Industry Develops Realistic Future for Autonomous Cars

While most of the folks who attend FMS (Flash Memory Summit) like to talk (brag) about their storage advances, we’re more interested in how the stuff is being used.

Sure, you have it in your computer, smartphone and other devices; but increasingly, every auto/tier 1 and chip firm has an outpost here in Silicon Valley trying to figure out how they can cram more and more technology into your vehicle so you have to do less and less.

They’re pushing hard because the faster we can get to a ZE/AV (zero emissions/autonomous vehicle), the sooner we’ll be able to reduce a major source of pollution and maybe help the environment … a little.

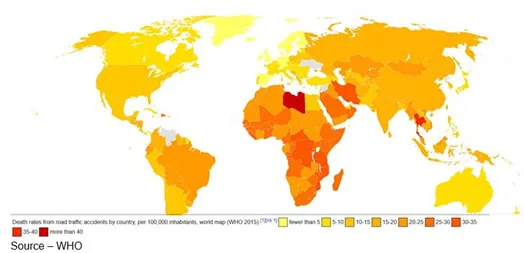

In addition, we’ll be able to dramatically reduce the daily carnage on the globe’s streets, highways, byways.

That’s important because:

- Every year, roughly 1.3 million people die in car accidents worldwide – an average of 3,287 deaths per day

- Young adults aged 15-44 account for more than half of all road traffic deaths

- Globally, car accidents are the leading cause of death among young adults ages 15-29 – and the 9th leading cause of death for all people

- The annual economic cost of car accidents in the United States is an estimated $242 billion

- The average claimed economic losses (such as medical expenses and lost wages) increased by 8 percent among personal injury claimants and by 4 percent among bodily injury claimants

- The average automobile liability claim for property damage was $3,231. The average liability claim for bodily injury was $15,443

- The average collision claim was $3,144. The average comprehensive claim was $1,621

- Private insurers pay about half of all car accident costs, while individual crash victims pay 26 percent, and third parties pay 14 percent

- The cost of medical care and productivity losses due to injuries from car accidents was more than $99 billion – nearly $500 for each licensed US driver

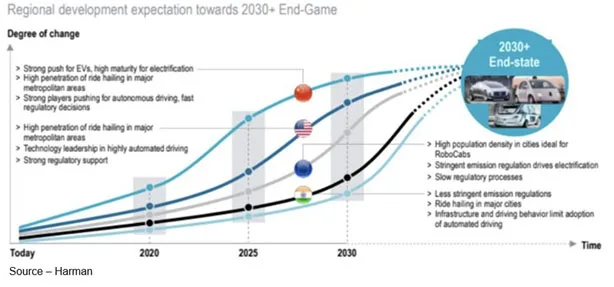

But according to Alan Messer, one of the session moderators and CEO of InnovationShift, the autonomous solutions to solve these are going to come gradually in waves, starting with simple shuttles and Robotaxis.

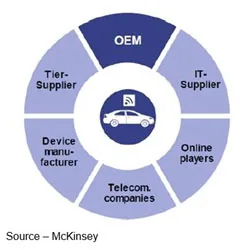

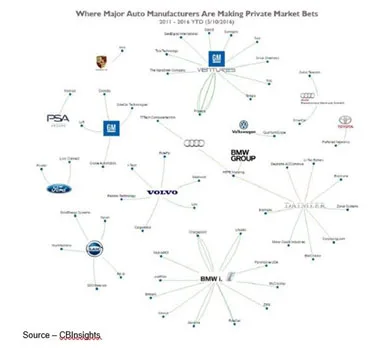

The task of developing an autonomous vehicle is increasingly a team effort of auto/tier 1 firms and technology firms.

“Even for the geographically limited Robotaxi market, OEMs have found it takes more to produce a solution that drives at least as good as a human. The result is that several of those programs’ pilots for driverless have been postponed for the last year.” Messer commented. “even when Robotaxi pilots go driverless, it will likely be years before we see them in most of the major cities.”

“It has been harder, slower, more costly than they originally thought,” he added.

To amplify the challenge, he cited two recent opposing studies by DriversEd.com and J.D. Power:

- DriversEd.com found 67 percent of Americans believe self-driving cars will be safer than human-operated cars — and 44 percent say that if a self-driving Lyft car picked them up, they would get in

- J.D. Power found that more than a third (39 percent) of consumers were not excited about any self-driving technology and concerns include tech failures (71 percent), risk of a vehicle being hacked (57 percent) and legal liability as a result of a collision (55 percent)

Panelists from Daimler, Harman, ARM, Intel, IBM, ATP, Cypress and other hardware/service providers agreed. They emphasized that it is important to have consumers on the same road and heading in the same direction.

Everyone in the industry is working to inform and educate consumers while addressing the growing task of delivering the autonomous vehicle.

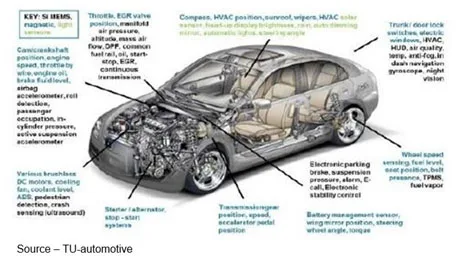

To control and monitor all of the vehicle’s systems ARM, Intel, Nvidia and other processor manufacturers are working closely with auto manufacturers and their partners to capture and process data from every system in the car and surrounding environment.

ARM’s Neil Werdmuller noted that the automotive systems have to have sensors/processors and storage that will heterogeneously capture, compute, store, transmit and act upon data.

It sounds simple enough until he tells you that a Boeing 787 operates on about 14M lines of code, but a Level 5 AV will require at least 1B lines of code to safely and reliably deal with its moving environment.

Requirements include redundant sensor centric systems, sensor fusion (camera, Lidar, etc.), storage of sensor data for AI training, and constant object detection that relies heavily on AI.

The data is constantly processed and presented to the car’s driver/passengers through the vehicle’s infotainment system in the form of clear, concise displays; touch, speech, gesture input devices; player/radio user content presentation and more–all with ultrafast update cycles.

Harman’s Ivan Ivanov and Daimler’s Michael Hounker noted that many of the vehicle and Tier 1 manufacturers prefer to have embedded systems instead of Google or Apple so they can exercise complete control and guarantee the systems’ operation and performance.

Ivanov emphasized that it is possible for smartphones to become part of the infotainment systems. Samsung’s Dex technology is a good example. But he is quick to add that auto manufacturers prefer embedded systems to smartphone technology.

Auto manufacturers are already incorporating connectivity and telemetric systems and he believes most vehicles will be delivered with embedded system control.

“No auto manufacturer wants the consumer to make a car choice based on her or his smartphone,” Ivanov said.

“At the same time, they want to minimize distractions while the person is in the car while enabling them to take advantage of all of the vehicle’s navigation, communication and entertainment and ADAS/autonomous functionalities are delivered,” he added.

Ivanov noted that countless studies have shown that people use their phones in the car. The goal is to allow them to use the devices in a safer fashion.

Manufacturers also want and need an open system that can be quickly, easily and reliably updated.

Tesla, Google, and others have historically been racing for years to build the first viable autonomous vehicle capable of navigating all environments without the input of a human driver.

Their primary approach has been onboard computers and radar to scan the environment around the vehicle and decide a car’s next movement based on the information.

Their approach has been an integral part of the tech industry’s DNA … move fast, break things, move on.

Greg Basich, associate director at market research firm Strategy Analytics, noted that back in early 2018, many in the auto industry were more optimistic, believing that within the next few years engineers would solve the most vexing problems related to enabling vehicles to drive autonomously in a wide range of on-road situations and conditions. They were more confident that there would be a significant number of self-driving cars shuttling people around by the middle of this decade or not long after.

“They were overly optimistic,” Basich commented. “They believed that by adding more sensors, more powerful processors, memory, and advanced software that they could achieve their near-term objectives.”

Although they continued to make progress, it wasn’t moving fast enough to enable large-scale production of autonomous vehicles any time soon. In addition, consumers have become more skeptical of autonomous vehicles due to media reports of fatalities.

He recalled the self-driving Uber car in Tempe, AZ, being tested by Uber that hit and killed a woman walking a bicycle across a street last year.

Elsewhere, four Tesla drivers (as of May, 2019) died in crashes that occurred while the company’s Autopilot driver-assistance system was engaged.

Today, many are more inclined to follow the auto industry’s more holistic, cautious and total ecosystem approach of standardizing on safety and competing on everything else.

Basich noted that all of the participants (auto manufacturers, Tier 1 providers and processor/storage providers) are focused on determining how much data must be captured and used/stored in the vehicle, what can be discarded and what data needs to be uploaded, analyzed, and used by other parts of the transportation environment.

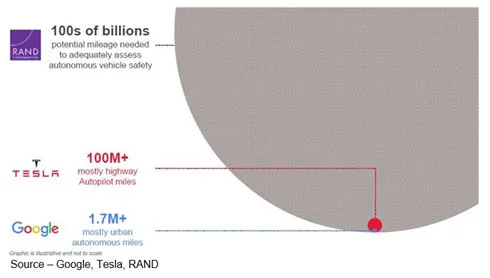

Last year a combined 2M autonomous miles in California – one of the largest testbeds – were logged.

But miles alone aren’t worth much because they also need quality. There is a very low probability of such lethal events as discussed earlier, but it will still require auto manufacturers and autonomous service providers to conduct millions of miles of real-world testing with a large number of vehicles in a wide range of environments and encounters.

“In addition,” Messer added, “every time a major software update is required, the benchmarking will need to consider if they should begin anew.”

Alternatively, the auto industry is taking pages from the aviation and nuclear industries by breaking the task into component parts, developing safe systems and validating them through tight testing loops with software simulation, hardware validation and then real-world testing.

Translation? It’s going to keep a lot of engineers employed for years to come.

But some day, in the distant future, your kids’ kids are going to ask which came first the EV or AV – electric vehicle or autonomous vehicle.

Then Messer, Basich, the AV session executives and FMS attendees will tell Jim Douglas that it’s a standard, not a fluke, in response to his comment that, “They make ten thousand cars, they make them exactly the same way, and one or two of ’em turn out to be something special. Nobody knows why.”

# # #