The Key to Great Entertainment is Controlling Content, Sources

Yes, the gods of content have decided to change the rules … all of them! And we’re working like crazy to understand the M&E industry’s new normal.

Studios are returning to the theater but there’s too much more money to be made by going D2C. They’ve discovered a new way to measure a project’s success … their balance sheet.

Sure, the theatrical opening numbers are nice, but the world is really slow at reaching herd immunity, so only the dedicated are returning to the giant screen and that’s out of the need to reconnect.

In the meantime, it seems everyone is jumping back to the early TV set days … size matters.

That’s fantastic for the home screen builders and resellers as folks get new bigger screens.

We got a note from Rob up in Oregon who simply had to let us know that he had just installed his new LG 77-inch OLED set and Sonos 5/1 sound system (topping our LG 55-inch OLED) and it’s awesome.

Of course, he didn’t have enough content for the bigger screen, so he added HBO Max to his streaming roster.

That puts him in NPD’s average – he hates average – streaming consumer category with seven services.

We’ve found streaming is a lot like Lay’s potato chips … bet you can’t get by with just one.

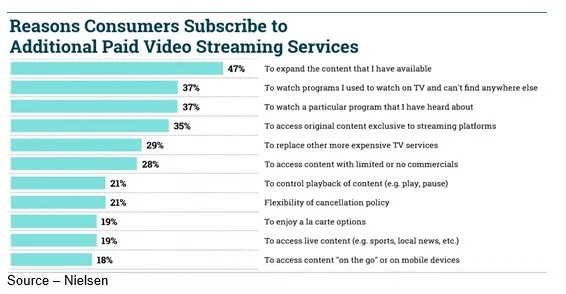

Almost every cord cutter/shaver we know has built their own viewing bundle with both paid and free services so they can get the content they want, when they want it.

Today, it’s all about having new, audience-capturing exclusive and uninterrupted content.

It started out innocently enough – people got fed up with the networks and bundle guys who constantly raised their prices and ad volume.

They had you between a rock and hard place until Netflix switched from sending you DVDs to sending content over the air.

Amazon saw an opportunity to send one more thing to your home and it was a great option to taking a break and going to the theater.

Studios, networks and other tech folks saw it as a way to cut out the middleman cable guy and offer something special, so they introduced something special – the plus (+) – just as people were forced to stay away from the theater.

With a lot of fanfare, the plus services joined the crowd Disney +, Apple TV +, Hulu +. Peacock +, Paramount +, Discovery + and BET + followed by folks who thought their name alone would attract subscribers like HBO Max and others.

Usually, that leads to service churn because all entertainment is good/great but there’s still a budget to juggle.

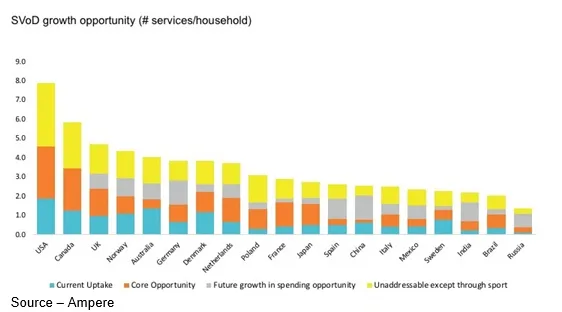

Making just the right selections isn’t easy with about 300 plus US subscription services and 1,000 plus globally, all vying for their share of the more than 226M US subscribers this year which is estimated to grow to 350M by 2025.

According to Omdia, the redirecting of the content and forced theater closures cost the worldwide cinema industry $32B last year.

And you wondered why the cinema industry didn’t believe AT&T’s Stankey when he said moving this year’s roster of films to day-date sharing with HBO Max was a win-win-win for everyone.

So far it hasn’t been as rosy as he and Warner’s Kilar had hoped but boy are they optimistic.

We’ll see if pushing Universal’s Godzilla vs King Kong to their HBO Max at the same time they’ll be releasing it to theaters helps their subscription numbers.

Having the top five subscription services and free content from IMDb TV, Pluto and Tubi means if you can’t find something to fill the hours … you aren’t trying.

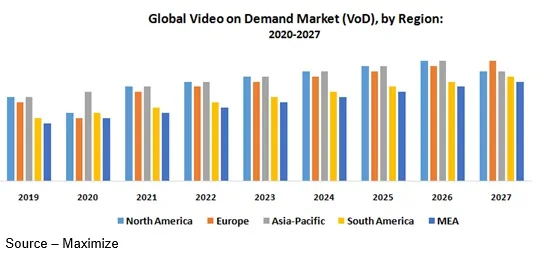

That’s one of the benefits of living in the Americas, you’re in the world’s largest streaming market and everyone wants a chunk of your streaming/entertainment budget.

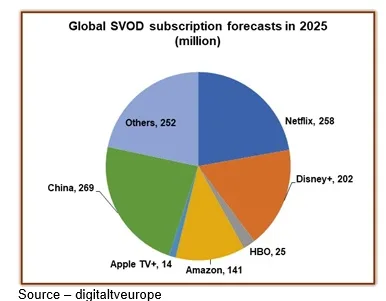

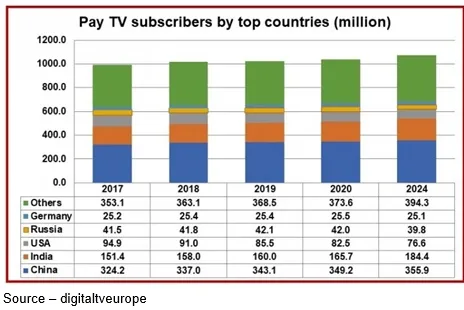

By 2025, the global SVOD market should surpass 1.1B subscribers spending an estimated $103B.

While consumers are happy with the services and content, the financial market is already complaining that the total lack of spectacular growth by the big three (Netflix, Amazon, Disney) is a sure sign streaming was just a passing fad.

No one said double digit-growth year after year was sustainable. In fact, M&E experts feel growth in the years ahead will require work and a heavy investment in even more new content.

Or, in plain English, all of the services will experience their slowest growth since 2015.

It will really be tough for Apple TV+ because of a very small content library and high-volume subscriber churn.

Of course, they could use that massive financial reserve to get really serious about the M&E industry and acquire one or more of the available studios for their creative teams and rich libraries.

Just a hint, Tim.

That’s just a thought to consider but the three leaders are focusing on growth in international markets while keeping the wolves away from their doors at home.

In the meantime, the big three (Netflix, Amazon and Disney) have made a series of very strategic moves in the rest of the world to capture subscribers and, perhaps more importantly, help them discover new and unique content for their home and other audiences.

And for the first time, government regulations helped rather than hindered a company.

Governments around the globe established quotas for streaming service providers, mandating that if they wanted to sign up subscribers to show their stuff to, 30-40 percent of the content shown in the country must be produced locally.

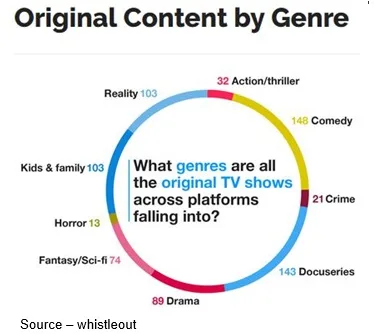

While US superheroes are big attractions around the globe; American created reality, documentary, sci-fi, horror and war/spy stories that also play well in Europe, SEA and MENA.

Perhaps a one country, one region video project could also have solid global appeal.

And viola it worked!

Story lines had strong appeal, production quality was equal to anything done at home and projects weren’t bogged down with expensive agent and union costs.

In fact, in many countries, the government went out of their way to assist with financial and legal incentives.

It has worked so well that Netflix and Amazon are now working on projects in more than 190 countries for local and international distribution.

Disney is also rapidly expanding its develop/release footprint around the globe and Warner has their eyes on tomorrow.

At the same time, the ad-supported services have been able to expand into other areas of the globe–not just with their services but also by offering international films/shows to viewers in the Americas.

Enhanced dubbing and subtitling have made it possible for the streaming services to offer local language enjoyment of foreign content.

Okay, just because something is well received in Brisbane or Bangkok or Benin or Beijing, doesn’t mean it will do well in Boston or Banff; but it’s a consideration point.

Who knew that you liked documentaries, they liked documentaries?

You liked comedies, they liked comedies. Okay, some of the comedy goes over our head but the storyline(s) are great.

Your kids liked kid/family-oriented shows … so did theirs.

And the reality shows were dynamite no matter where or who produced them.

Global streaming services were able to tap into a content hungry market and a wide variety of content was available for their respective libraries that was economic to acquire/produce.

Two of the hottest production/consumption hubs that have emerged this past year are Bollywood and Nollywood.

Around since the ‘30s, Bollywood was best known for sensuous dancing and a few male/female stars until the mid-‘90s. Even in the early 21st century they followed formula storylines, fight scenes with larger-than-life heroes and over-the-top dance routines.

Knocking out over 1,000 films a year, the country’s visual content industry has slowly moved beyond sleaze to films/TV shows with substance, intrigue and exciting/interesting drama.

Already the country’s leading content streaming organization, Hotstar took a big jump forward in 2020 when it’s parent company, Disney, quickly expanded Disney + into the company’s service line-up to increase the power and potential of the largely free service.

With a subscription upgrade option, more than 28M of Hotstar’s 150M active users have become subscribers with all the rights and freedoms that come with watching Mouse House films/shows.

Even before Disney + entered the Indian streaming market, Netflix had been heavily investing in new content as well as experimenting with a wide range of pricing options to convince the fragile population that subscriptions were worth the cost.

Nigeria’s Nollywood is often positioned as the second largest film production country in the world behind India and ahead of Hollywood with films shot in a mind-boggling 10-15 days on a budget of $10,000 – $25,000 that US film caterers would call a point to start talking.

With little professional theater/TV distribution, the country’s projects still reached significant audiences because of piracy and that was what caught the interest of Netflix which has scored a growing roster of excellent video stories.

While all of the free and subscription service would like to establish a streaming footprint in the Middle Kingdom, they also realize that it’s only a long-term goal.

China’s dominant ad-supported video services (Baidu’s iQiyi, Alibaba’s Youku and Tencent Video (BAT) already have major challenges to contend with including a slowing Chinese economy and government scrutiny.

That same Chinese intervention also makes it difficult for streaming leaders to penetrate the country’s content production/distribution marketplace except with closely scrutinized content relationships.

The right films have done well in Chinese theaters and people around the globe are slowly returning to them when the time is right because people like to go out.

And the cinema provides the perfect total entertainment experience you just can’t get at home.

In the meantime, every streaming service will be inviting you to drop the other guy’s entertainment bundle and get the stuff you really want … from them.

That’s one of the few things the phone guy actually knows how to do – give you enough to keep you semi-happy while convincing the other guy’s customers he has better stuff.

The streamers sucked up subscribers faster than they thought possible this past year and they know that to keep you, they need to constantly refresh their content and be convincing their stuff is more fun/interesting than the other guy’s stuff.

One of the best ways to do that is to buddy up with service aggregators – the streaming device producers and Pay-TV services.

AT&T found out late last year that if they weren’t available with the leading aggregators (Roku and Amazon) they simply didn’t exist to millions of potential subscribers.

It took the phone/content guy a lot of gentle negotiation to convince them the relationship would be good for everyone … especially the aggregators.

As for Pay-TV, they’ve always been content aggregators.

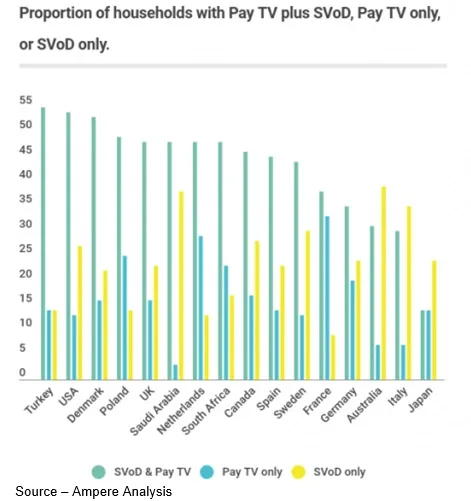

While many like to say day/time Pay-TV is dying as anytime, anyplace, any screen streaming takes over their customers; it’s a little overstated.

True, the US is the world’s worst performer with subscription losses slowing while revenues continue to shrink ($106B in 2015, its height, down to an estimated $70B by 2024).

But around the globe, Pay-TV subscriptions will increase, and income will stabilize because the operators provide the critical last 100 feet to the streaming subscriber’s home/screens.

In addition to owning the delivery platform, they also collect the vital customer data the entertainment ecosystem needs to feed the content hungry consumer.

Globally, digital Pay-TV will grow to more than 1B by 2024 as consumers increasingly rely on it to not only efficiently, effectively deliver their streaming content but also assist them in managing their monthly subscription budget.

Admit it, it’s nice to have all of your video services – and budget – in one place.

Admit it, it’s nice to have all of your video services – and budget – in one place.

It’s a little like what Perseus said in Clash of the Titans when he picked up the sword to cut his budget, “My father told me: someday, someone was gonna have to take a stand. Someday, someone was gonna have to say enough! This could be that day.”

Going to be difficult because you can expect to see your service charges rise as more content is needed and major stockholders want a bigger slice of the pie.

# # #

Andy Marken – [email protected] – is an author of more than 700 articles on management, marketing, communications, industry trends in media & entertainment, consumer electronics, software and applications. He is an internationally recognized marketing/communications consultant with a broad range of technical and industry expertise especially in storage, storage management and film/video production fields. This has led to the development of an extended range of relationships with consumer, business, industry trade press, online media and industry analysts/consultants.