Streaming Media is so Promising Everyone’s Getting into the Act

A millennium ago, we were visiting a small computer company in Round Rock, TX, with a storage client (there were a lot of storage companies in those days) to understand exactly what features/capabilities met their needs in the systems they sold.

The VP of marketing was ready with all the ammunition he needed to walk away from the meeting with a nice fat contract.

Their directors of engineering, marketing and purchasing sat politely and listened.

Halfway through the pitch, their head of purchasing got up, went to the whiteboard, drew a crude computer tower, added small boxes inside it – power supply, fan, motherboard, etc. – all with dollar amounts next to them.

He then added another box along with a very low dollar amount and said, “We know what all the other costs are going to be to produce the new system for our target price. Want to be included? Our cost has to be $XX.”

The streaming industry is in the same position!

The consumer knows her/his “slightly flexible” target entertainment/information budget:

- Broadband/Internet service to the home $50-$60

- Wireless service $50-$100

- 2-8 OTT Channels (i.e. Amazon, Netflix, Apple TV+, Disney+)

BAM!!! they’re good to go with their entertainment anywhere … anytime … any screen!

Of course, “the other guys” will say it’s not all about Netflix because they’re offering richer, newer content and a huge library of stuff people will really, really want to watch.

They may say they’re not competing against Netflix but why did folks cut, shave, avoid their cable?

Sure, it was because of their high cost of their TV bills and less than stellar service but still … it was the new ease and access to high quality content streamed by Netflix and other early services.

There were other good-to-great streaming options – Sling TV, Roku (our point of entry favorite), HBO Max, TenCent, iQiyi, Youku, Sky, Hotstar, ALTValaji and Voot – but just as TiVo in the late ‘90s became synonyms with DVR, Netflix means OTT SVOD.

Yes, horror of horrors, Netflix just lost some U.S. subscribers and only gained 2.7M globally.

Wall Street and market analysts overlook the fact that Netflix U.S. subscriptions alone passed cable TV subscriptions in mid-2017 and double-digit growth can’t be sustained by anyone.

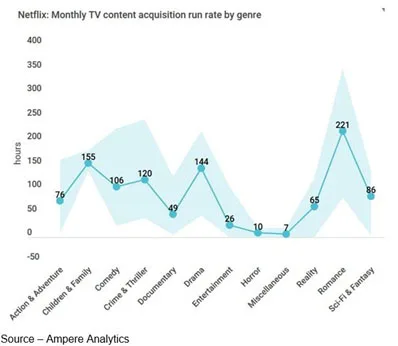

Netflix currently has about 150M subscribers in 190 countries because people like the unique content that the company has to continue to aggressively spend to acquire/develop.

That investment in content – $15B this year – was one of the reasons Netflix subscription fees went up and U.S. subscribers bailed.

There are options and a budget to consider, after all.

Still, we bit the Netflix bullet and stayed subscribed because there was enough new, unique content.

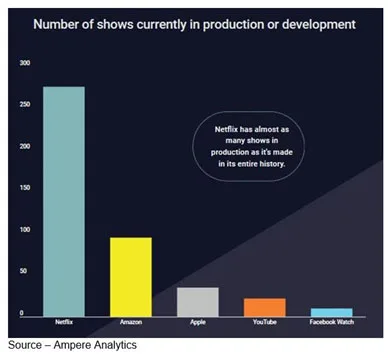

Last year, they added an insane amount of content and they don’t show any signs of pinching the pipeline…yet.

Perhaps more importantly, Netflix knows how to keep you coming back and connected.

According to a study for Digitalsmiths (TIVO), people liked their carousel UX (user experience):

- 42 percent liked the viewing recommendations

- 36 percent liked the way it categorizes show/movie lists

That’s one of the beauties of OTT streaming, the service can amass a tremendous amount of viewer data – what they like/dislike, day/hour variance on viewing genre and screen, how long they watch the content. The data assists the company in developing/selecting projects that will keep subscribers coming back for more.

Strong streaming services like HBO Max, Hulu and CBS All Access use similar carousels to keep people engaged.

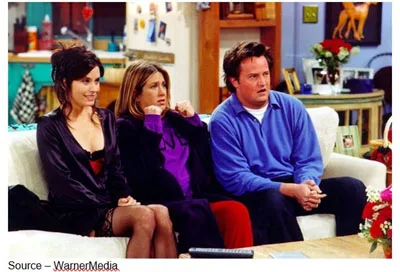

AT&T’s CEO Randolph proudly proclaimed Netflix wasn’t even on his radar when he took on an $85B IOU to grab up TimeWarner’s (now WarnerMedia) – huge library – and its crown jewel HBO Max. Still, his company didn’t waste a lot of time in taking back the Friends TV series.

It is becoming apparent that they’ll need all the friends they can get especially since their purchase of DirectTV hasn’t been all that stellar having lost nearly a million subscribers in Q2 – 3M this year. Now after replacing their DirectTV Now name with something Randolph likes better – AT&T TV Now, they are ready to:

- Take on all content comers

- Have a path to work off a huge acquisition debt

- Spend to build a robust 5G/Wi-Fi 6 network nationally and internationally

Leveraging their Time Warner and HBO content, the telco is jumping into the streaming content world with a dizzying array of services – HBO Go, HBO Max, HBO Now, AT&T TV Now, AT&T TV, AT&T WatchTV, AT&T U-verse, and DirecTV – with a phone bill array of subscription costs.

Okay, that may look a little confusing; but the content gorilla in the room suddenly seems to be a mouse.

Disney’s Iger knows technology – he’s heavily invested in a significant number of successful and emerging tech firms – but he also knows how to build services to entertain folks and keep them coming back for more.

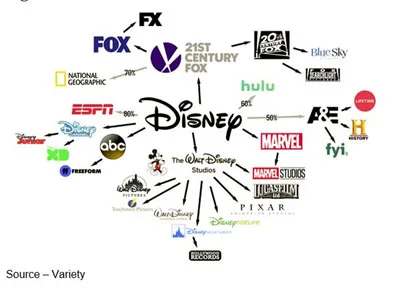

Disney easily jumped to #1 after acquiring the 20th Century Fox film and TV studio. It also has ultra-favorable (and friendly) brand-name recognition, dominance of recent box office trends and strong franchise properties related to Pixar, Marvel and Star Wars.

Shows and movies that Disney once licensed to Netflix are again back at the mouse house and others will soon appear in the exclusively bundle – Disney+, Hulu with ads, ESPN+.

And to achieve scale immediately, Iger is also talking with Google, Apple and Amazon to make the Mouse House easily accessible and your entertainment choice … globally.

Finally, OTT SVOD subscribers have some meaningful choices for original content to enjoy on their screens.

But even if it’s HBO, CBS All Access, Disney+ Hulu and ESPN+, Netflix or whatever mix of service you have on your Roku service device or mobile app; everyone knows you’re starting to take the step away from what has been the television entertainment model.

With aggressive pricing like $13 for everything, Iger may help you change the way you talk, so you might start to say you’re Mousin’.

Some will say we overlooked Amazon Prime in the entertainment program directory, but it’s somewhat difficult to determine how many of their 100M subscribers are there for entertainment content or free product delivery.

Bezos and his team have done an excellent job of finding and investing in some excellent projects that have been well and widely received by Rotten Tomatoes, reviewers and streaming viewers.

We really like this and checked out their offerings a few times, but most of the times we go there to watch content filmmaking friends were able to get into Amazon’s library.

Apple TV + is nice but even big names get bored. A $1B+ doesn’t buy much today, and the library is pretty empty.

The biggest challenge for all SVOD services, at least for the next two years until people settle into a viewing habit, will be churn.

People can subscribe on a monthly basis, binge on all the stuff they want and cancel … done and done.

HBO experienced it when Game of Thrones ended.

CBS All Access saw the numbers shift when Star Trek: Discovery ended, so they ordered up four more Star Trek shows.

Hulu witnessed the bounce when The Handmaiden’s Tale ended and was then renewed.

Netflix undoubtedly saw subscriptions shift when Friends and The Office were pulled just as when House of Cards stumbled, so they’re prepared for some churn as Orange is the New Black enters its final season.

The big difference is the viewer information they have accumulated over the years that gives them sign posts to follow to determine the shows folks want.

In addition to being a powerful tool to keep subscribers connected to show recommendations, it also aids them in knowing what projects have the greatest chance of resonating with their expanding global audiences.

But even with so many mouth-watering SVOD shows available, the entertainment budget is still finite.

While people cut or shave their cable services for anytime, anywhere, any screen viewing, AVOD has its potential to grab its share of viewers with more or less free shows with ads wrapped around them.

Allan McLennan, Chief Executive of PADEM Media Group, noted following IBC that ad-supported companies have a unique opportunity to capture a strong national and international viewer base as people struggle to get a balance between what they “gotta’ watch/want to watch” and their household budgets.

“The barriers for both parties – providers and viewers – are quite low,” he said. “With the introduction of Disney’s Disney+ Hulu and ESPN+ bundle, enriched HBO Now and Apple TV+; people are getting close to a saturation point, and even though it’s quite easy to cut a subscription for a different service, it can be difficult to cut one to add another.

“People don’t like to be ‘forced’ to make that kind of decision,” McLennan continued, “so to add an intelligent ad-supported service that has some exclusive content is an easy decision to make.”

McLennan pointed out that 90 percent of TV has historically been ad-supported and that people have a tolerance for ads on the screen.

He emphasized that now that all content is digital and streaming, the ad-supported providers – and advertisers – have a unique opportunity to make watching them even more tolerable if they are accurately targeted and the commercial pods limited in size.

“Channels like Tubi, Pluto, Xumo and Roku can profitably deliver fewer and more customized ads to individuals who are specifically interested in the information/ad presented,” he said. “At the same time, advertisers are starting to recognize the value of audiences that are interested in their products which in many cases will equate to paying a higher CPM/price to reach a more accepting, friendly and interested audience.

“This is especially true too with a strong and attractive viewer interface,” he added. “Good content like what is available on Amazon’s IMDB Channel and others, as well as intelligent ad insertion is a win/win for everyone – content provider, marketer and viewer,”

We recently read that today, there are already 228 OTT providers in the U.S. and are certain the number will continue to grow … globally.

As Brian Grazer, co-founder of Imagine Entertainment, recently said in a New York Times (howard.html?searchResultPosition=1) interview, “Three new Netflixes needing content — quality content — are probably popped up while we’ve been talking.”

At some point, pay-TV and streaming services will become just that …viewing services.

Hub Entertainment Research recently conducted a survey among OTT viewers, and they rated these services especially Netflix as “indispensable.”

Fortunately for the content creation/production community, Hub later rephrased the question and folks said, “The network a show is on makes no difference to me.”

AT&T, Netflix, Disney and Amazon shareholders, as well as investors in all of the emerging and planned streaming services, will have to pay less attention to themselves and focus on the stream of new projects.

AT&T, Netflix, Disney and Amazon shareholders, as well as investors in all of the emerging and planned streaming services, will have to pay less attention to themselves and focus on the stream of new projects.

They’ll need to deliver a wide spectrum of content (think Chris Anderson’s Long Tail) to meet the appetites for an increasingly discerning global audience.

Don’t like the new world? Just remember what the train conductor said, “Hey, Mister, you just can’t pull the emergency cord and jump off.”

Oh, and not that it matters but we didn’t leave Round Rock with a contract.

# # #