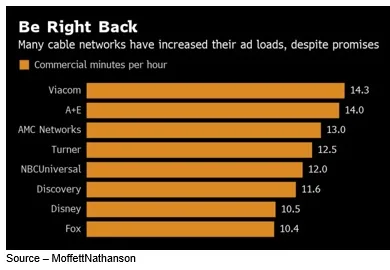

We didn’t cut our TV bundle because it was too expensive.

We cut it because we were sick and tired of watching 20 minutes of ads an hour.

Well, that’s not entirely true. We were sick and tired of watching the same D*** ads every hour after hour after…

Contrary to snotty elitists, we don’t think ads are beneath us or that ads don’t affect us.

We like ads … honest.

We know ads help businesses reach consumers (business and individuals). Consumers buy stuff and that helps the local, national and world economies.

But the volume of constantly repeated ads (and the constantly rising pay TV cost) pushed us over the edge.

We cut the cable and we’re far from unique:

- 5.2M US households did the same in 2021

- 4.9M (10.3 percent of cable folks) will do the same this year

- Total cord cutters will reach 55.1M over past seven years

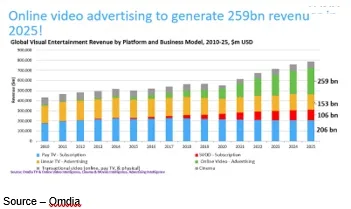

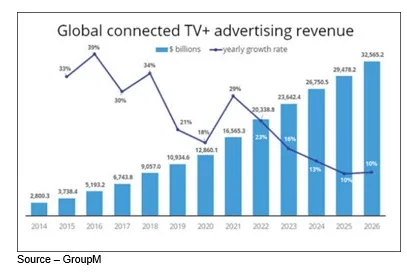

- Streaming revenues increased 340 percent 2015-2020

- 5M UK households canceled pay TV every year for past five years

- 69 percent of households have streaming service

We replaced our 3000-channel bundle with some subscription services – Netflix, Disney +, Amazon Prime, Apple TV +, Hulu and not sure why, BritBox and HBO Max.

Thought about Paramount + and Peacock but storm clouds were emerging:

- Everyone thought his/her service was the best one ever and worth “a few” bucks more

- With the pandemic becoming less frightening, we were getting out more

- Minor things like food, gas, kids’ clothes and consumer stuff were getting more expensive

- Finding something to watch from one service to another and another was starting to really tick us off

- Personalizing our content was different for every service which was “irritating”

In a “free enterprise” world, we can’t force the SVOD services to develop a common standard for searching for some entertainment, regardless of the paid service it’s on.

Or agree on an industry wide algorithm to help zero in on the genre we like based on the popularity of the content, our mood, or maybe share ideas of what stuff friends or others find interesting, fun, satisfying.

If they did that, some governmental bureaucrat or service that wasn’t in our service budget would complain so, that ain’t gonna happen!

We focused on our entertainment budget and added a few of the free services – Pluto, Tubi and FreeVee – for something from the distant past.

Yes, we got a few ads but not a lot because we don’t think marketers understand how to handle advertising to individuals. They’re accustomed to buying ad slots that reach consumers by the bushel.

Of course, all of the SVOD services saw it was getting tougher and tougher to get new folks to pay $12-$15 for their service so they focused on taking viewers from one of the other guys.

The problem is that kind of stuff works both ways … churn.

Mobile phone people have dealt with that problem for years, which is perhaps why AT&T’s John Stankey decided he’d dump all of his Warner Bros debt into a new bucket called Warner Bros Discovery and focus all of his attention on getting new subscribers from the other mobile and broadband guys.

Smart move.

After all, once the cable/fiber is installed and the cell tower is up, all phone folks have to do is pretend to listen to customers instead of constantly developing new stuff.

Sure, they try from time to time to give you a deal you can’t refuse to switch from their flimsy service to your outstanding service; but come quarterly report time, they stress how many people they’ve had for a long, long time (MAU – monthly average user) because that’s where the profit is.

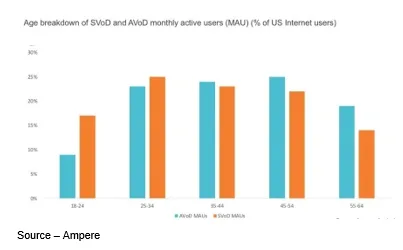

When it comes to streaming entertainment, you may have noticed SVOD services have shifted their quarterly/annual success emphasis this past year, placing more emphasis on their retention – MAU – rates rather than new subscriber numbers.

Unless you’ve got a gig and relationship on the side, you usually don’t have three or so phones; but with your

Entertainment, lots of families have three to five, and that isn’t growing the market if everyone is counting the same household.

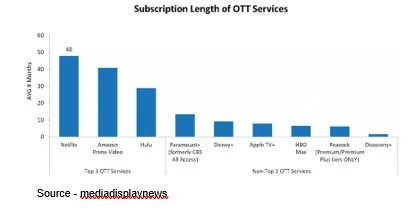

So, the longer the subscriber sticks with the service the more valuable she/he is to the provider.

If they’re simply bouncing from service to service…no one in the industry wins.

We know people who enjoy signing up for really cheap 30-90-day trials, watch all the stuff they’re interested in, then drop the service and move on to the next available trial.

In 6-months or a year, after the services have refilled their content inventory with great stuff, they repeat the process.

There are probably tens of thousands of people just like them.

For them, a bargain is a bargain but that doesn’t grow the market or increase the service[s bottom line.

There had to be a better way to increase the subscription numbers.

More importantly, there had to be a way to keep the individual, household for as long as possible … maybe forever?

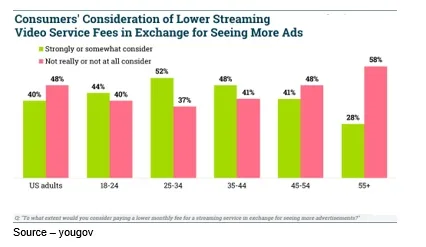

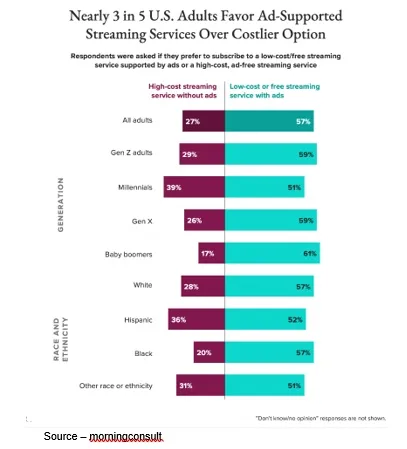

Streaming services (OK.,Netflix) decided it was time to rethink strategies:

- Ads with video content isn’t totally new idea, TV viewers had watched/ignored ads since screens were B&W and the size of a handkerchief

- People like options beyond take it or leave it

- Cheaper options might convince the millions of pay TV subscribers to switch to streaming more quickly or at least add a less expensive anytime, any screen, anywhere service

- They could tier their service with tiers of ad/cost and reserve the very best stuff for full subscribers

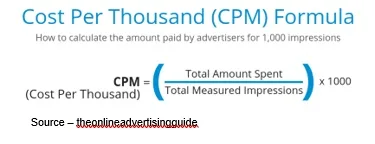

- Get a chunk of the real money marketers were spending elsewhere to convince folks to buy their products, services

Sounds like a win-win for everyone.

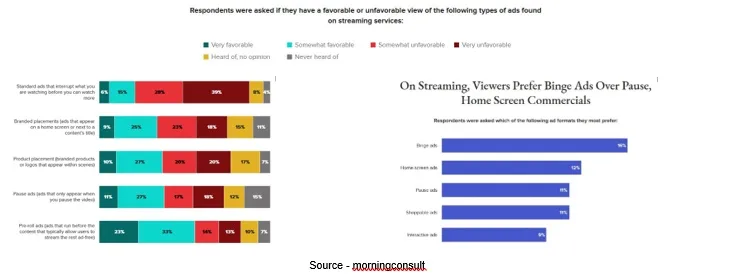

Of course, the challenge for the streaming services was figuring out what types of ads, where to put them and how many.

Instead of trying to reinvent the wheel and in the process really **** people off. Just ask folks:

Okay, you’re never going to be able to please everyone.

Just remember, when a deal is involved, people want as much as they can get for as little as possible and in the final analysis, they’re glad you asked.

Now about the ads!

We understand marketers are going to say their advertising message is so important, so complex, so compelling that they need at least two to three minutes to effectively tell the story.

At the same time, ad creatives are saying they need at least that much time to deliver a memorable message.

In addition, their art/words are so mesmerizing that people will be delighted to watch at least that much time.

In fact, they will be disappointed when the ad ends.

Jeezz folks, get over yourselves.

Ad performance analysis doesn’t lie.

A cluster of a few really great ads are more effective with consumers than a long boring ad or worse yet, going back to the old 20-minute ad slot!

Works better for the advertiser and the streaming service.

In addition, the consumer has a better image of both of you!

Streaming service keeps subscribers longer and begins making real money.

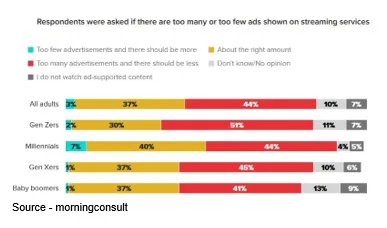

Ad-supported and FAST streaming is starting out slow for a combination of reasons:

- No service wants to antagonize their audience with too many ads because it’s too easy for the viewer to switch

- Most of the services honestly don’t have the complete ad mechanism in place – sales, insertion/placement, measurement, reporting, analysis

- Ad demand is slow because advertisers have to get comfortable with being able to reach a very specific audience

- Everyone wants to figure out exactly what the right number of ads per hour is for marketers … and subscribers

WDB’s HBO Max, Discovery + and Peacock are starting out light – no more than 4-5 minutes of ads per hour for their subsidized services and more for their free limited library service.

Hulu pushes ads at the beginning of the stream and then throughout their original content much like on traditional TV shows.

Netflix, Disney+, Amazon Prime and the others are trying to resolve a number of numbers:

- What’s included/excluded in AVOD program, number of ads, ad rates

- What’s included/excluded in FAST program, number of ads, ad rates

The free services – Pluto, Tubi, FreeVee and others – are doing great in the sweeps. The interest is there, the viewers stick around longer and advertiser interest is growing.

While content search is hit and miss, they’re now trying to shake that stigma of being the library of old stuff.

With all of the studios trying to do their own thing, they realize library content will come and go more quickly and will be more expensive.

So, it’s time to begin developing their own original content or acquiring some of their own fresh stuff.

You know … move upscale.

That could make things interesting, especially for content creators who want as many “sales” options as possible.

While they don’t create or buy any content, there’s another group that wants to be a gateway fee collector and take some of those ad dollars … CTV (connected TV).

The home big screen folks – Samsung, LG, Sony, Hisense, Vizio and others – figured out that if Roku, Xfinity and a few interface services could help consumers consolidate their services and eliminate the pain/frustration of the show/movie selection process, why not cut out the dongle and improve their profit margins?

They may sell a new TV screen every couple of years; but if they can convince the consumer they’re giving you a really neat added feature, they can sell that household connection over and over to other marketers for a helluva long time.

But we’re getting a little concerned.

According to Statista, video streaming revenue is projected to be $80.83B this year and will grow at the rate of 11.48 percent through 2027 to $139.2B.

User penetration will be about 12.2 percent this year, growing to 20.6 percent by 2027 with about 1,636M users so, there’s still plenty of room for subscription growth. It’s just more difficult and expensive to convince folks to make the switch, and some never will.

But people invest in the tech/studio companies based on constant growth and financial guys/gals get concerned when services don’t show significant, continuous growth.

No one likes to tell shareholders and financial guessers that they didn’t make their numbers.

To satisfy their bosses, company bosses dream up ways to increase profits. They can raise prices – subscription and ad cost, run more ads…do both.

Dudes, don’t make us leave your streaming entertainment services and go back to reading books instead of waiting for you to make it into a movie.

Remember what Harry Brogan said in Gemini Man, “There is no perfect version of me.”

Andy Marken – [email protected] – is an author of more than 700 articles on management, marketing, communications, industry trends in media & entertainment, consumer electronics, software and applications. An internationally recognized marketing/communications consultant with a broad range of technical and industry expertise especially in storage, storage management and film/video production fields; he has an extended range of relationships with business, industry trade press, online media and industry analysts/consultants.

# # #