Streaming Evolution Is Fast, Some Can Be Disingenuous

Like the M&E industry, what is considered acceptable and what is frowned upon is constantly evolving.

We’re not certain if the changes are good/needed or we’ll simply become numb and ultimately accept it as the “new norm.”

Comedian and social satirist Lenny Bruce was thrown in jail in 1964 for obscenity.

In the early ‘70s, George Carlin developed a funny as h**l monologue – Seven Words You Can Never Say on Television – https://bit.ly/39WJiNK.

Right now, Oscar winner Nicholas Cage is busy working on a six-episode docuseries for Netflix, History of Swear Words – https://bit.ly/39WRGN2.

Sure, we know the words, there are times we’ve reached the point where we’ll occasionally use one or two (okay, three).

However, we often wonder what they really add to a movie or TV show script.

It’s here, it’s the new norm … live with it.

But in the case of the M&E industry, everyone has a stake in the changes because it’s an ecosystem that touches/affects everyone.

It’s a poorly kept secret that studios and content owners have wanted to break/modify the theatrical window.

Covid-19 just might have been the kick they needed to smash the window and make way for a new relationship between studios/content owners, exhibitors, creators/creatives and consumers.

Covid-19 just might have been the kick they needed to smash the window and make way for a new relationship between studios/content owners, exhibitors, creators/creatives and consumers.

Maybe…

Hundreds, probably thousands of very good, very expensive titles with great actors are stacked in warehouses, gathering dust, looking for a screen.

Theaters have been opened/closed so many times the locks had to be replaced and the places cleaned. Even then, movie lovers around the globe are reluctant/slow to put their seats in the seats for the foreseeable future.

Streaming new and old projects D2C appears to be an excellent way for studios and content owners to increase sales/profits and develop funds for even more movies/series.

That would be great news for indie filmmakers, crew members and specialty talents (an estimated 456 thousand in the US and at least four times that globally) who need a constant flow of new projects to work on to pay the bills.

As for theater owners and what some call the 1 percenters (A-list agents of producers, directors, talent), it’s complicated.

AT&T’s WarnerMedia went along with Christopher Nolan, the heavy hitter producer, when it agreed to a theatrical release for Tenet despite being in the middle of the pandemic. The results were underwhelming – $41M U.S., $280M WW–especially when they saw Trolls World Tour produced nearly $100M PVOD fees for Universal and Mulan generated $270M for Disney +.

Following “a lot of discussion and monetary exchange with director Patty Jenkins, talent Gal Gadot and others,” AMC’s Adam Aron and Warner jointly announced the reduced window release of Wonder Woman 1984 in theaters and that it would also be available to AT&T/Warner’s HBO Max subscribers.

Not spectacular for movie chains around the globe but given the difficulty/concerns in seeing major films at the cinema right now … it was “okay.”

Hustled away from Hulu last year, Jason Kilar, Warner’s CEO, was faced with the overwhelming tasks of remaking/streamlining WarnerMedia, refocusing HBO from a masterpiece production house to a volume producer, and turning the 17 films scheduled to be released – an estimated $1.5B plus investment – into cash.

Of course, his boss – John Stankey – had an even larger set of challenges:

- Ma Bell (AT&T) is creeping up on its 150th anniversary of stringing wire, faking service and investing like crazy to deliver fiber everywhere and 5G … soon

- Randell Stephenson had left him with ailing DirecTV, U-verse, Warner’s enviable library of old and brand new (expensive) content and $164B of debt

- A world of pandemic-ridden “opportunities”

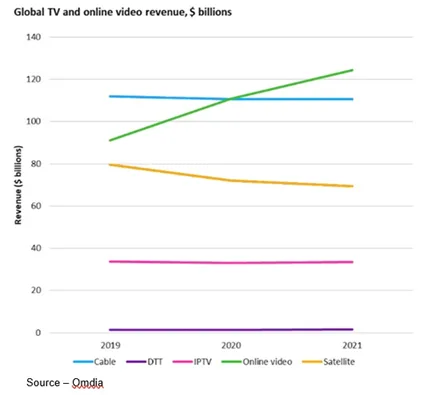

Stankey and Kilar envisioned HBO Max to be a streaming super-player sought after by viewers like the industry leaders – Netflix, Disney +, Amazon Prime, Hulu, YouTube, CBSAllAccess, Peacock, Apple TV+ and shortly, Discovery +.

If a mouse and package mover could do it, how hard could it be?

After all, Warner had a ton of content in the vault, new stuff people would beg to see and a respected service called HBO.

In for a penny, in for a pound!

Even though it was charging a premium price of $15, HBO Max had attracted only 8.6M, 38M HBO/HBO Max subscribers.

With 2021 looking grim for theatrical ticket sales (50-50 split), Stankey and Kilar developed a great hybrid solution for the 17 movies in the can–share day-date release in theaters and on HBO Max.

Stankey’s goal is to put AT&T, WarnerMedia, and HBO Max squarely in the center of an industry that is changing … rapidly.

The company is building out its fixed, wireless and fiber-based broadband service that enables AT&T to have a direct customer relationship (his words) and provide world-class content.

While he describes the shift of content to HBO Max as a move that is a win-win-win for partners, the company and the consumer; few in the Hollywood community have been as enthusiastic.

Stankey didn’t ask Legendary, the company that footed a lot of the cost for Dune and Godzilla vs Kong that were included in the bundle what they thought of the holiday surprise.

He didn’t bother checking with their tier 1 people and he certainly didn’t talk to theater folks.

Tenet’s Nolan in a THR interview said, “makes no economic sense, and even the most casual Wall Street investor can see the difference between disruption and dysfunction.”

AMC’s Aron called the move one which sacrifices theaters (AMC has 11k plus screens WW) and the movie studio division to subsidize HBO Max.

Others saw the move as a way for AT&T/Warner to sidestep paying tier 1 participants theatrical backend payments by selling the movies to the nicest folks they know – their own streaming platform – rather than put them on the open market for someone like Apple, Amazon or Netflix to buy.

After all, the phone streamer needs all the bait possible to climb into the heady realm of D2C entertainment where Disney + shot up to 86.8M worldwide subscribers and its associated services like Hulu, Star and rich roster lineup–Amazon Prime serves 150M; Apple TV + 33.6M; Netflix an estimated 193M subscribers; as well as Peacock now with 26M subscribers.

And he was stuck with 8.6M U.S. folks paying for a great experiment and more around the globe.

Still a staunch advocate of the moviegoing experience, NBCUniversal’s Jeff Snell was the first to modify the 90-day theatrical window to 17 days with Trolls World Tour. But he eased the pain with revenue-sharing PVOD.

He noted that even before the pandemic, there is a large segment of the public that like movies but don’t want to or can’t go to the theater to view new releases.

Snell added that Universal is a movie company and needs to serve the total entertainment audience.

Allan McLennan, Chief Executive at PADEM Media Group and streaming expert, observed that movie theaters are likely to face a long dry spell, for at least one perhaps two years.

“Studios and content owners that are holding out hope for movie theatre audiences fast return back to normal behavior by next year probably won’t pay off,” McLennan explained. “And moving everything but big budget tentpoles isn’t entirely promising even if there’s a meaningful portion of the public vaccinated.

“Their confidence in seeing films in the theater has been severely challenged,” he continued. “It will return, but there will be much compromised in order to build the numbers back, and that isn’t attractive in the short term for the supply chain to survive on.”

At the same time, he noted that streamers need to provide new and high interest projects in order to meet their audiences’ appetite.

“Even before the pandemic, the move to selling films to streamers was beginning to be recognized as a smart move for filmmakers and Covid-19 only accelerated that move,” he commented. “After all, streaming services are capturing a lot of eyeballs and for people creating content, that’s important.

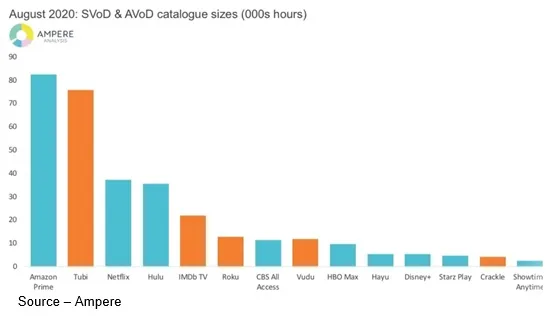

“The streaming industry has entered a new phase where it has become not simply about capturing new customers but sustaining and retaining those customers,” he added. “And that requires a solid library at a great value and the willingness to constantly adjust the title line-up to keep viewers interested.”

McLennan emphasized that the streaming audience appears to be reaching a saturation point for SVOD and people are settling into a phase where content quality, price and user experience make it difficult for new entrants to penetrate the top ten, let alone top five provider category.

“50 percent of the consumers now have an average of 3-5 SVOD and 1-2 AVOD services,” he noted. “And adding a new service means they have to consider cancelling one or more of their proven services. It is becoming increasingly difficult and expensive to get customers to switch.”

Regarding AT&T/Warner’s release of its full slate of major projects this next year through HBO Max, McLennan noted that he’s not certain the company has given sufficient attention to an area of major concern to streamers and their content producers—piracy, which costs the U.S. economy an estimated $29B annually.

“It’s too easy to capture and use the content when it begins and ends as IP and protecting it isn’t easy and isn’t cheap,” he emphasized.

To entice subscribers and pirates in 2021, the 17-title release lineup includes The Little Things, Judas and the Black Messiah, Tom & Jerry, Godzilla vs. Kong, Mortal Kombat, Those Who Wish Me Dead, The Conjuring: The Devil Made Me Do It, In The Heights, Space Jam: A New Legacy, The Suicide Squad, Reminiscence, Malignant, Dune, The Many Saints of Newark, King Richard, Cry Macho and Matrix 4.

Neither Stankey nor Kilar have indicated if their hybrid policy might extend beyond next year.

In his defense, Kilar did say that for the next several decades there will be a very large volume of consumers worldwide that will choose on any given night, especially a Friday or Saturday night, to go out to a theater to be entertained by a great Warner Brothers movie.

However, he clearly didn’t say that when the dust settles, life will return to ‘normal.’

One theatrical executive summed up the feelings of many tier 1 folks when he said, “HBO Max is now Napster.”

That’s cold … really cold!

We don’t want to read too much into that observation, even though Margo in All About Eve did say, “It isn’t as though you personally drained the gas tank yourself.”

We don’t want to read too much into that observation, even though Margo in All About Eve did say, “It isn’t as though you personally drained the gas tank yourself.”

Disney wowed investors, production people and talent when they laid out their creative and content distribution plans.

The phone/film people? … not so much.

Realignment and adjustment are still taking place at a very hectic pace and missteps/miscommunications can mean that some will be left behind when the streaming services hit the track.

# # #

Andy Marken – [email protected] – is an author of more than 700 articles on management, marketing, communications, industry trends in media & entertainment, consumer electronics, software and applications. He is an internationally recognized marketing/communications consultant with a broad range of technical and industry expertise especially in storage, storage management and film/video production fields. This has led to the development of an extended range of relationships with consumer, business, industry trade press, online media and industry analysts/consultants.