People are Settling into New Entertainment Habits

We primed ourselves for a real treat last week, checking NYC flights, hotel reservations, theater ticket availability.

No, it’s not a vacation or business trip.

Broadway is finally reopening so we’re planning to go back and see Tina … again!

To get in the mood, we watched her 2009 final concert music video. Then her 1993 movie, What’s Love Got to Do with It. Then the documentary Tina.

Sure, movie house experiences are great, watching stuff on our home screen is good but feeling the vibes of live theater is ridiculously outta’ sight.

Don’t get us wrong, we were glad to hear AMC’s CEO Adam Aron proclaim, “We’re back and we’re hot,” this summer.

Tentpole upon tentpole upon tentpole, validated theaters were back … bigger, badder and more profitable than ever.

Every movie house owner and studio partners pulled out all of the stops, squeezing two years of content into one abbreviated period.

They were so anxious to bounce back better than normal that they even had a special week of “y’all come” events in June and July to entice people back into theaters.

Producers, directors and actors hung out around ticket booths and concession stands to ensure folks knew coming back to the “true” movie experience was way better than staying home to enjoy that “mundane” streaming stuff.

Even without the whoopla, Susan and her “gotta see a movie in a theater” addict friends were delighted to slip into the darkened cinemas and go where no man – or woman – had gone for a long, long time.

Aron and the rest of the theatrical industry hope people keep up the momentum because ticket and concession sales are better than they were in 2019.

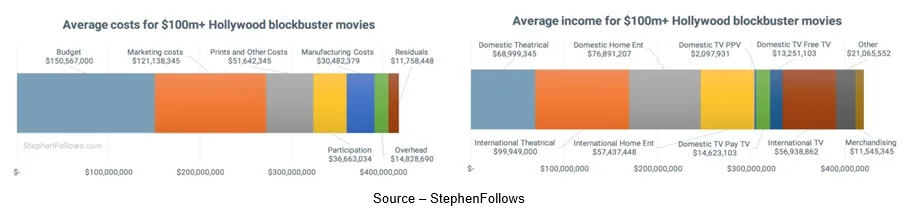

Right now, studio execs need that audience because their big budget backlog of sequel, prequel, spin-off superhero and over-the-top stuff need the ticket sales to make a profit before they recycle the films to their streaming services.

And the movie house industry – NATO (National Association of Theatre Owners), international cinema associations, and indie cinemas – need the attendees to buy popcorn as they put seats in seats to make a profit.

It’s been that way ever since Alice Guy-Blaché directed her first film in the late 19th century.

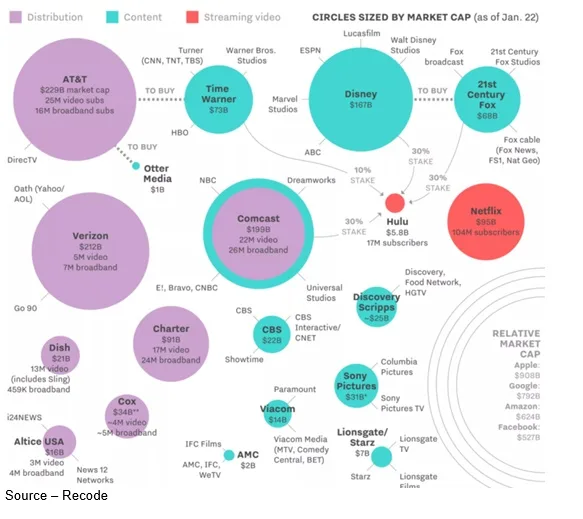

The M&E industry changed when TVs entered the home but there was an uneasy truce until streaming video slowly began to change the entertainment landscape.

People quickly realized they had a new entertainment option beyond the rising bundle cost, day/time TV appointments and growing crap load of ads – 20-minute blocks out of every hour of entertainment.

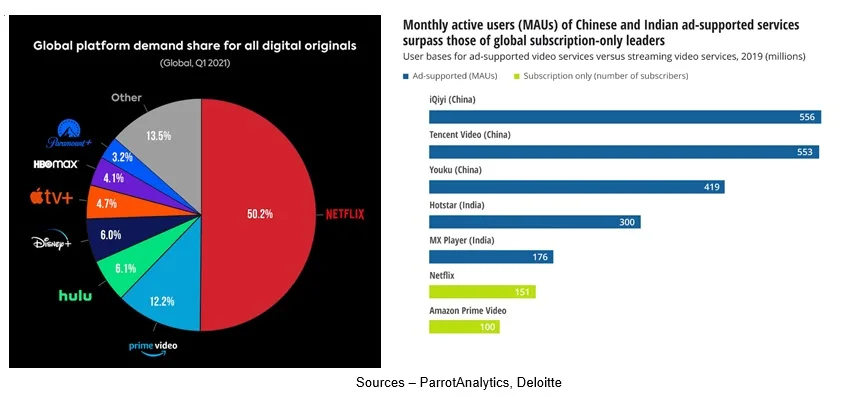

Netflix, Amazon Prime and Hulu became so popular that today they account for 60 percent of the U.S. streaming.

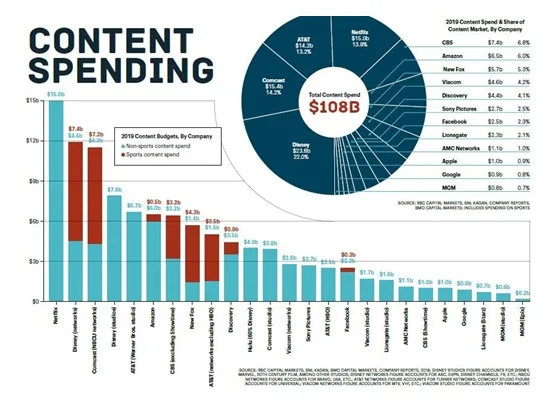

Success like that is too good to be ignored so, every media organization determined streaming was tailor made for them.

To stay ahead of the hungry pack, the three switched from licensing content to creating new, different stuff – actually studios said they wanted their content back so they could recycle it and be more competitive.

In addition, they – and some of the “new” competitors figured they should reach beyond the world’s biggest entertainment market (the U.S. which now has an estimated 300 streaming services) and sign-up viewers globally.

Of course, the Middle Kingdom (with the largest population) carefully isolates its viewers while India (second largest population) is willing to let its folks experience all of the world’s entertainment … within reason.

India – and 190 other countries – wanted something in return.

To slightly support the 1,000 + local streaming services and give their video creative industry a lift, streamers had to produce 30-40 percent of their content in country.

That probably wasn’t much of a strain because the leading services today are:

- Netflix with about 220M subscribers in 190+ countries

- Amazon Prime Video 200M+ subscribers in 190 countries

- Tencent 130M users in 10 SEA (Southeast Asia) countries

- IQIYI 120M users in 10 SEA countries

- Disney + 100M+ subscribers in 40+ countries

- Youku 90M users in 10 SEA countries

- Disney Hotstar 26M+ subscribers

It didn’t take Televisa and Univision long to determine they were better together in the new content arena and they merged to become the world’s largest Spanish language content development/production organization as well as a linear/streaming video entertainment organization.

After all, Spanish is the fourth most widely spoken language (23 countries) in the world behind English, Mandarin and Hindi.

Netflix invested $200M+ for content in Mexico last year. Disney is planning 70 originals in the region, Warner is planning on big things for HBO Max in Latin America, and expect to see more latinos on the screen in the year(s) ahead.

While people can enjoy subtitled and dubbed content, the jokes are funnier, monsters are scarier and heroes/heroines are braver when they speak their lines in your language.

There’s another advantage for streaming that organization executives became even more sensitive to as they began cranking out more and more films and TV shows for their “new, different” thirsty audiences.

Production/post talent around the globe is universally excellent and a lot of times it’s less expensive/less restrictive to create video stories in other countries rather than Hollywood or Georgia or …

In addition, with today’s advanced production technologies and tools like Sony’s crystal LED virtual production wall and Unreal’s real-time game engine, producers/directors can not only reduce a project’s budget but also improve overall efficiency and blow the doors off creative possibilities.

Taking a page from Netflix’s and Amazon’s production script, studios are abandoning their old production/distribution model of shipping movies/shows to other countries.

Instead, they’re investing billions to make culturally specific, local language content as well as sign long-term contracts for studios around the globe to increase the volume of film work they’re doing without minimizing quality.

Streamers that want to/need to expand their audience reach realize that the majority of their prospective consumers are going to be outside the U.S.

Last year’s worldwide streaming subscriptions topped 1.1B, up from fewer than 400M subscriptions in 2016, according to the MPA (Motion Picture Association).

Global content demand has created more work for producers, video storytellers and indie film creatives everywhere as Hollywood-created content begins to play a smaller role in the worldwide entertainment industry.

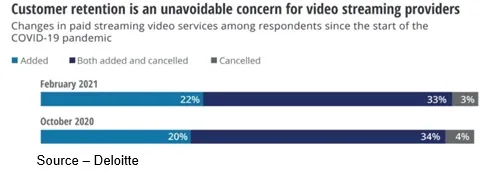

The rise in overseas production has created a dramatic increase in films/TV shows in languages including Hindi, French, Portuguese, German and Polish as streaming providers focus on acquiring subscribers … and keeping them.

And as Netflix’ Hastings and Sandaros and Amazon’s team will tell you, one of their keys to success has been understanding – and listening to – their subscribers as well as what they want/don’t want.

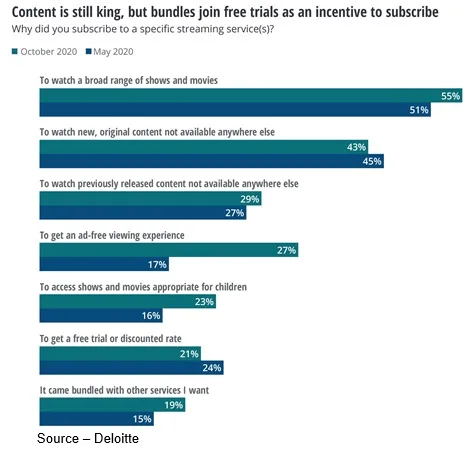

Netflix’s subscribers told them originals are “absolutely critical” to their decision to keep using the service (21 percent), while 41percent rank them “very important.”

The two organizations use viewer/viewing data analysis to guide the greenlighting of creative projects and ensure they have the right mix of video stories … people like variety now and then.

Both Netflix and Amazon have been paying increased attention in the Asian market such as when the Chinese public flocked to the cinema to see Hi Mom, Detective Chinatown 3, and Wolf Warrior 2.

In addition, the data-driven firms saw global interest rise in K-drama and Japanese anime.

Early this year, Netflix said it would spend $500 million on South Korean films and series in 2021. Shortly after that, the company premiered 40+ new original Japanese anime titles (2x over last year).

The two genres have boosted their subscriptions in both countries as well as throughout Southeast Asia and increasingly, in the US and in Europe.

Anime titles have consistently been on their top 10 most watched list in 100 countries this year, while Korean content viewing has quadrupled throughout Asia on their service.

With mind-boggling growth in the area and around the globe Disney + has also rapidly ramped up its local content operations, emphasizing that anime and K-drama are bedrock foundations for area growth.

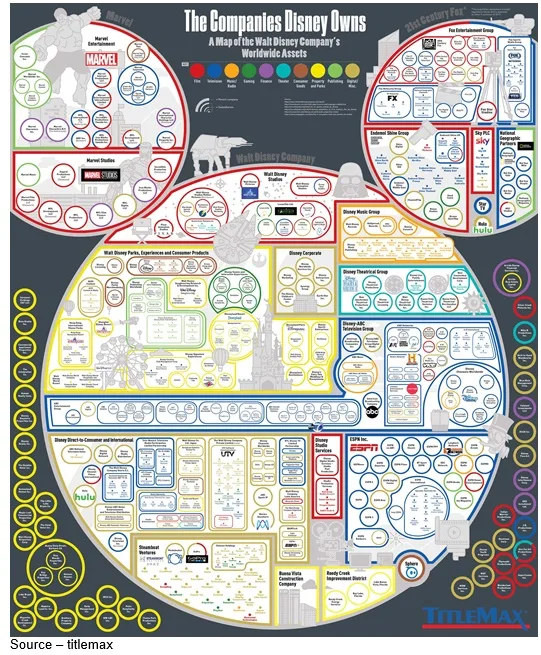

O.K., we admit it, we felt really sorry for Disney’s Bob Chapek when Igor seemed to say, “Hey look, stuff is gonna happen next year so you take over as CEO, I’ll sit in the back seat and you drive.”

Despite having to shut down the parks, dock the ships and close retail outlets around the globe, the company stepped on the gas for Disney+ and used its stable of A-list, family-friendly brands—Marvel, Star Wars, Pixar, Nat Geo, Lucasfilm, FX, Fox, History Channel, and more – to attract more than 100M subscribers worldwide in less than a year and a half.

Of course, offering a chance to see Hamilton, Mandalorian, WandaVision, Soul, Captain Marvel, and some of the greats from their vault sure made it easy to sign up for their service.

In addition, thanks to people anxious to have some fun again, park employees are back and so are families.

The new service’s unwavering focus on branding and cultivating its global audience – along with quadrupling its content spend to $8B plus – proved they could rapidly turn fans into subscribers.

And at the same time, they continued to be the friend theaters needed to get seats into seats.

With Netflix, Amazon and Disney having firmly established themselves as the streamers of choice in the minds of global consumers, the big question that will be answered in the year(s) ahead will be how many other second-tier providers will consumers support in addition to their local and niche services.

Those that misstep will have to admit Augustine was right when he said, “I’m afraid we didn’t do a very good job of looking after the place while you were away.”

While folks are citing problems, we want to note that someone really didn’t do a good job of looking out for Broadway for us.

No more cheesecake at Stage or Carnegie Delis … gone!

Despite what AMC’s Aron says, no entertainment comes close to live theater–especially Tina!

# # #

Andy Marken – [email protected] – is an author of more than 700 articles on management, marketing, communications, industry trends in media & entertainment, consumer electronics, software and applications. An internationally recognized marketing/communications consultant with a broad range of technical and industry expertise especially in storage, storage management and film/video production fields; he has an extended range of relationships with business, industry trade press, online media and industry analysts/consultants.