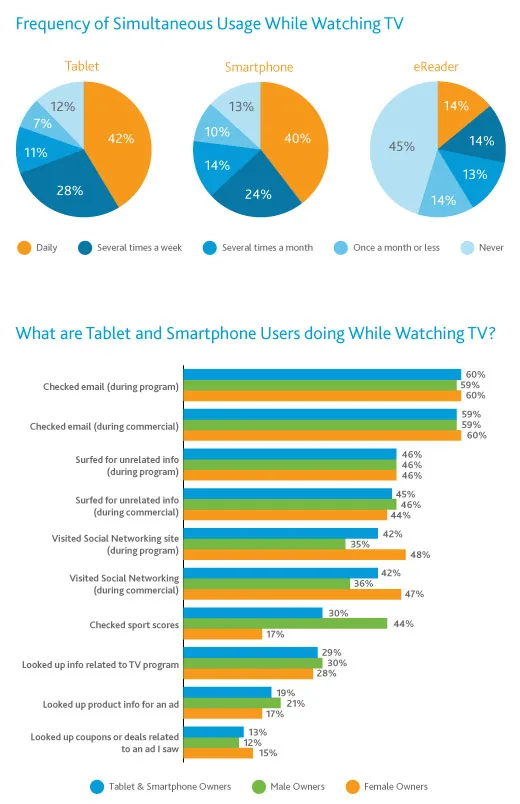

While the digital landscape is changing yesterday’s TV formula, television executives like to say, “people are just watching in a different way!”

Ahh … right!

The bundle folks, big TV and cable executives point out that consumers have always had choices. It’s just that by enriching their entertainment experience with rich content and new services, viewers are now able to be engaged with their screens.

It’s presented as an option but in reality, it isn’t a good one in the long haul because the TV/CableCos give up a good portion of their most valuable asset–their “brand franchise.”

People turn on their screen and choose Netflix, Hulu, Vimeo, Tencent, CanalPlay and Hotstar for entertainment, news, informational content. When they turn to YouTube, Facebook Live and Twitter Periscope, they wade through the world of frenemies, good/bad/ugly stuff.

For the content producer, franchiser and distributer, there’s a difference.

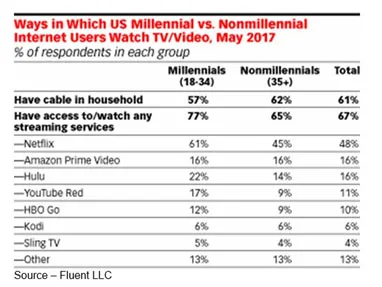

According to Forrester, 40 percent of millennials still watch TV shows as they air. However, more than 50 percent stream their content through a combination SVOD and AVOD.

A dwindling number, about 15 percent, go for the pay-for-view or TVOD (transaction service). You know, the special events (fights, concerts, football), that have their greatest appeal with boomers. But by definition, boomers are old … and getting older.

“The digital landscape is very fluid right now,” said Allan McLennan, president of PADEM Media Group. “Digital channel services are looking at skinny bundles and niche SVOD channels as well as added AVOD channels to appeal to the widest possible potential audience.

“In addition,” he noted, “content owners like Discovery, BBC, Australian Broadcasting, TV5Monde, Deutche Welle, Viacom, Al Arabiya, Star World, Al Jazeera and others are aggressively exploring new strategies to expand the licensing of their content and their reach. They’re also adding new viewing options through partnerships with Netflix, Hulu, Amazon Prime and MoviStar to keep their audience.”

“The digital landscape continues to create new opportunities to make content available, including the launch of skinny bundles and niche SVOD channels while also creating more upstream competition for new content,” said Andrea Downing, co-president of PBS Distribution. Content owners are also constantly “exploring innovative new strategies to expand licensing of our content.”

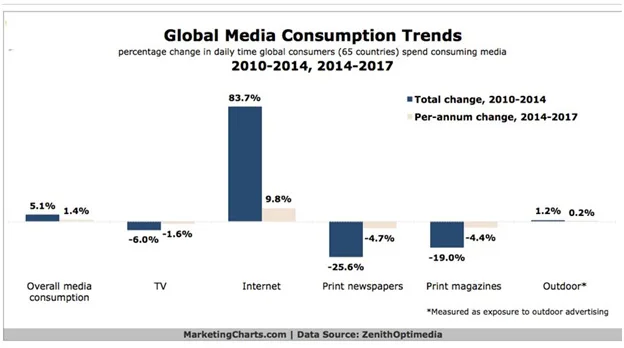

Why? Because online viewing has more than doubled in the past two years as people of all ages find streamed content more convenient for their hectic lifestyle.

The growth of IP-delivered TV/movie content is not only reshaping the distribution models, it is expanding the amount of content viewers can stream.

This is putting tremendous pressure on the new “channels” (and creating opportunities for filmmakers) to expand the amount of original and premium content they can offer through a combination of outright purchase or shared revenue.

“IP SVOD services like Netflix, Amazon Prime, Hulu and other service providers such as Tencent and Deluxe have become major disruptors in addition to providing benefits for the broadcast industry,” McLennan emphasized.

“I still believe the major players in the various regions of the globe are well positioned to take advantage of these opportunities,” he predicted. “They can add subscribers for both their fixed schedule and streaming services as long as they expand their budgets for content acquisition, origination and branding.

“Channels and services are in the middle of a content and branding arms race,” he added.

As the subscribed and stolen viewing of Game of Thrones proved, people expect theatrical/cinematic quality as well as strong character and storyline development.

That’s a challenge for traditional broadcasters who have viewed their audiences as mindless hordes … i.e., if you liked this cop, hospital, reality show; we’ll give you a spin-off or two and you’ll obviously follow along.

Most of today’s viewers have a short attention span. They want a balance of a shorter episodic series as well as richer character and storyline development that combine to deliver either quick resolution for the viewer or deeper, longer-run immersion and involvement.

In both scenarios, specific choices are demanded by the increasingly discerning audience. The day of SVOD/AVOD services having people pay for 1,000 channels when they only want a specific selection of channels – paid or free – is potentially coming to an end.

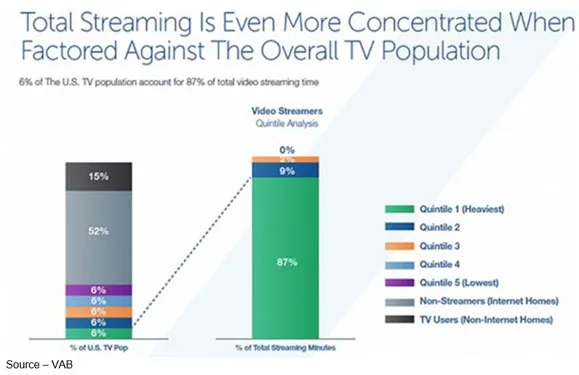

Personalized choice has been the major reason cord-cutting is growing so rapidly.

Realizing that audiences are abandoning their 1,000-channel take-it-or-leave-it bundles, many service providers are moving to OTT to hedge their bets and stay relevant to their viewers.

Doing the same old thing in a new dress or suit doesn’t win back deserters.

That means not only producing high-quality content but also knowing the viewers interests and anticipating what they want to watch, when and how.

This is a critical part of the equation Netflix, Amazon Prime, Hulu, MoviStar and the major streaming services have … access to user data that tells them which shows and films different groups of viewers are streaming and understanding how their interests overlap.

Traditional networks have relied on Nielsen audience measurement numbers (which they are slowly, reluctantly abandoning) to tell them in general terms if people are watching a specific show (and the competitive show).

Specific data about changing viewing habits provides insight into knowing what programming to invest in and how to market that content to viewers.

And with each passing month/year, the data gets deeper and richer and they get better at developing/presenting content people want to minimize/eliminate churn.

As viewers get more discerning as to which SVOD and AVOD services they view regularly (and according to ComScore, most OTT viewers use four to five services), what wins and keeps them is the quality of the content.

The talents of the script writers, audio experts, producers/directors and supporting crews will always set the pace.

The creators are committed to delivering viewer satisfaction just as Stannis Bartheon was committed to his cause when he said, “We go forward. Only forward.”

The creators are committed to delivering viewer satisfaction just as Stannis Bartheon was committed to his cause when he said, “We go forward. Only forward.”

Delivery may be king, but content is the queen people watch on their screen(s).

# # #