Entertainment Selection Satisfaction Is On Its Way

Some folks are talking about web 3.0 like it is the beginning of a whole new, better world that will make everything that went before it obsolete–especially for the M&E industry.

We’re also talking about the Metaverse like it’s the place where everyone is going to be.

But entertainment is fundamentally the same with a few added enhancements — digital and profuse.

You’re not going to see the “old/familiar” forms disappear. We’ll still have vaudeville … we’ll still have live theater and live events with even more people crowding the venues … we’ll still have movie houses that folks want to gather in to experience/enjoy the dynamic/dramatic projects … we’ll still have orderly linear TV you can turn to for predictable stuff.

Technology and data are simply helping us enrich and personalize our content–the more data the more personal our content will become.

Personal data has enabled Netflix, Amazon, Apple and Disney to scale up their video streaming services nationally and internationally.

We laid the foundation more than 30 years ago when technologists determined a zero-profit tool was needed for people to quickly and easily exchange information, ideas.

BAM! Today we have leveraged that tool to enable creative people to develop/deliver more and more varied content to folks everywhere.

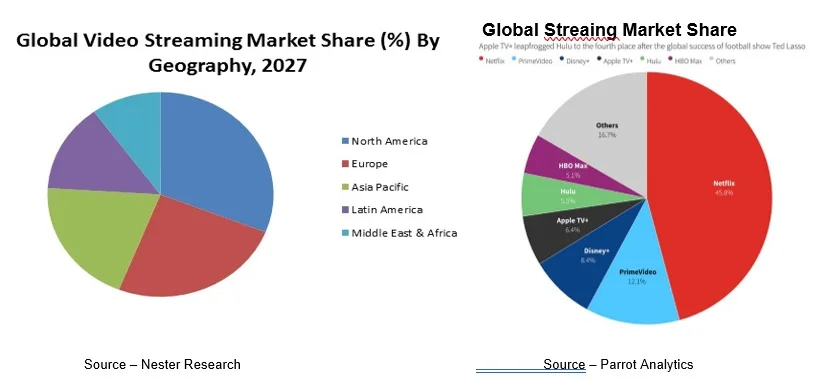

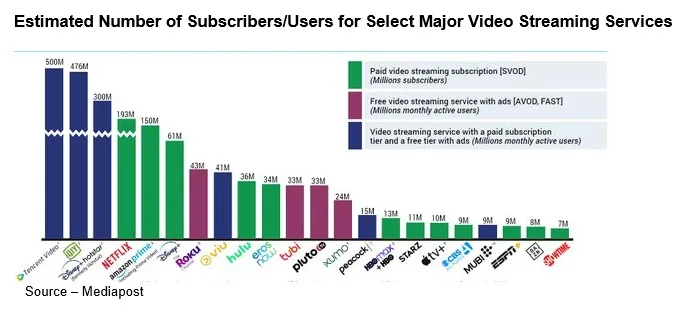

Global OTT traffic from more than 200 US and 2000 global services are delivering a dizzying array of content to more than 340M U.S. and more than 770M around the globe, and traffic is expected to increase nearly 200 percent this year over last.

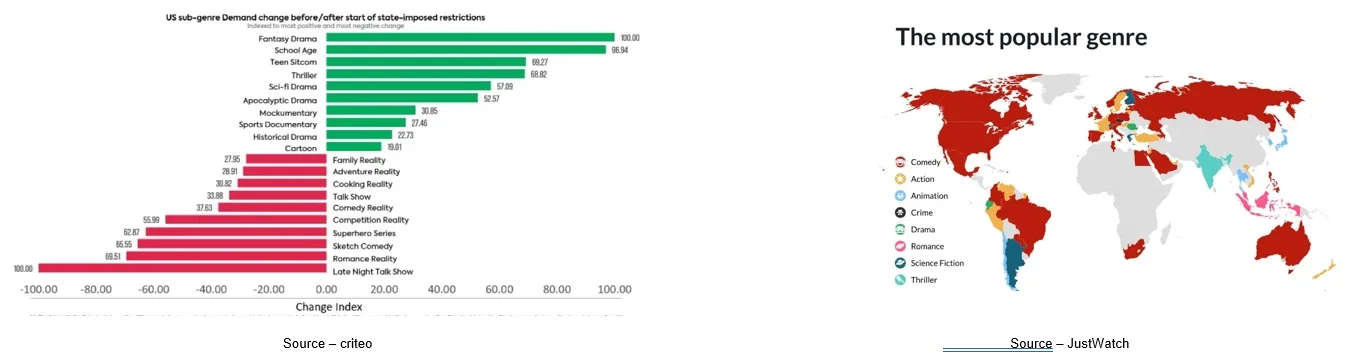

The pandemic certainly gave the industry a major boost:

- 82 percent of U.S. consumers have a video streaming service with the average being four subscriptions.

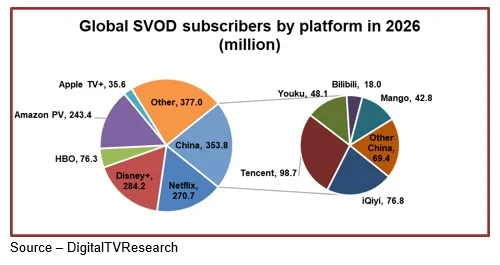

- Across the globe, 770M people signed up for an SVOD service this past year, nearly a 40 percent increase over previous year.

- US OTT income will grow to nearly $48B in two years, while China’s revenue will triple to $26B–one-fifth of the global market.

- Western Europe is projected to have 196.3M OTT users by 2024, 45 percent of the population

- The U.K. has 286M plus internet-enabled devices – 10 per household

- Leading Asia-Pacific markets are the Philippines, Indonesia and Australia which are growing to nearly $45B by 2024.

- Latin America is projected to have 116M OTT subscribers with Brazil and Mexico leading the pack.

Content came first from the technology leaders who had a solid grasp of the fast, reliable, global reach of the internet. Netflix, Amazon Prime Video, Apple TV+ and Disney+ steadily invested in new, different, unique and outstanding content.

Allan McLennan, CEP/Media, Head of M&E North America, Atos, pointed out that we’re two years into the streaming wars and the newness is starting to wear off.

People have settled into a modified, yet enhanced entertainment routine.

“All of the services benefitted from the shifting of movies that would have been viewed in theaters to watching them in the comfort of their home,” he observed, “but two years of lock down and limited access was enough. People are cautiously returning to selective IRL (in real life) gatherings and the office while tempering their streaming entertainment.

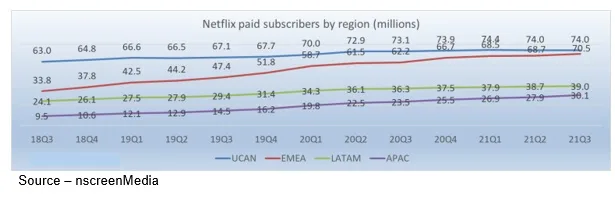

Netflix, the streaming giant, remains the leader with more than 218M subscribers worldwide, ahead of its closest competitor Disney (200M) which includes Disney+, ESPN+ and Hulu.

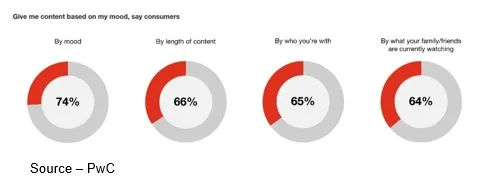

McLennan noted that most of Netflix’s new subscribers have come from the Asia-Pacific and EMEA (Europe, Middle East and Africa) regions. As a result, it has increased its investment in foreign-produced shows which are not only less expensive to make but travel well beyond country borders.

Amazon Prime is a strong contender but it’s difficult to define its subscription base (stated to be 200M+) because it also includes folks that are there for the shopping discounts and free shipping.

However, Amazon continues to invest heavily in new content — $11B, compared to Netflix’s $17B. But with its pending $8.5B acquisition of MGM, it will not only have a strong content library to draw from but a number of content franchises for future projects.

The streaming services have steadily increased their investments in fresh documentary, family, animation content with Netflix and Prime Video leading the SVoD ranks with the largest thriller projects.

Cautiously straddling the lines between theatrical, same day and streaming first, the family-oriented content producer Disney has had exceptional subscription growth (200M) in two years. The company has benefited from its extensive global presence and content for Disney+ from subsidiaries including Marvel, Pixar, Lucasfilm, FX, History Channel, ABC and Touchstone Pictures.

Hulu is an anomaly in streaming because it is 60 percent owned by Disney (Comcast holds 30 percent) thus indirectly contributing to the streamer’s growth. If/when Disney can convince Comcast to give up it’s 30 percent share, Hulu will take its rightful place in the Kingdom. If not, it will remain a solid financial contributor to Disney’s bottom line and a streaming option for more adult content.

Emphasizing their streaming-first approach, Disney’s CEO Bob Chapek has ensured that new ESPN sports deals also include full streaming rights.

The bundle of Disney +, ESPN + and Hulu offers one of the best streaming solutions for the entire family.

While Apple has always been known as a content over process company, many in the M&E industry really didn’t take the fruit company’s Apple TV + serious because of it’s calculated, slow-paced approach.

But projects like Ted Lasso, The Morning Show, Greyhound, Finch and The Velvet Underground have earned the company a shelf full of awards and an estimated 40M subscribers (free and paid) from the more than 1B global Apple users.

And should CEO Tim Cook and his crew decide to ramp things up the company entertainment presence, the company has cash reserves of about $200B which could enable them to acquire one or two of the streaming late comers.

Now that the merger of Warner Media and Discovery is almost within reach (Warner Bros Discovery), HBO Max has a solid chance of becoming a fifth major streaming option for folks around the globe. The $43B mega-merger adds a lot of financial pressure for Discovery’s David Zaslav, the head of the new firm. However, he is confident he can quickly reduce expenses an estimated $3-$4B by eliminating duplication (staff cuts) and merging the two firms’ subscribers – 70M HBO and 20M Discovery – into a strong global viewer base.

Many feel that only five streamers can succeed on a global scale, which leaves others to focus on regional or niche participants.

This calls into question the place for Peacock (Comcast’s NBCUniversal) and Paramount + (ViacomCBS’ rebranded CBS All Access) in the global streaming marketplace.

The two have worldwide subscriptions of more than 54M and 47M respectively but still rely heavily on day/date series and film/show libraries.

McLennan noted that broadcast outlets still attract millions of viewers daily and that pay TV will continue to be a profitable entertainment alternative to streaming for the foreseeable future.

However, for streaming, we can expect more consolidation and service aggregation.

“The major differentiator between appointment and streaming video entertainment is data,” McLennan emphasized, “and the tech-driven organizations have understood this at the outset.”

“From the outset, they have been accumulating vast caches of information – feedback, subscriber day/time/location information and even a breakdown of the amount of time people watched individual movies/shows,” McLennan commented.

“Instead of practicing the matras of ‘content is king’ and ‘if you build it, they will come, they understand that the consumer is king and his/her viewing habits vary and are constantly changing.”

There is so much premium content at their disposal (more than they can possibly consume) that their interests and entertainment needs are constantly changing.

To keep pace, McLennan said that AI (artificial intelligence) and ML (machine learning) data are increasingly being used by streamers, project creators and A-listers to track and anticipate what new content will appeal to subscribers and potential subscribers.

In the early days, Netflix focused on subscriber households that tuned in to at least two minutes of a program/ It produced impressive numbers (billions of minutes) but was also rather meaningless.

Other streaming services quickly followed suit, as did measurement services.

To make show and movie viewing more meaningful (and probably keep everyone guessing), they shifted to total hours viewed as a standard metric.

“The demand for original and exclusively licensed content is a leading indicator of subscriber growth for SVOD platforms,” said McLennan. “Since this form of delivery isn’t selling ad slots within their content, it’s obvious that they are a little less outwardly transparent on project performance. Instead, all of the data/results/analysis are used internally to develop new movies/series, keep present viewers and entice new subscribers.

“In their defense,” McLennan added, “streaming services are hesitant to share their results, especially when it comes to what really counts–viewer wants and sentiment feelings, views and opinions.”

Financial analysts like to point to the deep, wide libraries of “rich” content they have that will obviously ensure their success.

Wrong!

First, if you viewed many of the films/shows in terms of today’s political/social environment, you’d notice they have to be seriously edited or folks would unsubscribe … in droves.

You know, stuff we innocently enjoyed years ago – Blazing Saddles, Airplane, Tropic Thunder, Sixteen Candles, Breakfast at Tiffany’s, Song of the South, many early Bond films, Dumbo, The Jerk, Sausage Party and your own WTF unfaves!

No, people want fresh, original content that “feels” as though it has been developed for them personally. Content that interests, attracts and keeps them.

When viewers log in to watch “something,” they want/expect a hyper-personalized bundle of entertainment options that gets better and better the longer they subscribe.

That data also helps Netflix, Amazon Prime, Apple TV (and increasingly, Disney) to determine which projects to greenlight. It also helps the production team create a film/series that will earn audience attention and accolades around the globe.

Even A-Listers understand what Abbas meant in Foundation when he said, “Past behavior is the best predictor of future performance.”

Even A-Listers understand what Abbas meant in Foundation when he said, “Past behavior is the best predictor of future performance.”

We’d just like to be able to use one entertainment search entrance point instead of our five separate streaming sites.

We know Demerzel meant well when she said, “The search for meaning is not always about the answer. It’s also the process of seeking that enlightens.”

Thanks, but we simply want our entertainment coming to our screens as we envisioned it five years ago!

# # #

[email protected] – is an author of more than 700 articles on management, marketing, communications, industry trends in media & entertainment, consumer electronics, software and applications. An internationally recognized marketing/communications consultant with a broad range of technical and industry expertise especially in storage, storage management and film/video production fields; he has an extended range of relationships with business, industry trade press, online media and industry analysts/consultants.