Everyone in the M&E Industry Wants the Same Thing … Viewers

You may not realize it, but the entertainment food chain has changed dramatically over the past few years.

In fact, according to MPA’s (Motion Picture Association’s) head, Charles Rinkin, it’s on the cusp of some fantastic growth.

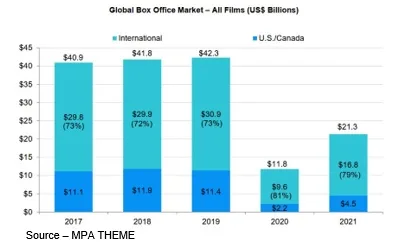

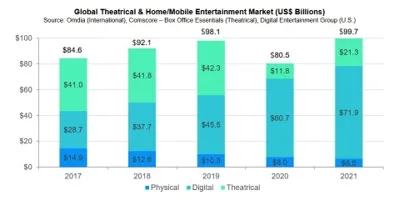

He reported in their recent Theatrical and Home Entertainment Market Environment (THEME) report that the industry grew a very healthy 24 percent since 2020 to $99.7B–even better than 2019’s results.

The production of new shows and movies by MPA members skyrocketed last year with more than 2,600 projects being released and more than double that figure completed by non-members and indies.

More than 940 films entered production in 2021 in the US/Canada in addition to the release of 1,800 original scripted series that including children’s programming, daytime dramas and unscripted shows.

Yes, a lot of those video stories went direct to home screens rather than the big, big screen but for gawd sake, folks got used to the idea of instant entertainment gratification at home rather than trudging off to the movie house.

Families had gotten used to paying for five streaming services (Ampere Analytics’ average) and still having access to a couple of free (ad-supported) services.

At least it’s a known cost and lots better than going to one of Adam Aron’s AMC theaters to see a killer flick like Tom Cruise’s long awaited Top Gun: Maverick that will fire up the afterburners beginning May 27.

AMC owns/operates 10,500 of the worldwide 200,000 +/- screens and Aron creatively thought outside the box by charging “a little more” (surge pricing) so people in the ticket booth can say “surprise!” when it comes to hot films people are starved to see.

Waiting for 36 long years for Maverick/Cruise to light up the big screen certainly qualifies.

Now you – and more than a few studio execs – may call it greedy, but he prefers to call it being creative and imaginative.

We have an even more creative option for Aron…install a Vegas wheel of fortune by the ticket booth, let the theatergoer spin the wheel and see where it lands.

Now that’s creative!

Even though ticket sales climbed dramatically last year ($21.3B – compared to 2020’s $11.8B), global box office revenue was still down 50 percent compared to 2019’s $42.3B.

True to his out-of-box thinking, Aron recently invested $27.9M in a hole in the ground.

O.K., it’s a gold/silver mine, but one hole (owning theaters) is as good as another (Hycroft Mining) as far as Aron is concerned.

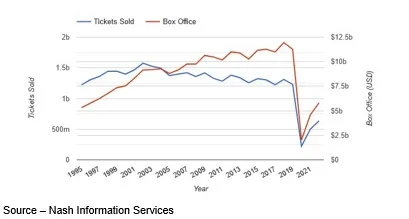

As Nash Information Services has consistently reported in recent years, ticket sales have fallen steadily since 2002 while box office receipts rose steadily until 2018, thanks to higher ticket prices and mouth-watering concession stuff.

But even AMC’s Perfectly Popcorn hasn’t been enough to offset the rapid shift to streaming video services, which is probably why he came up with the idea of selling his popcorn delicacy at retail in shopping malls, grocery stores and food delivery services.

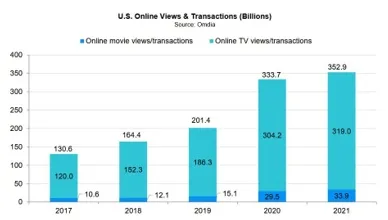

It shouldn’t come as a surprise to anyone that the global home/mobile entertainment market is huge and getting even bigger.

The number of global online video service subscriptions rose to 1.3B (multiple subscriptions per household) last year for an increase of 14 percent over the previous year.

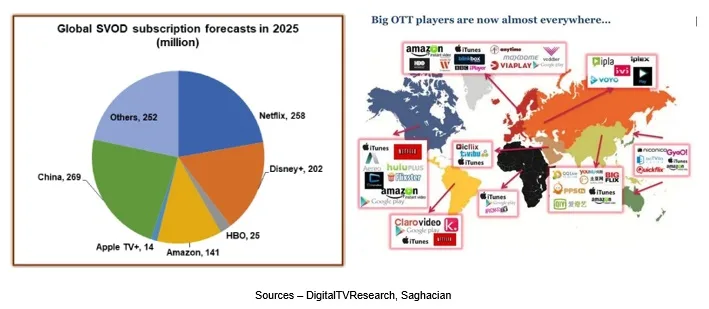

Even though there are already well-established global streaming video services, there are 220+ organizations jockeying for a larger piece of the home streaming market as well an estimated 2-3 times that number of regional and local services.

The rush to “get in on the ground floor” reshaped the entire content development, production, delivery industry.

Folks pulled back their content from the people who started the industry (Netflix) so, they turned around and set up long-term contracts with many of the M&E industry’s A-list creators/actors in Hollywood and major production hubs around the globe to produce 40 percent of the original content they offered in 2021.

By 2025, Reed Hastings and Ted Sarandos (co-CEOs) estimate that 75 percent of their offerings will be original.

More than 214M subscribers in 190 countries will be able to choose from more than 80 films and a growing list of series this year from studios and regional A-listers around the globe.

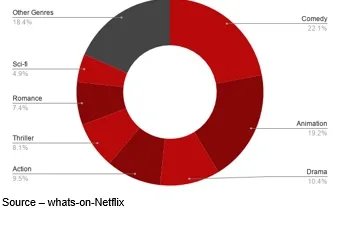

In addition to the most popular genre globally and regionally, the company is also using its own secret sauce to determine which films/series to greenlight that will have the greatest chance for subscriber appeal to help grow their subscriber base and reduce subscriber shrink (switching to another service).

Okay, detailed subscriber data is the world’s worst kept secret; but by studying the detail in painstaking detail, they are better able to predict which shows/series will best resonate with viewers around the world to optimize their project budget investments.

Does it work?

It’s proven to be pretty effective in helping them select and launch South Korean, Japanese, Indian, Spanish, Mexican, French, Nigeria and other waves of content around the globe–especially in the Americas.

To expand their subscriber appeal, they also made a move into the online gaming industry, which is projected to be a $196B market this year according to NewZoo and is expected to have steady growth of 10 percent annually through 2025 … and beyond!

It’s true, Amazon Prime has similar drill-down information on their 200M+ subscribers but sometimes it’s difficult to determine if people want more Reacher, Upload, Hustle or a new pair of boots.

Of course, closing the $$8.5 B deal to add MGM to its inventory might make Andy Jassy, Amazon’s CEO, more anxious to replace Jeff Bezos on the red carpet so Bezos can play with his rocketships.

Although Disney’s CEO Bob Chapek is finding it a little difficult right now in what he communicates/doesn’t communicate with his team and the outside world, he’s done a pretty good job of keeping the company’s content train on the track over the past years when no one seemed to know where the tracks were.

While his predecessor, Bob Igor, brought all of the content pieces together (Disney, Marvel, Pixar, Star Wars, National Geographic, Fox, Touchstone, Lucasfilm, History Channel, Hulu (80 percent ownership), Star, and more), Chapek and his team have been able to grow Disney +’s global subscriber base to more than 130M in the past two years and plans to equal Netflix’s in the next few years.

Taking the reigns of the new Warner Bros Discovery, David Zaslav (Discovery boss) is bullish about bringing together two already established streaming services – HBO Max and Discovery – to develop one of the strongest, most aggressive streaming services on the planet.

His transition team is already busy reducing corporate overhead for the combined media assets, which his CFO Gunnar Wiedenfels is confident can “easily” produce $3B in annual savings for the new DTC (direct to customer) company.

But they’ll need to move more than that to the bottom line to justify Zaslav’s eye-watering compensation package of $246.6M.

In the months ahead, the organization will be focusing on harmonizing the technology platforms, building one very strong/responsive service. You can expect the new organization to maintain (not increase) its content production spend over the next year or two and to also mend a lot of bridges with entertainment A-Listers, which cost Warner a few hundred million because of past team members.

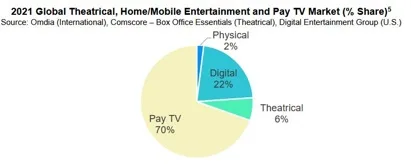

MPA’s Rivkin noted that the young, emerging streaming content marketplace produced 72 percent of the M&E’s combined theatrical and home/mobile entertainment market.

Pretty good growth for an industry started by a guy who was tired of licking red envelopes 17 years ago.

Now everyone is stepping up to say they are reinventing the way people watch their entertainment … any time, any place, any screen.

With nearly 2B TV households worldwide and more than 5.68B people projected to have TV sets by 2026, there are still plenty of growth opportunities for global, regional and local streaming services to sign-up/retain at-home subscribers/viewers.

After all, “they” all say pay TV is so yesterday … or is it?

Rivkin said appointment TV folks took in more than $328.2B in income last year, six percent over the previous year.

In fact, pay TV subscriptions were 70 percent of the total M&E market last year.

Not bad for a has-been!

While each segment player (theatrical, streaming, pay TV) can brag about their growth and potential for the future, it doesn’t make much difference to us.

What the THEME Report and every analyst’s projections tell us is that there are a lot of great opportunities for content developers, creators, producers and postproduction folks in the year(s) ahead.

The one thing all of those movie houses and program listings as well as ad-supported and subscription services need is the same thing … damn good content!

The one thing all of those movie houses and program listings as well as ad-supported and subscription services need is the same thing … damn good content!

As Danny Archer said in Blood Diamond, “That’s for breaking my TV!”

# # #

[email protected] – is an author of more than 700 articles on management, marketing, communications, industry trends in media & entertainment, consumer electronics, software and applications. An internationally recognized marketing/communications consultant with a broad range of technical and industry expertise especially in storage, storage management and film/video production fields; he has an extended range of relationships with business, industry trade press, online media and industry analysts/consultants.