New Blood Can Give Theaters a New Lease on Life

Truthfully, if it weren’t for the fact that our daughter had to see Trolls World Tour, we wouldn’t have given the film a second thought.

She would have had to force us (pout) to take her to the theater but dropping $20 for something special for her to watch OTT wasn’t that bad.

And the popcorn was just right – not overly aged, over salted, over buttered, overpriced!

NBCUniversal took a huge gamble offering it TVOD rather than waiting for theaters to reopen.

They pulled in about $100M, compared to $153.7M for first theatrical showing of Trolls.

Disney + showed Hamilton starting the 3rd of July and racked up ¾ of a million added subscribers.

Universal realized about 80 percent of the sales vs. 50 percent in theaters, so it was more profitable to them.

Going OTT to the consumer had some folks whispering “good goin” and others screaming “never again.”

According to Gower Street Analytics, only one percent of the global cinemas were open in early April–mainly in Japan, South Korea and Sweden.

When Universal went around them, Korean cinema owners said they wouldn’t bother playing it, which probably didn’t hurt Jeff Shell, Universal’s CEO, too much since their April showing of La La Land only resulted in 2,101 tickets sold.

AMC, which was up to its ears in debt, said that when (if) they reopened, they would never show another Universal film.

NATO (National Association of Theater Owners) and UTE (The Union des Théâtres de l’Europe) said “D*** right!”

It was a clear battle cry against the streaming barbarians who have been viciously attacking their exclusivity window for years.

Of course, there are others who feel a film–a real film–has to first be shown in a theater, not sent to the second-class TV (or smaller) screen.

Netflix, Amazon, UK’s TVoD Curzon, Disney and others have constantly challenged the Oscar and Emmy rule makers because the awards usually translate into bumps in subscriptions and transactions.

However, if they do a limited theatrical showing, get a bump in ticket sales and then stream it, everyone is happier.

What’s the difference?

The same creative talent and work is involved, and that talent/work deserves to be celebrated regardless of the venue.

The industry has changed and it ain’t gonna go back to the “good ol days.”

There are more viewing opportunities for consumers.

There are more opportunities for content creators to get their work in front of people and find their audience (or not).

That boosts the entire industry.

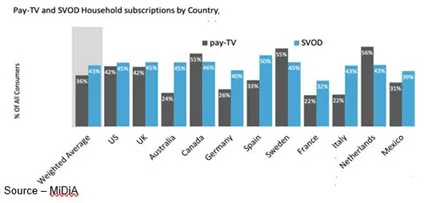

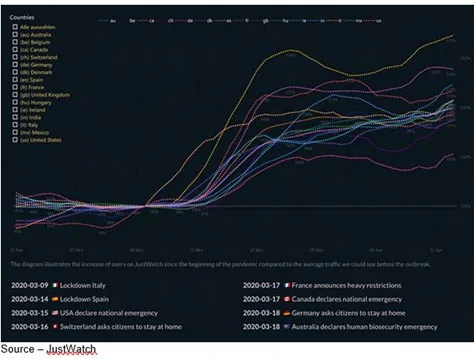

Even without the pandemic, SVoD surpassed cinema in the US and was on track to do the same in the European and Chinese markets before nearly all of the 1,895K screens around the world went dark.

OTT reached $46B in subscriptions last year, beating worldwide box office receipts of $42.5B.

The few cinemas that stayed open–primarily in Italy, Japan, South Korea–had miserable sales.

While revenues have gone up for the last few years, movie ticket sales around the globe have been flat. When the screens light up, no one expects people to rush back…at any cost.

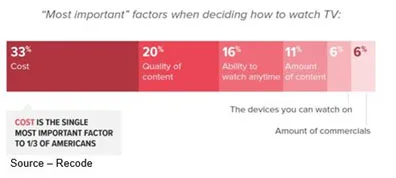

Certainly, high ticket prices are one reason but there are dire, difficult-to-change reasons.

Ampere executives note that with the global lockdown, people have found great entertainment, whether it’s on the big; small or smaller screen, is comfort food for the mind and soul.

They point out that OTT film viewers are often avid cinema goers and that theater owners should focus on rekindling/reinforcing the shared experience of watching a film on the big screen rather than raising prices and viewing barriers.

Telling studios and content owners “our way or the highway” isn’t exactly smart, since people have multiple roads to their entertainment.

They don’t really care which one they take as long as they arrive at their destination.

Trolls World Tour, The Invisible Man, Hamilton and others didn’t go T/SVOD to thumb their collective noses at stagnant/shuttered theaters, but rather to recoup as much of their investment as possible.

Immediately rushing back to the cineplex won’t be high on the consumers’ gotta do now list anytime soon.

Even as they pay multi-million-dollar leases for buildings that sit empty, they will have to rebuild the consumer’s interest and trust over a long period of time.

Things were so glum for theater screen owners that even VIP Cinemas, the world’s largest manufacturer of luxury reclining movie theater seats, threw in the towel and filed Chapter 11.

The successful streaming of a tentpole project made life even more difficult for global theater chains that have been struggling for years.

Yes, Quentin Tarantino rescued LA’s historic New Beverly Cinema and Netflix purchased New York’s Paris and Hollywood’s Egyptian Theaters to preserve the industry’s past, but they also did it with an eye to the future.

Thanks to the reversal of the 1948 Supreme Court ruling that broke up the studio system, the old and new deep pocket content developers/distributors (Netflix, Amazon, Apple, Disney and their international counterparts including Baidu, Alibaba, Tencent) have an opportunity to grow their entertainment opportunities … over time.

Already an integral part of folks’ day-to-day lives, Amazon has been stalking the weakest in the herd – AMC (2200 EU and 8200 US screens) – to add to its entertainment roster – Prime Video, IMDb, Twitch, etc.

AMC shareholders were thrilled anyone was interested in the heavily leveraged chain.

Shares had dropped 50 percent and the prospects of returning to profitability over the next 12-18 months were dim.

Actually, it could be a good match for Amazon:

- It gives them “legitimacy” for statues with the Academies

- It gives them added destinations for Prime members, similar to Whole Foods

- It presents opportunities for them to fill the lobbies and dark spaces with permanent, rotating shopping opportunities

Amazon already has more than 101M U.S. Prime subscribers (150M plus globally), so Prime member exclusives/special showings could fill a lot of seats–when folks are ready to return.

Even the 49-50M European theaters can be leveraged by Amazon because countries such as France require a strong percentage of the content to be produced locally and to be shown in theaters prior to streaming.

A win-win for Amazon.

A similar strategy could work for Disney, Netflix and Apple.

O.K., it would take “a little” creativity for Disney because their parks are like cinemas–shut for now–but it’s all entertainment and the two Bobs (Igor and Chapek) know that stuff.

In addition, they also have 200+ Disney stores in slowly opening malls, so working out deals for theaters would give them a chance to co-locate a more complete entertainment experience and could make sense.

Disney has already shown where its content future lies by moving film version of the hit stage musical Hamilton from a Q4 2021 theatrical release to Disney+.

The play was dynamite on Broadway and should be a great boost to help them meet their original 2024 goal of 70M subscribers ahead of schedule (presently 50M).

The first name in entertainment was so well received that several analysts have since raised the bar to 200M by 2025.

Disney quickly learned what Netflix has come to understand over its 10 years of streaming–that people are hungry for all of the new stuff.

As a result, they’re also rolling out Artemis Fowl, the second season of Mandalorian (yes, our daughter got her Baby Yoda) and In the Heights. Unfortunately, Marvel’s Falcon and the Winter Soldier, WandaVision, and Loki won’t be online until next year because…well, you know.

Apple is an evolving animal, making more money on its apps/content than on hardware and they certainly have the financial reserves to broaden their entertainment options for customers.

The only major U.S. content service we didn’t touch on was Warner’s HBO Max, which priced at $15/mo. is more expensive than Netflix, $13; the Disney + bundle (Disney +, Hulu, ESPN+), $13; and Apple TV +, $5.

WarnerMedia has enough issues and adding more debt on top of AT&T’s current load – $158B – probably isn’t a high priority for them at this time.

That’s undoubtedly why they slapped a price of $15/mo. on it. Or, as AT&T’s CFO John Stephens said, “We’re going to be smart about it. We’re going to follow it.”

He forgot what global OTT services have learned from consumers over the past few years and especially in the rough periods:

- Value is in the eye of the beholder

- Consumers sign up because of the new stuff and stay for the library

In addition, AT&T has to protect/invest in its core business – wireless.

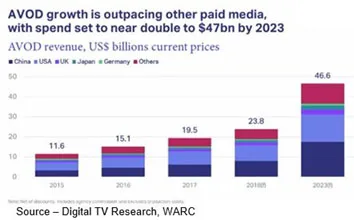

While streaming is growing rapidly, Pay TV is not only still quite strong but has taken notes from all of their competitors.

Comcast expanded both horizontally and vertically with NBCUniversal, European leader Sky, DreamWorks Animation, and AVOD streamer Xumo.

The firm has aggressively expanded into AT&T wireless territory to become a major MVNO (Mobile Virtual Network Operator) with Xfinity Mobile.

At this year’s virtual upfronts event, networks told advertisers that they heard marketers/consumers loud and clear and were reducing their ad loads by at least two minutes for many shows and continue to minimize clutter.

In addition, they were returning with a full slate of new and returning shows created in single locations and in line with new SAG/AFTRA (Screen Actors Guild/American Federation of Television and Radio Artists) guidelines.

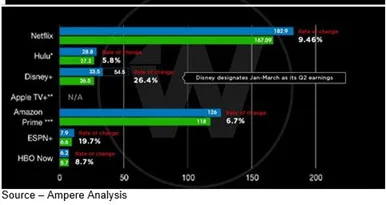

The industry and analysts totally redid their projections as a result of the pandemic lockdown because consumers quickly moved to SVOD subscriptions.

At the same time, they quickly realized that cutting/shaving the cable can be almost as expensive as what they left behind.

While the wife and kids seem intent on getting all of our money’s worth, as we mentioned at the outset, Trolls World Tour wasn’t our thing. Game of Thrones was addictive and so was Mandalorian. See, For All Mankind and Little America were good. Outer Bank, The Last Kingdom were cool.

The new stuff was well … new but added another SVOD monthly payment to our credit card.

We know, we go against the grain when we admit we really like ads … but we do.

They can be a very pleasant, entertaining break in an intense sci-fi, horror or other well-done film/series.

What most folks don’t understand – pity – is that there are far fewer streaming ads (typically, a couple of minutes in an hour show) and they’re becoming more tailored to the stuff we’re interested in (like Netflix, the service “learns” about you the better the ads).

In fact, we picked our go-to AVOD service based on their edgy ads, but that’s us.

According to Ampere Analysis, Crackle; Roku TV; Tubi; Vudu and Pluto have a ways to go to be “mainstream” streamers since they account for only 3-6 percent of US online households.

Ampere estimates that 80 percent of the catalogues are five years old but if we’ve never seen them before … they’re new.

We binged on John Statham, Paul Walker, Samuel L. Jackson and Wesley Snipes films we never knew they were in … yeah, so they were new to us.

And there are 10s of 1,000s of hours of really great stuff just waiting for us to discover and enjoy!

The cost?

The time to find the content and a couple of minutes of ads.

As one long-time member of the industry said, “It takes what it takes and costs what it costs.”

That just about sums it up for the entire industry.

That just about sums it up for the entire industry.

Sorta like the Reese’s commercial, “Not sorry!”

Or, it could be like Phil Potter said in Starting Over, “Maybe it’s not always about trying to fix something broken. Maybe it’s about starting over and creating something better.”

As fast as the M&E industry is moving, we may never know.

# # #

Andy Marken – [email protected] – is an author of more than 700 articles on management, marketing, communications, industry trends in media & entertainment, consumer electronics, software and applications. He is an internationally recognized marketing/communications consultant with a broad range of technical and industry expertise especially in storage, storage management and film/video production fields. This has led to the development of an extended range of relationships with consumer, business, industry trade press, online media and industry analysts/consultants.