Content Providers Prosper One Project at a Time

There are a couple of fallacies in the M&E industry – or any industry – and when company management really believes them, it seldom ends well.

There’s always someone who knows that the other guy is making all the money, all the profit … the grass is always greener on the other side of the fence.

No one bothers to think that the neighbor’s grass might be greener because they have a septic tank problem.

The person who owns the pipe to the consumer knows the individual who owns the content is raking in the profits and the best path to huge profits is to own the front and back end.

Oh yeah, and once they have the content, they just know it is the most valuable stuff around and folks will do anything to watch it, including paying more for video stories in their library and putting up with so-so service.

After all, … content is king, isn’t it?

Nope!

People have to want it, like it and that is tricky … at best.

The M&E business is complicated, complex, finicky … different.

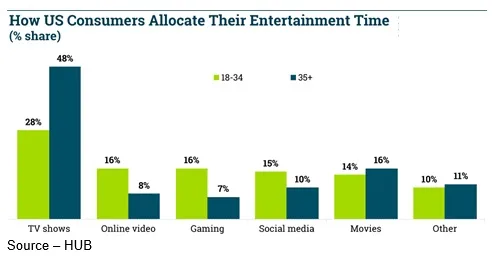

It’s tough/impossible to be good at everything–especially now when the consumer controls what’s viewed, when it’s viewed, where it’s viewed.

Back in the old content delivery days, cable companies delivered an overwhelming bundle of choices – 50 to 500+ channels – each with specific day/time shows.

Legacy networks blocked their shows.

For example, for CBS Monday is NCIS viewing, Tuesday is FBI viewing and so on while news of is at 5, 6, 7, 11 p.m.

Want it at a different time? Use the DVR.

Perfectly fine if you’re of “a certain age” but with digital streaming, new shows/movies are added to the services constantly.

Last year, Netflix released more than one new show/movie a day – 371.

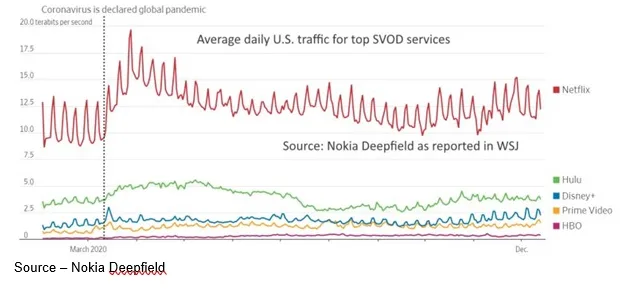

The company is on track to spend $17B to increase that number by more than 50 percent this year with content from around the globe for its 210M SVOD subscribers.

But Netflix knows there’s more to entertainment than shows/movies. so it has taken a page from Amazon and Apple to expand the options that are available in its walled garden.

After all, for even the most dedicated viewer there are only so many drama, comedy, thriller, dating, cooking, travel, talk, sci-fi, cartoon, documentary shows before they need a break.

While Netflix’s Reed Hastings has half-jokingly said its competition isn’t other services but sleep, he really knows the SVOD services competition is Fortnight – a multiplayer online video game – and YouTube’s constant barrage of ad-supported, constantly changing user content.

Netflix is beginning to cautiously add interactive video experiences and games built around some of their most popular shows.

Don’t expect a flood, but there will be a steady series to keep folks in their walled garden and hopefully reduce churn.

While Amazon is in the final stages of adding MGM to its growing library of entertainment choices and ad business, it continues to expand its options that have included a complete range of entertainment including books.

It may be a stretch, but they do have the deep pockets that are needed and … free shipping.

At the outset, Apple has maintained a balance of education, information and entertainment with a robust library of video games, books/periodicals and premium content designed to appeal to its more than 1B device users.

But the glamour and promise of synergy, the video story industry hasn’t been easy for the three firms as they might have expected in the early stages, but they learned by going slow and integrating themselves into the fabric of Hollywood.

It was easy for Netflix because it gained a strong industry foothold in the red envelope DVD days.

Amazon backed into the arena with its global cloud storage/delivery service that studios and content owners learned to trust for every phase of a project.

Apple had a strong advantage because of the creative relationship Jobs developed with Disney’s Isner as well as content creators around the industry.

But for most conquerors, the industry’s uniqueness and personal relationships have proven impenetrable.

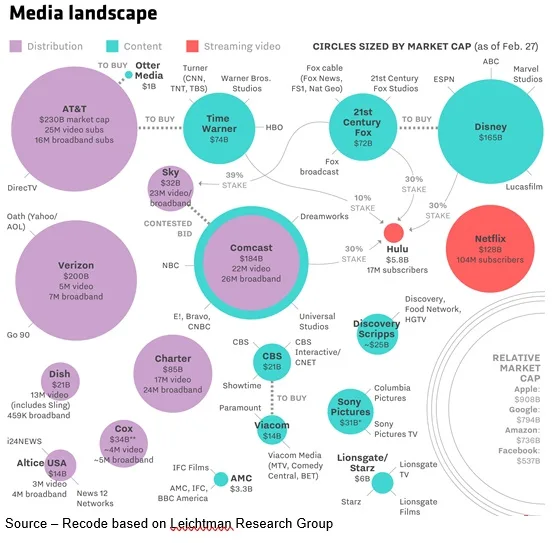

Despite the missteps in acquiring DirectTV, WarnerBros and a mountain of debt ($150B plus), AT&T’s CEO Stankey extolled his firm’s entertainment industry accomplishments in the past three tumultuous years when he announced the WarnerMedia-Discovery deal.

At the virtual JPMorgan 49th Annual Global Technology, Media and Communications Conference earlier this year when he announced the deal, he proclaimed HBO Max wouldn’t be where it is today if it weren’t for the strength of the combined companies and AT&T’s ability to normalize agreements and get the product/service off the mark.

Senior analysts at Global Data said that the WarnerMedia-Discovery deal will force AT&T to get back to basics and attempt to catch up with competitors (Verizon, T Mobile, Comcast, Charter and others) to build out its 5B and fiber broadband services to remain competitive.

Who knows, they may even take another page from the competition and develop a range of bundled streaming services to offer/entice customers.

Bundles make sense … when they’re priced with the consumer in mind.

They keep consumers watching stuff in the service provider’s walled garden instead of checking out the new service.

What the short-lived AT&T-Warner nightmare did validate is that the entertainment industry is so idiosyncratic that conquering or reshaping it is nearly impossible.

While the challenge of repairing WarnerMedia’s/HBO Max’s relationships won’t be a walk in the park, the head of the new organization, David Zaslav, is imminently qualified for the task.

Over 15 years, he built Discovery into a firm with excellent assets and has been working to get the best Warner people to stay despite his goal of cutting $3B of annual costs (layoffs).

During the merger announcement, he noted, “This is a business built on relationships and I’m old enough to remember that when I started out, if you could spend time with anyone in the business, you’d want to spend time with [Time Warner founder] Steve Ross. He was the guy who gave people the freedom to tell the stories they wanted to tell. He created a lot of value for Warner Bros. He really set the standard for how these businesses should be run.”

JPMorgan’s annual media, communications conference highlighted that even the unique entertainment industry continues to be different and the same.

Warner’s Ross would have spent time with Disney’s Igor and AMC’s Aron working on the coming two year’s theatrical window calendar and then letting the other studios negotiate the other film opening slots.

This year, the two organizations and other M&E firms discussed how they were juggling their creative content work and weighing which projects they were acquiring/planning, how they were leveraging/balancing their national/international subscription services, PVOD efforts and theater openings to optimize their global consumer expansion.

During the virtual event, Disney’s Chapek outlined a more humble and increasingly customer-focused organization.

“We learned flexibility is good,” he noted.

At the same time, he highlighted that consumer behavior has changed and that people want/expect options on their terms.

To deliver and grow globally, Chapek said the company is focused on keeping its evolving distribution channels well stocked with content offerings that will “sort of” keep everyone happy.

Disney is staying laser focused on its moneymaking M&E business while Warner/Discovery is struggling to return to the business it helped establish.

There are still a number of opportunities for shift and consolidation in the industry.

Traditional TV networks are still struggling to second-guess themselves on what flavor of entertainment people will agree to, on which day and what lead-in/follow-up shows will keep viewers connected.

With the rapid growth on anytime, anywhere VOD viewing, industry players like Lionsgate, AMC Networks, ViacomCBS (Paramount +), NBCUniversal (Peacock) and (despite rigorous denial) even Sony appear to be likely targets for acquisition or merger to develop the mass needed to compete in the changing environment.

Can’t wait to see what ViacomCBS becomes after Sheri Redstone rolled the management dice because Paramount + needs lots of great content and there’s not enough in her purse for great theatrical movies and great streaming content to entice mobs of subscribers.

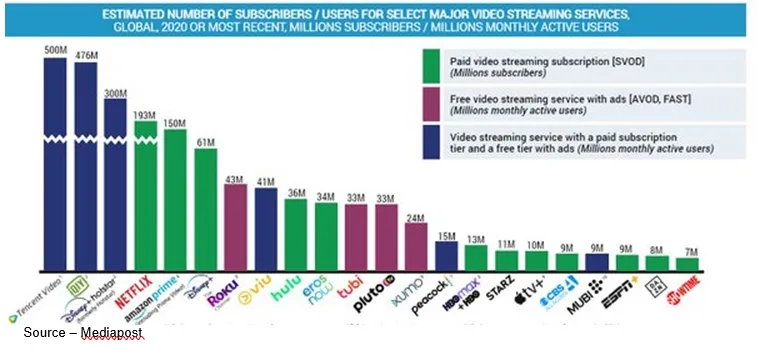

And the U.S. is one corner of the M&E industry that has an estimated 600 streaming service options which also have to compete with 2,000 plus services around the globe.

While Netflix has an impressive 210M global subscribers, Disney+ 110M and Amazon Prime 200M; there is still plenty of room for content-rich providers to grow globally.

The largest providers in China – now the world’s leading content production/consumer – Tencent (500M+) and iqiyi (480M+) have rapidly grown in SEA.

In addition, there are equally solid VOD (ad supported, subscription, transaction) services in Europe, Africa, MENA and elsewhere that have their sights set on the worldwide market which is projected to grow from 650M last year to more than 1.25B by the end of 2024.

Regardless of where they begin, streaming services all follow a similar path – license the catalogs/libraries of others, build their brand on the content of others and then build their own large library.

Rights-owning studios and licensing outlets skate on increasingly thin ice.

To effectively compete in the new global entertainment environment, providers need the largest – and constantly growing – content library possible.

Without billions of dollars, management’s ability to invest in new, different content success is virtually impossible.

As Joe ‘Deke’ Deacon said, “Not that much has changed then.”

As Joe ‘Deke’ Deacon said, “Not that much has changed then.”

To survive, grow and compete, second/third tier providers only have two options – buy something or be bought.

It doesn’t require huge leaps, just a continuing series of small steps moving forward.

# # #

[email protected] – is an author of more than 700 articles on management, marketing, communications, industry trends in media & entertainment, consumer electronics, software and applications. Internationally recognized marketing/communications consultant with a broad range of technical and industry expertise especially in storage, storage management and film/video production fields. Extended range of relationships with business, industry trade press, online media and industry analysts/consultants.