U.S. Needs to Catch Up with Global Mobile Wallet Marketplace

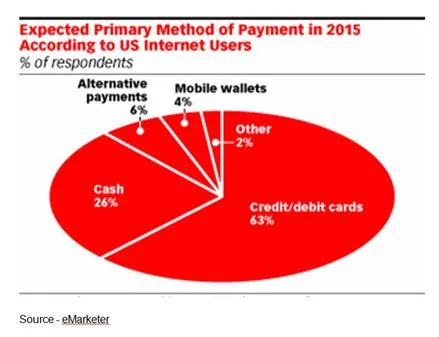

You know Google Wallet, PayPal, bitcoin and the other digital forms have been working for years to convince you to abandon plastic with very little success. The digital solution for the cash-less society just hasn’t gotten much traction in North America and the U.K.

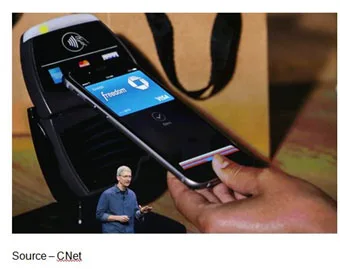

Of course, Apple introduces Apple Pay (renamed Apple Wallet at WWDC – Worldwide Developers Conference) and BAM! in no time at all, the entire world will be mobile payment-enabled.

Slow down folks, it takes time for miracles to happen!

Quick Look Back

Credit cards started in 1887 when Edward Bellamy, Looking Backward, talked about a way for you to spend your government refund (refund?) instead of borrowing.

Before we got to the almighty plastic companies and organizations tried charge coins, medals; but there was fraud taking place until the 1930s’ Charga-Plate.

That went well in Canada, the US and UK; but most cultures of the world have stuck with the old idea of, “what you’ve got in your pocket or under the mattress was what you spend;” or you bartered for goods.

Still, there are over 16B credit, debit and prepaid cards in circulation in the world, with about 775M in use in the U.S.

Most were (are) pretty anemic—having your basic information on a magnetic strip. All people need are the numbers and they can buy anything they want … even if it isn’t their card.

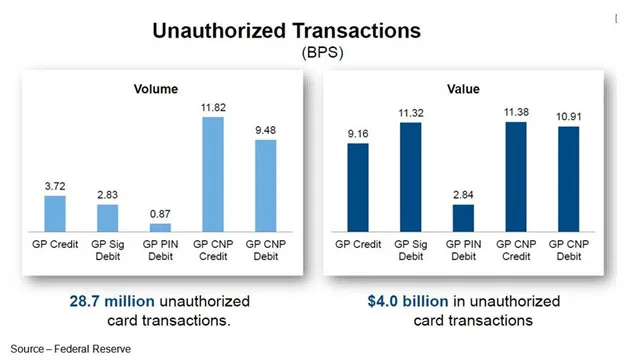

Up, Down – While the volume of unauthorized transactions has gone down over the past few years, the value of the loss to retailers and financial institutions has risen.

Up, Down – While the volume of unauthorized transactions has gone down over the past few years, the value of the loss to retailers and financial institutions has risen.

Europe and other countries switched to chip-based cards (credit and debit) that make fraud more difficult long ago.

Not the Americas.

In spite of all of the news about large-scale breaches, identity fraud was down last year.

According to a study released by Javelin Strategy & Research, roughly 12.7 million Americans were hit with identity fraud in 2014, a 3 percent drop from a year earlier.

Data breaches and identity fraud have become commonplace but credit cards are such an integral part of our lives that 95 percent of the Target customers who were affected simply replaced their cards.

But that hasn’t slowed the connected generation from firmly embracing the “credit card-killer.”

Apple introduced Apple Pay/Wallet and every bank, card company and retailer announced they were going to be onboard immediately.

In just days, there was a raft of headlines saying thieves were using stolen credit numbers on Apple Pay and there were security issues.

Of course it was Apple’s fault, even though the financial community was using an ancient, bloated processing infrastructure.

It’s Complicated – Some things are difficult to explain; others are impossible. The transaction processing for credit/debit card purchases is a virtual maze. Everyone wants to be different and everyone wants their finger in the pie.

It’s Complicated – Some things are difficult to explain; others are impossible. The transaction processing for credit/debit card purchases is a virtual maze. Everyone wants to be different and everyone wants their finger in the pie.

Apple Wallet should slash fraud because each time you do a transaction, the equivalent of a new credit card number is created and the merchant never actually sees your information.

The banks didn’t ask for (and didn’t have) the usual information like full phone number, address, and the stuff that is included in your 16-digit card swipe that they ask for from anyone … anyone but Apple.

Okay, live and learn.

As Thorsen pointed out, it was a lot better than ordinary credit cards when he said, “I can prove it. Give me your card.”

Mobile payments are more widely used elsewhere; but in the Americas, it is barely crawling and the ecosystem is still a work-in-progress.

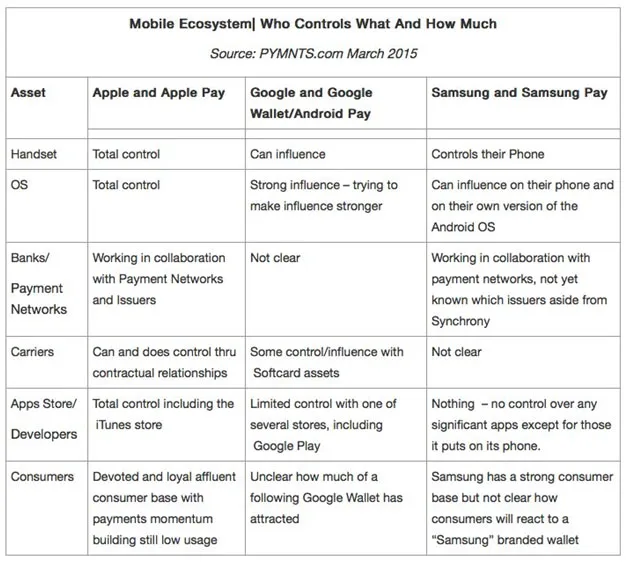

Ecosystem(s) – While it might be nice for the consumer (and retailer) if there was just one mobile wallet ecosystem, we all know that isn’t going to happen. The most we can hope for is that they all efficiently, effectively and securely talk with each other.

Despite the stumbling start, Catapult found that 44 percent of millennials would rather use their phone to pay than cash and 62 percent were okay using an app for purchases.

And of course the digitally connected generation (70 percent) said that within five years, mobile payments will be used for almost everything, noting that it is more convenient, it’s faster and will be safer/more secure than a physical wallet. It will also show others they are more technically advanced.

A number of industry analysts believe that the fraud stigma will slow growth in the near-term, but in the longer view it will come to pass.

Apple Pay – While other firms can introduce a product and people say, “that’s nice,” when Apple does it, it’s a real market. That’s the way it was until the company introduced Apple Pay.

Apple Pay – While other firms can introduce a product and people say, “that’s nice,” when Apple does it, it’s a real market. That’s the way it was until the company introduced Apple Pay.

Tap-and-pay should be safer than the normal credit card transaction because two unique safeguards are used.

When you enter credit card information into the Apple Pay/Wallet or Google Wallet (now Android Pay), the platform obscures your data behind an added level of security such as Apple’s fingerprint scan or Google’s PIN (personal identification number).

And as Thad Peterson, payments analyst Aite Group LLC noted, it’s as safe, if not safer than handing your card to a waiter at the restaurant.

Digital payment is already in widespread use in China where Alibaba showed the power of mobile devices and eCommerce on Singles’ Day when they racked up over $10B in sales in 24 hours using Alipay.

They, and their local competitors, are working rapidly to handle more of people’s mobile wallet payments like water/gas/electricity/TV bills, tuition, traffic/lottery tickets, school fees and more.

Beyond eCommerce, they’re promoting mobile wallet solutions for retail stores.

They launched an O2O (online to offline) last year with more than 20,000 stores in about 100 retail chains with deep mobile discounts.

Alibaba and the retailers reported thousands of post-60/70 people who had never shopped online shopped using their iPhones for payment.

While there’s a clear love affair for Apple and Alibaba, the company sees a great potential for mobile online/retail sales on all platforms.

British-based Tesco stores and E-Mart have taken the next step in making O2O seamless.

In South Korea, they have both physical and virtual store locations that are being closely watched by retailers around the globe.

Pop-Up Store – Tesco, in South Korea, is testing a program of pop-up/virtual stores in locations around the major cities. Simply shop the shelves, make your selection, point/click and your order will usually be home by the time you arrive.

Pop-Up Store – Tesco, in South Korea, is testing a program of pop-up/virtual stores in locations around the major cities. Simply shop the shelves, make your selection, point/click and your order will usually be home by the time you arrive.

They have installed pop-up shops in subway stations, building lobbies and other locations.

Rather than drag yourself out to shop after getting home or tying up your busy weekend, you simply shop, click-and-buy without missing a beat.

If you have a coupon or discount … done!

Deliveries are made in minutes or hours.

Just think, your smart refrigerator can ping your phone to tell you you’re out of milk and you can stand in front of the virtual store, switch to a six-pack of your beverage and it will be waiting for you when you arrive.

Not sure if your refrigerator will be happy, but do you really care?

Mobile wallets will certainly help eCommerce because you won’t have to punch in all of your credit card information on the infant keyboard. The mobile-optimized buy buttons will let you effortlessly complete the transaction.

We know you expect Apple to save, shape, lead the entire mobile wallet industry but there are other players like Google and Samsung.

There will be a big rush for all parties to post who has the largest number of apps installed, but the real key will be how many people use them on a regular basis.

If the volume of mobile search, music, viewing etc. is any indication, Android may claim the title of the most users; but Apple will be the one that handles the most purchases and for e/retailers, that’s really what counts.

Of course, the real key is how many folks are going to activate (and use) their mobile wallet app.

That’s where the real money is as Eugene pointed out, “It’s not a State secret.”

Most of the research is only mildly optimistic about how rapidly people will make the transition to the cashless or credit card-killer solution.

Yes, But – Mobile payments, mobile wallet are technologies that are still works-in-progress. The infrastructure has to change, retailers have to install new point-of-sale solutions and consumers have to feel the solution is safe–even safer than physical plastic cards.

Yes, But – Mobile payments, mobile wallet are technologies that are still works-in-progress. The infrastructure has to change, retailers have to install new point-of-sale solutions and consumers have to feel the solution is safe–even safer than physical plastic cards.

Many folks were pretty happy with payment status quo but they obviously aren’t tech savvy teens. But according to BI Intelligence, mobile in-store payments will be about $100B this year and will have a steady 172 percent compound annual growth rate (CAGR) over the next five years, which ain’t all that bad.

Face it; anything has to be more secure, more reliable than the credit/debit card systems being used in the U.S. today. Mobile payments can solve the security issues we have. Then, when your store or healthcare provider gets hacked; you can breathe a little easier.

Retailers will have to enable mobile wallet payments at the cash register and that’s going to cost a little, so don’t expect to use your mobile wallet everywhere you go next week or next month.

Then you help others and pass it along.

As Jerry noted, good news travels as fast as bad news, “Somebody comes along like your son, and gives me a leg up, I’ll take it. Even from a kid, I’ll take it.”

# # #