Engaging Live Audience – Teams, Players, Fans –Want it NOW

Back before we cut the cord, we wondered if perhaps football and golf were losing their charm (and audience) because of over exposure. After all, we had five football, some baseball, soccer and NASCAR channels, as well as two golf channels in our big bundle and not everyone was really a sports fan … right?

Okay, Super Bowl (love the ads) and the tail end of Tiger Woods’ coming back to win a major tournament after a five-year dry spell were big draws but other than that, not so much.

At IBC, there was renewed excitement about sports broadcasting and live news opportunities, thanks to the rapid growth of IP-based OTT viewing.

Futbol, football, baseball, basketball have always had a warm place in network executives’ hearts because let’s admit, it they brought in big ad dollars and more than their fair share of eyeballs.

Then there were the ultra-profitable PPV (pay per view) boxing, mixed martial arts and wrestling shows.

But sports like equestrian, rowing, fencing, cricket, lacrosse, skateboarding, drone/hotrod racing, and a horde of niche sports were left to fend for themselves on YouTube. Or, if they were fortunate, to be included in the ESPN +, Hulu Live or Amazon’s viewing library.

But according to Allan McLennan, Chief Executive of PADEM Media Group, teams, leagues, TV networks, digital firms and players themselves are finding new ways to connect with fans around the globe with OTT.

“Done right, streaming over IP represents a significant new option for MVPD’s by enabling them to offer video material directly to their audience,” said McLennan. “It provides them with added revenue opportunities; and more importantly, a closer customer relationship.

“Event sponsors, teams and athletes can focus on delivering the best experience potentially more economically,” he emphasized. “And at the same time, new solutions can deprive illegal operations of selling lower-quality content.

“The technologies have matured, and more are being deployed right now,” he continued. “Streaming sports content over IP can be much better, more inclusive and in many ways more participatory than past linear TV. Appointment TV has a 50-year history; and in just a few years, IP-based delivery is already moving up the ladder to provide what viewers want – live engagement on whatever screen or device they’d like. The key will be introducing and delivering it in a way that fits the fans needs while not confusing them due to the options.”

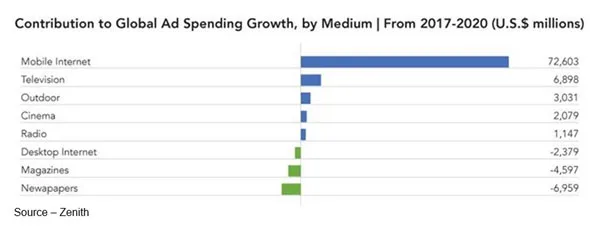

With lower-cost production and enhanced distribution capabilities, there’s renewed interest in Sports and eSports are reaching their dedicated viewers and an ever-expanding audience.

And because each has a well-profiled audience (even what was niche sports), they are in a position to provide more value to new sponsors and in many cases, ad support (i.e., income).

Why?

A recent Limelight report found that 60 percent of global consumers would like to watch (and pay for it) sports online if they could be guaranteed to enjoy it on the screen of their choice without viewing delays, buffering or other issues.

Study highlights:

- Cable subscribers pay for more streaming services than cord-cutters. More than half (59 percent) subscribe to at least one video on demand (VOD) service.

- Cable subscribers are supplementing traditional TV with online video, paying for an average of 1.2 streaming services, while non-cable subscribers pay for 0.7 service.

- Millennials lead the global shift to online video. Respondents age 18-35 currently watch more online video than broadcast. Young millennials (age 18-25) watch an average of nine hours–13 minutes of online video weekly, compared to six hours, 11 minutes of traditional TV. 15 percent of young millennials spend more than 20 hours a week watching online video.

- Consumers will cancel their service due to price increases. More than half (55 percent) of worldwide consumers say price increases are the primary reason for canceling an SVOD service. Nearly half (46 percent) note the same for their cable subscription.

- Online viewing ranges widely by country. Viewers in the Philippines watch the most online video at eight hours, 46 minutes each week, followed closely by India and the United States at nearly eight and a half hours of viewing each week. Germany has the lowest online video viewership rate at five hours, two minutes.

According to McLennan, live sports and synchronized engagement (multiple devices) are some of the fastest growing categories in streaming media.

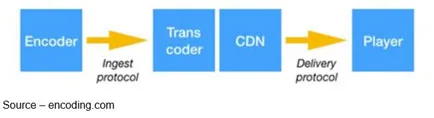

Because of the ready availability of proven CDNs (content delivery networks) and because the Internet and Wi-Fi are ubiquitous, many new sports groups are considering establishing their own channels for events, historical looks and behind-the-scenes/participant views with a robust roster of content.

Delivery Platforms

HD, UHD, 4K/HDR video and sports are already being streamed daily with excellent results.

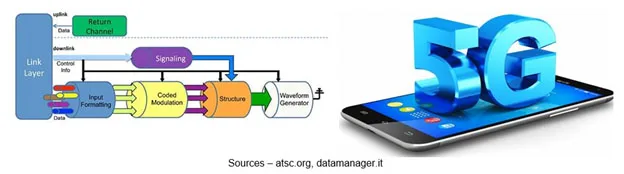

In addition, McLennan, one of the earliest people in the OTT and on-demand programming field, stated, “SMPTE’s (Society of Motion Picture & Television Engineers) has done an excellent job of solidifying the ATSC (Advanced Television Systems Committee) 3.0 standard which has been optimized for broadcasting to simultaneously and instantaneously bring viewing to millions of people.

“5G developers have also done an excellent job of finalizing their standard too,” he added. “Together, they can provide homeowners and consumers the viewing they want, especially their sports.

At the 2018 Mobile World Congress (MWC), telcos recently announced they will have 5G technology deployed in 50 markets. In fact, Verizon opened up four markets this past month and Ericsson forecasts that 10+ percent of the global markets may be 5G-enabled by 2020.

“The two will provide a solid platform for ultra-high-speed streaming,” said McLennan.

“Sinclair, Pearl and several international broadcasters have already deployed ATSC service with great results and more are scheduled for rollout this year and next.” he noted

Latency

Missed moments, the dreaded spinning buffering wheel, voice out of sync with the action, content arriving 1-5 seconds on another person’s screen before you see it has been a part of the biggest challenge facing the streaming video industry – latency.

The lower the latency, the better the viewer experience, the more satisfied the customer and the less likely the sports enthusiast will click away or switch services

All of the CDNs and hardware/software providers are focused on trying to deliver ultra-low (near zero) latency performance of HD, UHD and 4K/HDR content.

They are doing it consistently and reliably … and with new technology, it will get even better!

State-of-the-art encoding solutions, especially solutions like V-Nova as well as Bitmovin, ATME and others, are already being used to support sports video formats such as HD, Ultra HD 4K, and 360 VR.

They also support HLS (HTTP Live Streaming), HEVC (High Efficiency Video Coding) and MPEG-DASH (Dynamic Adaptive Streaming over HTTP).

All of them have been enhanced with new, high dynamic range HDR pixels (trust us, it means killer viewing on any screen).

The goal – deliver broadcast-level experience to all IP-delivered devices and drive deeper levels of live consumer engagement. Solutions such as Net Insight’s Sye make it easier to enjoy cross- device activities – event on the big screen, close-ups/background on the 2nd screen and texting/tweeting on the 3rd screen at the same time.

Audio

Woody Woodhall, president of Allied Post, drilled into me several years ago that the sound track of a film is the most important, and underrated, creative aspect of a great film.

It is perhaps even more important for people who really want to be totally immersed in their sport event of choice.

Admit it, the best part of the sport is audio whether it’s feeling the hit of a linebacker, the swish of a futbol into the net, the thunk of a racket against a tennis ball, the connection of two NASCAR vehicles or the trash talk of LeBron and Draymond.

Without sound, the sport would be … boring!

Whether it’s Dolby Atmos or a generic audio codec, it’s the HD, UHD, 3D or immersive sound that keeps you “in the game.”

The Ugly Part of the Game

The worst part of streaming sports (and video content) is piracy.

Soccer’s World Cup in Russia had 2,637 pirate streams for the semifinals on Facebook, YouTube, Twitch, and Periscope. There were nearly 30M views and 3,653 streams of the France-Croatia final with more than 60M views.

That “shrinkage” (inventory disappearing) cost FIFA and those who legally secured rights millions!

Yes, the rights owners can precisely pinpoint the offenders right down to the IP address, but regulations require the copyright owners to send notices to websites, asking them to take down the offending videos.

Really?

Fortunately, there are tools like those introduced by NAGRA which has a robust security platform and can protect the sports viewers and content owners before litigation is required.

“The average sports fanatic might consider event piracy a victimless crime,” McLennan noted, “but this is incorrect on several levels.

“What people don’t realize is that they are in even greater danger by enjoying the pirated sport,” McLennan emphasized. “The illegal streams also include ‘added features’ like malware, cybertheft ads and other criminal activities that can make the cheap sporting event potentially expensive.”

The global availability of bandwidth and technology enables almost instant transmission of high-quality content like sports that can be viewed on any screen in real-time or when it’s convenient for the enthusiast.

Increasingly, sports franchises, sponsors and athletes have flexible tools and solutions available to them to deliver local, regional, national and local events and activities at very consumer-friendly pricing.

We have already seen that sports fans have been early adopters of live streaming services and are highly engaged, interactive viewers.

And deeper, more immersive sporting experiences are increasingly being offered direct-to-consumers.

Sports streaming of major, minor and niche sports increasingly have an opportunity to build a distinctive brand voice and be responsive to casual or fanatic fans and viewers.

With digital OTT streaming, viewers can get it more easily with a growing array of content that is only limited by the communities’ imagination–as long as they don’t make it complicated.

Then, everyone wins!

No one wants viewer enthusiasts to repeat the instructions back to them as Lou did to Bud, “Same as you! Same as YOU! I throw the ball to Who. Whoever it is drops the ball and the guy runs to second. Who picks up the ball and throws it to What. What throws it to I Don’t Know. I Don’t Know throws it back to Tomorrow, Triple play. Another guy gets up and hits a long fly ball to Because. Why? I don’t know! He’s on third and I don’t give a darn!”

No one wants viewer enthusiasts to repeat the instructions back to them as Lou did to Bud, “Same as you! Same as YOU! I throw the ball to Who. Whoever it is drops the ball and the guy runs to second. Who picks up the ball and throws it to What. What throws it to I Don’t Know. I Don’t Know throws it back to Tomorrow, Triple play. Another guy gets up and hits a long fly ball to Because. Why? I don’t know! He’s on third and I don’t give a darn!”

# # #