Negative Income Unicorns Can’t Be Worth More Than Real Companies

We’re pretty certain Anand Sanwal and his team at CB Insights didn’t develop the idea of unicorns — startups valued at $1B + — however, they did make them one of the most hunted animals on the planet.

Folks lust to have them in their portfolio–especially when the valuation is stratospheric.

Profit and loss – and prospects – are so meaningless.

Are you Sh(kidding) me?

Sorry, our eyes don’t glaze over when a kid drops out of college and talks another bunch of kids into give them a couple hundred million to start a company.

They can focus on spinning fairy tales, buying other folks with worthless stock and blowing through the cash, so they ask for more because…

Somehow, glamorizing infant companies that seem to focus on losing money hand over fist by tongue in cheek – it’s worse if they believe it – saying they are going to change the world and are therefore worth mind-boggling multiples just seems…wrong!

The problem is they follow the same route as the person in front of them because … it’s the thing to do.

Too many of the start-ups measure their success by comparing their valuation to the guy’s next door rather than the progress they are making in solving real problems for potential customers.

There are the people who burn through a few billion, see no profit on the horizon and the underwriters/VCs say it’s time take the enterprise public.

Take Uber.

They went public last year raising $8B, even though they never earned a profit. Instantly, they were valued at $75B and reported a loss of $1B on $3.1B in revenues for the quarter following the IPO and $1.8B on income of $11.3B in 2018.

Investors complained…they didn’t lose enough!

So, they tried harder by dabbling in other stuff and were told that all those people driving for them were really employees which slowed them down … a little.

Cripes! Pets.com only lost $61.M on $5.8M in sales and had to close their doors.

BAM! the greatest hand puppet we’ve ever seen was suddenly out of a job.

Who would think buying doggie/kitty stuff online was a good idea?

As with a lot of startups … timing sucked!

But they tried.

WeWork or simply We is the latest in a long line of big losers causing the media to question if perhaps unicorns really are fictional:

- Close, intelligent look by CB Insight – https://tinyurl.com/yd9956h8

- NY Times https://tinyurl.com/y2b5vdvs

- Recode’s Kara Swisher – https://tinyurl.com/y4bnozun;

- The Verge– https://tinyurl.com/y2d7t54t and well before that a close and searing look by

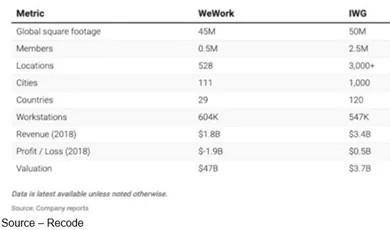

In fact, We trails its closest competitor (IWC) in every area but one – the one that counts if you’re ready to go public … valuation.

Their IPO pitch was so creative Netflix and Amazon are both bidding on the film rights. O.K., they really aren’t, but seriously!

Sure, we understand it’s more fun burning through strangers’ money.

The idea of maxing out your credit cards or asking friends/family to loan you money so you can develop, refine, profitably sell this thing that solves a real market problem isn’t fun, isn’t easy.

But the folks who do it right and build a profitable company, have a steady interest and laser focus on creativity, innovation.

In fact, many who look back on their organization’s organic growth, rather than relying on pure money to pave the way, seem to appreciate their firm more.

It has become a badge of honor.

According to CB Insights, key factors for success are:

- Founders are driven by impact, resulting in passion and commitment

- A commitment to stay the course and stick with a chosen path

- A willingness to adjust, but not constantly adjusting

- Patience and persistence due to the timing mismatch of expectations and reality

- A willingness to observe, listen and learn

- Development of the right mentoring relationships

- Leader has general and domain-specific business knowledge

- Implementing “Lean Startup” principles: Raising just enough money in a funding round to hit the next set of key milestones

- Balancing technical and business knowledge, with necessary technical expertise in product development

Jon Oringer, founder of Shutterstock, is quoted as saying, “When I get asked, ‘When is the right time to take on VC funding?’ my answer — ‘In a lot of cases, never.”

He built the company slowly and with his own money until the company needed to take the next growth step with a private equity round to scale up the management team and put the infrastructure in place for staff expansion.

It’s worth noting the approach allowed him to retain 57 percent of the company’s stock – an impossibility for any VC-funded firm.

We discussed the “alternative” way to start and build a company with a friend we’ll call Larry.

He bootstrapped his company more than 30 years ago, starting on a kitchen table using his own money as well as “loans” from friends/family.

He built the company slowly, developing quality products that people needed/wanted and focused on standing behind the products 100 percent by focusing on customer service/support.

We’ve seen photos of him balancing customer orders/questions while his young son bounced on his knee.

To him, family and customers had the highest priority and it’s the philosophy that permeates the company.

Today, the company is a highly successful and respected global firm in the technology industry.

We find it somewhat ironic that CB Insights – an organization that leads the field in capturing and serving up information on startups for folks who want “a piece of the action,” actually avoided and purposely rejected outside investors during the early days.

They’re now wildly successful, serving startups and VCs around the globe

All three of the individuals emphasized that fighting bureaucracy and keeping the company’s culture were their most difficult challenges.

They grind it out, invest long hours to build something from nothing and make their toughest decisions with only themselves as their own final counsel.

Over our years of working with folks like these, the most important personality trait in successful entrepreneurs is not creativity or charisma. It’s grit.

Each of the self-funded entrepreneurs said building their organizations sounds fun, almost romantic; but stuff happens.

No matter the funding route or depth of management/planning challenges still arise that money can’t solve – technological roadblocks, logistical challenges, poor/non-existent management/people skills, focusing on frills instead of the product or simply coming face-to-face with the stark brutality of business.

When this happens, they crash/burn.

Or, they simply lose interest.

More money will not solve any of these problems — it only contributes to them.

With the whole unicorn phenomenon, there will be lots of unicorpses!

Ideas are a dime a dozen; the difference is in the execution.

The best entrepreneur is one who is passionate about solving real problems.

As Steve Jobs once said, “The people who are crazy enough to think they can change the world are the ones who do.”

Of course, it doesn’t work all the time.

For example, consider the fact that — you woke up on a Casper mattress, hailed a Lyft to get to your desk at WeWork, used DoorDash to order lunch to the office, hailed another Lyft home, and had Uber Eats bring you dinner.

You spent your entire day interacting with companies that will collectively lose nearly $13 billion this year. Most have never announced, and may never achieve, a profit.

As Jordan Belfort noted, “I’m not ashamed to admit it: my first time in prison, I was terrified. For a moment, I had forgotten I lived in a world where everything was for sale.”

Still, there’s a lot more satisfaction for the start-up that looks back and can say, “we built this” rather than saying it was all the VCs and underwriters doing … “they did this!”

# # #