Every Streamer Plans to Win

Reid (Hastings) once told us that Netflix,s only competition was sleep and we believed him … until we didn’t.

While we blissfully watched the new shows/movies he and Ted (Sandaros) pumped out, the two were expanding around the globe (now available in 190+ countries), making sweetheart deals with governments and studios like the recent one with France.

No, the agreements weren’t nefarious.

To the contrary, they were good for countries, local studios/indies, local viewers and the rest of us who accepted their first monthly price increase since 2020.

Price increases were something we had become accustomed to in the old cable bundle days, which was why we cut them off; but the increase was only $1-$2 and they don’t have advertisers to pay part of the tab so … it’s different for the time being.

In addition, Netflix agreed to show 25-30 percent of French content in the country and obviously they’re hoping they discover some projects that will resonate with subscribers here and abroad like Squid Games, La Casa de Papel (Money Heist), Atelier and more.

France sweetened the deal by cutting its theatrical window by more than half (36 months to 15) and the local industry will probably now be more receptive to Cannes Film Festival submissions (got the cold shoulder before).

Netflix has learned to embrace local projects because:

- Production is usually much less expensive outside the Americas

- Fantastic pre- thru post-production talent exists everywhere

- Good films/shows resonate with global audiences no matter where they are made

It must have worked because while Netflix was and is founded on technology, it has become a major content producer.

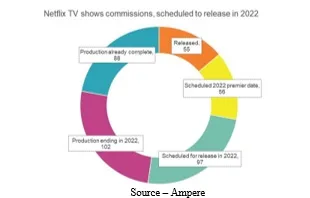

This year, they will probably turn out nearly 400 original shows that will feature increased diversity, greater volume of international work, broader spread of genres and yes, video games from their acquisition last year.

Why so much?

First of all, it’s because they need to sate the voracious entertainment appetite of its 220+M subscribers, minimize churn and … grow again.

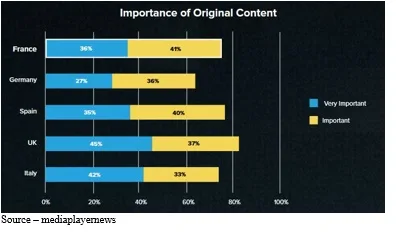

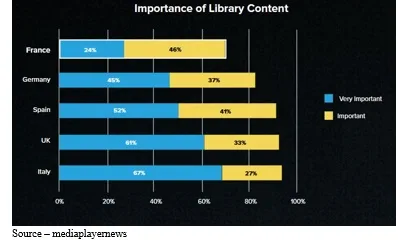

The former Red Envelope company found out long ago that people like, want and need new, original content.

At the same time, they stick around for the library of excellent and familiar movies, shows.

Content development, production, distribution has become big business around the globe.

China became the world’s largest movie market last year with $3B, nearly $1B more than the Americas.

China built more than 20,000 screens over the past three years – giving the country a total of 75,000 screens, double those in the America’s which are declining. In addition, the theaters opened sooner than in the ROW (rest of world), accelerating the Chinese industry’s growth timeline by 5-10 years.

Of course, the rigid governmental control over films/shows that appear on Chinese screens has also caused headaches with studios, content producers and streamers elsewhere.

While projects like Spider Man: No Way Home, No Time to Die, Matrix:Resurrections, Dune and others were either prohibited for Chinese exhibition or suffered from negative audience response; they did exceptionally well with the pirate viewing population.

Chinese censors either blocked or required heavy editing of Western films that did appear on the country’s theatre screens.

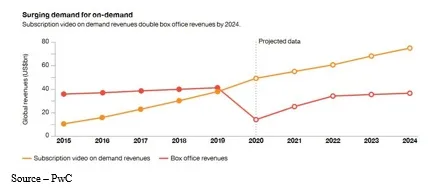

At the same time, global streaming video service popularity grew as people put seats in theater seats less frequently.

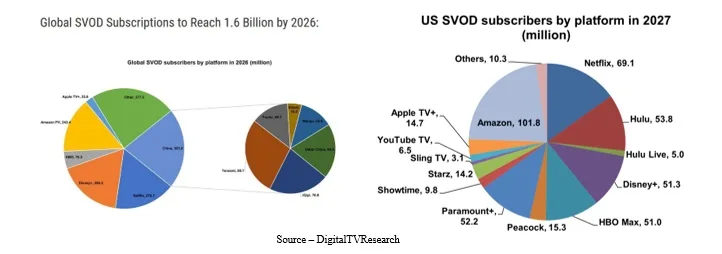

Subscription streaming services (SVoD) are still projected to reach nearly $83B this year and could grow to $116B by 2026.

Already a vibrant streaming market, SVOD services will bring in more than $36.5B this year.

As with their theatrical showings, China holds stringent control of the local-only streaming services which only include Tencent, iQiyi, Youku, and other smaller providers available to the country’s population.

US streaming customers will spend an average of nearly $70 annually for access to five services.

User penetration in the Americas is expected to be 16 percent this year and nearly 19 percent by 2026 or 1,586M subscribers.

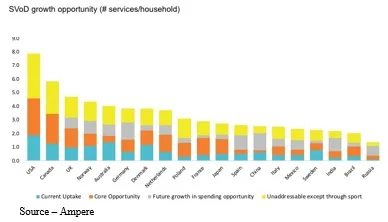

Obviously, there is still plenty of streaming growth opportunities–both in the Americas and abroad despite recent surprises.

According to analysts at Digital TV, the number of customers in Africa, Europe and the Middle East will not equal or outnumber those in the Americas for a couple of years.

Netflix’s past and present D2C (direct to consumer) growth and the slow demise of linear TV has not gone unnoticed by others in the industry.

Allen McLennan, CEP/Media, Head of M&E North America, Atos, suggested that five major U.S.-based platforms (Netflix, Amazon Prime Video, Disney+, WarnerBros Discovery’s – HBO Max and Paramount+) could control half the world’s SVOD subscriptions by 2027.

Despite its maturity and hiccups, he believes Netflix will add 60 million subs over the next five years.

“The other two technology-based providers (Amazon Prime Video and Apple TV+) view and approach their streaming subscribers differently from their Silicon Valley neighbor Netflix,” McLennan said.

“They both look to attract and retain their customers beyond being strictly a streaming service provider,” he emphasized.

“Amazon has more than 200M subscribers but most of them sign up to take advantage of free two-day shipping, video games, books and other services,” he noted. “Apple, with an estimated 20M subscribers, is a very successful lifestyle brand. Video content – as well as video games, reading materials, communications/storage – is designed to keep folks in the ecosystem.

“Both provide rich, fresh and distinctive content as a value-add service to their customers,” he added, “but Amazon has to pay attention of recent pushback on subscription fee increases.”

While Disney stumbled slightly when it rolled out Disney+ in 2020, the entertainment icon quickly recovered with outstanding content from its global production operations including Disney Pictures/Animation, Pixar, Marvel, Lucasfilm, 20th Century Fox, Searchlight, ESPN, National Geographic, Star, Hulu and Hotstar.

While Disney stumbled slightly when it rolled out Disney+ in 2020, the entertainment icon quickly recovered with outstanding content from its global production operations including Disney Pictures/Animation, Pixar, Marvel, Lucasfilm, 20th Century Fox, Searchlight, ESPN, National Geographic, Star, Hulu and Hotstar.

In Q1 of this year, Disney+ reported nearly 130M subscribers in six continents and is projected to overtake Netflix by 2028, adding 146M subscribers for a total of 276M.

It’s worth noting that Disney’s Hotstar service is projected to have 106M subscribers in 13 Asian countries. They’re hoping the India mix of sports (cricket is a national obsession in India) plus originals and low price will be important to folks across SEA (Southeast Asia).

Easily the biggest merger in recent history, Discovery’s David Zaslav, has more than his fair share of “issues” to tackle to prove his eyepopping new salary of $38M plus $190M in options as he moves to take control of the new Warner Bros. Discovery.

The new entity will bring together TV channels like CNN, TBS, TNT, HGTV, Food Network and Discovery Channel, the Warner Bros. film studio, and streaming services HBO Max and Discovery+.

Even before the ink was dry on the merger he signaled the demise of CNN+ which was felt throughout the news industry.

The organization(s) currently have about 90M global subscribers in 46 global countries and Zaslav is looking to grow that to nearly 150M subscribers in 190 countries within three years–even as he has to address relationships at home.

He has to mend a lot of fences in the content production/distribution arena after Warner’s short-timer, Jason Kilar, determined it was best to launch HBO Max streaming service with a modestly high subscription cost ( “Our content is so valuable people will happily bite the bullet”). He also surprised just about everyone by deciding the entire 2021 theatrical film slate would be simultaneously shown in theaters and on the streaming service.

The move forced Warner to pay out 10s of millions to satisfy disgruntled A-Listers and seriously damaged the firm’s 100-year reputation.

At the same time Zaslav will have to clean up Zilar’s second mess in shuffling people and furniture at CNN.

At the same time Zaslav will have to clean up Zilar’s second mess in shuffling people and furniture at CNN.

Warner Bros and CNN had historically been very siloed but now, Zaslav will have to accelerate his schedule of tuning the totally new organization into a lean, mean, focused team with one mission…make Warner Bros Discovery and services HBO Max, Discovery+ and Eurosport.com into global players.

With Zaslav and the rest of his “new” team moving to Hollywood, it’s becoming apparent that the town isn’t big enough for everyone and some folks will have to go.

The new Paramount (ViacomCBS), like everyone in the industry, is now all in when it comes to streaming in the increasingly crowded stage.

Chair Shari Redstone and CEO Bob Bakish have touted the breadth of content including sports, kids, general entertainment and news as they gloss over their steady losses, which are projected to end by 2023. Losses are projected to be $1.5B this year, even as they ramp up spending to $6B on new content in 2024.

The return of South Park, growth of Yellowstone’s and other popular projects are showing signs of producing a steady stream of spinoffs, expansions and line extensions. The optimistic duo is projecting that subscriptions will reach 88M by 2027.

It’s going to be an interesting ride as Paramount goes toe-to-toe with the powerhouses with their big IP portfolios

Comcast’s NBC, Universal Pictures and Peacock are struggling to find their place in the new broadband internet, linear TV, streaming arena.

While glossing over the miserable ratings for the Beijing Olympics, the company touted the strong numbers for football’s Super Bowl, emphasizing the events were good for advertisers.

Without citing specific subscription numbers for it’s premium and free versions, the company was anxious to discuss the roaring success of Hulu (their 33 percent stake could be bought by Disney as early as 2024) with more than 39M worldwide subscribers.

Yes, it’s confusing.

“While many say the US and global streaming service markets are approaching saturation, there’s still a lot of room for growth,” said McLennan.”Most consumers will have multiple services so they can enjoy a broad range of video content as the new participants – Disney+, Paramount+, HBO Max – make their presence known.

“Digital TV Research recently projected that global subscriptions could reach 1.75B by 2027,” McLennan continued. “Nearly half of that total will be generated by US and Chinese consumers so there’s still plenty of headroom for growth by the entire industry–especially since people in Africa, Europe and the Middle East are getting such a strong dose of local and international content.”

Studios will face strong pressure from all sides to support theaters with reasonable release windows while also operating and feeding their streaming service to expand and retain subscribers.

Studios will face strong pressure from all sides to support theaters with reasonable release windows while also operating and feeding their streaming service to expand and retain subscribers.

As Jerome said in Attack the Block, “There are worse things out there tonight! Trust us!”

# # #

Andy Marken – [email protected] – is an author of more than 700 articles on management, marketing, communications, industry trends in media & entertainment, consumer electronics, software and applications. Internationally recognized marketing/communications consultant with a broad range of technical and industry expertise especially in storage, storage management and film/video production fields. Extended range of relationships with business, industry trade press, online media and industry analysts/consultants.