Flash Memory Summit (FMS 22) Opens New Opportunities for Vehicles

It’s just a coincidence that the U.S. Congress passed the $280B CHIPS act a few days before the Flash Memory Summit (FMS) finally had its first in-person appearance since 2019.

But it sure boosted attendee enthusiasm.

Seeing the US chip/flash business fall from 37 percent in 1990 to today’s 12 percent was tough, but now it’s a global technology … not just one country’s.

Leaders like Samsung and TSMC have already ramped up US production, but talent is a little tougher to come by.

Technical/application conferences like FMS help make a difference.

The techie discussions are interesting, but we get more out of the sessions on how you use the stuff. Sessions like the AV/transportation panel discussions were packed as folks wanted to figure out how chips/flash will be used … in volumes.

People were eager to hear from moderators like Greg Basich, of Strategy Analytics; Michael Hounker, of Mercedes-Benz R&D and Alan Messer, of InnovationShift as well as their panelists to figure out how car/truck producers will capture/store mobile data as well as safety, security, application issues they can help solve.

The big question that was the ongoing theme of their sessions was will electric/autonomous vehicles remain expensive novelties or will they completely transform society?

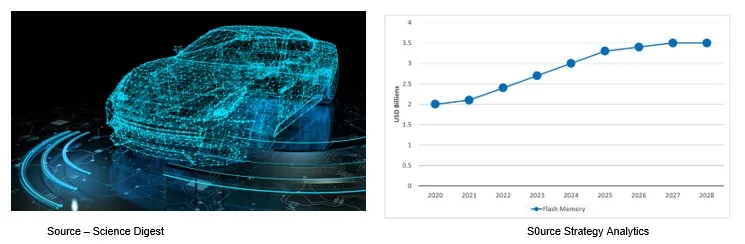

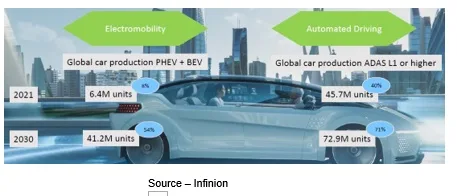

Basich noted that transportation manufacturers’ R&D investments have increased more than 61 percent in recent years as they focus on developing vehicles, they are also pushing near-term technology – EVs (electric vehicles) and ADAS (automated driver assistance systems).

Living in Silicon Valley as we do, EVs are everywhere.

Half the cars on the streets seem to be Teslas, Kia EV6s, Ford Mustangs, Nissan Leafs, Chevy Volts, heck we’ve even seen a few Lucid Airs and a smattering of Rivian pickups.

Half of the rest are probably hybrids.

Businesses have already made a heavy commitment to reducing their impact on the environment:

- UPS has ordered over 10K electric vans

- DHL has a combination of more than 10K electric vans, bikes, scooters

- FedEx plans to have 50 percent of its delivery fleet electric by 2025

- Amazon is receiving 100K electric vans now and plans to be 100 percent electric by 2040

Short-haul trucking electrification will have a substantial impact on reducing greenhouse emissions and the use of autonomous technology will substantially increase street/road safety.

Basich noted Europe and China have led the move to EVs with the carrot/stick approach – subsidies for manufacturing an EV, in China for example and deadlines on when ICE (internal combustion engine) vehicles will cease to be sold.

Manufacturers like Damlier, Ford, GM and others see this as an opportunity to move past centuries-old technology to advanced architectures that can save the environment and lives.

According to Strategy Analytics, it will be several years before there are millions of fully autonomous vehicles on roads. The market research firm doesn’t expect to see the number of SAE Level 4 vehicles on roads globally to approach 1 million units until 2030 at the earliest. By the time huge numbers of EVs and vehicles with SAE Level 1 safety systems need replacement, the industry should be well on its way to improved AV deliveries, though.

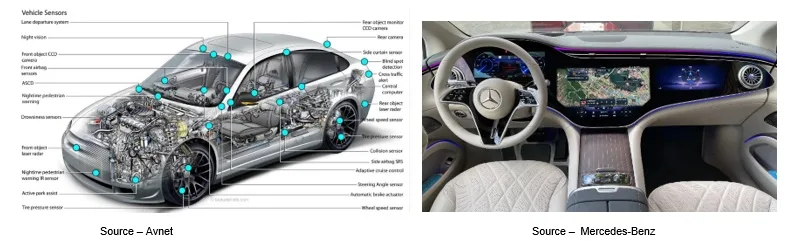

Whether folks realize it or not, vehicle manufacturers have already deployed a lot of ADAS technology we use every day — automatic emergency braking, driver monitoring, lane assistance, cruise control, auto-parking, monitored steering/driving, driving automation with close monitoring and event recording.

At the outset of his discussion, Mercedes-Benz’s Michael Hounker said today’s vehicles should be considered computers, not smartphones on wheels.

Infotainment and ADAS work so closely together that the vehicle’s central storage architecture requires major attention.

“Infotainment requires a robust CPU (central processor unit)/GPU (graphics processor unit) and considerable high-performance, reliable memory for on-board and off-board content enjoyment,” he explained. “At the same time, autonomous driving needs strong CPU/AI capabilities for object recognition and high RAM (random access memory) bandwidth.”

Self-driving provides the driver and passengers with free time while infotainment provides optimum enjoyment.

Automotive applications require the most current, proven storage technology – density, interface, speed, and functionality.

Later in the session, Tuxera’s Bernd Niedermeir agreed and disagreed, pointing out that filesystems (flash and middleware) need to be partnership projects because flash behaves differently in future auto use cases and filesystems need to be flash friendly.

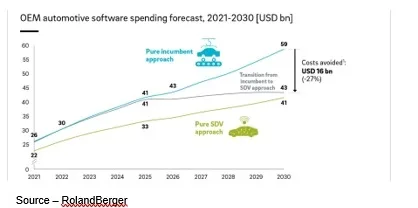

The latest software-defined car development study by Roland Berger (https://tinyurl.com/yszzx3uu) shows development will double by 2030.

We were surprised when Hounker said removable storage — USB/card memory — will have a major place in tomorrow’s vehicles until he noted that vehicle cameras, streaming, data logging and personalized user applications will need on/off-board content.

Of course!

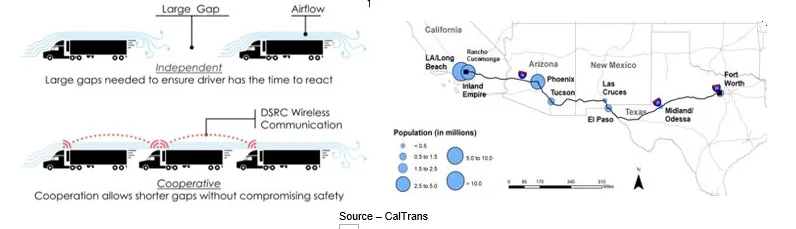

CalTrans’ Melissa Clark said the state’s DOT (department of transportation) is working closely with national and state transportation groups across the country as well as vehicle manufacturers on a number of programs to reduce fuel use/emission as well as improve throughput and highway/freight/vehicle movement efficiency.

One project she detailed is a 1,400-mile long-haul truck platooning project — four trucks in close proximity over long distances — project (California – Texas) weekly for 50 weeks to help officials determine policy changes as well as the potential for operator and on-road safety.

“We hope the project will help deliver fuel savings, vehicle safety, reduction in vehicle operating/maintenance costs and improved movement of goods travel times,” she explained.

“The key,” she added, “is to learn what we don’t know.”

With these data vehicle manufacturers, fleet owners and regional/national/international transportation organizations should be able to improve trucking savings as well as enhance truckers’ behavior, acceptance, performance and retention.

Trucking officials noted that nearly 75 percent of the components and goods transported from ports are moved by truck and US freight companies were unable to fill more 100,000 driver positions last year.

The lack of drivers was a major cause of supply chain disruption which continues even today.

Part of the problem is that the freedom of the open road isn’t quite as romantic as movies like Smokey and the Bandit and Convoy depicted, which has led to poor retention rates.

In discussing California’s issues, Ms. Clark said the challenges are similar around the globe – long lonely hours on the road, rigid time schedules and hazardous weather, driving and safety conditions.

To keep an edge and avoid highway hypnosis, truckers are limited to 11 hours of driving and a mandatory 10-hour rest period. In addition, they have to safely pilot a 26,000 lb. truck pulling a 53-ft trailer.

The strained supply chains, shortage of qualified dock/warehouse workers and truckers as well as the dearth of decent meals, lack of exercise and companionship makes it important for proven technology to be implemented in the trucking industry as quickly as possible.

Trucking represents the backbone of the supply chain and even incremental improvements in autonomous technology in trucks can improve the image and desirability of a big rig driving career.

While governments and auto/truck industries focus on developing transportation solutions that will save lives and decarbonize our world, Infineon’s Sandeep Krishnegowda noted that little has changed with ICE (internal combustion engine) vehicles since their introduction in 1863.

“The technology simply became more complex and more expensive,” he stated, “and now we have an opportunity to deliver solutions that will decarbonize the world and digitize transportation, bringing it into the 22nd Century.”

Krishnegowda estimated that by 2025, the total electronic BOM (bill of materials) will increase from today’s 16 percent to 35 percent as government and vehicle manufacturers move to emission-free transportation.

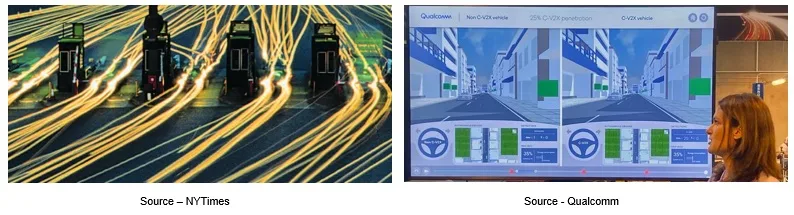

Autonomous driving has gained considerable attention over the past two years, but Krishnegowda envisions your next new car will not be simply self-driving, it will be a mobile IoT (internet of things) device that will sense its environment as well as communicate with cloud-based platforms and other transportation devices.

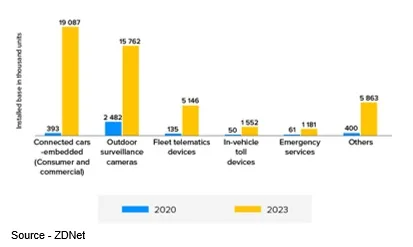

While full autonomy may still be years away, sensor-laden connected cars/trucks–a wider array of connected infotainment and safety services–are rapidly entering the mainstream.

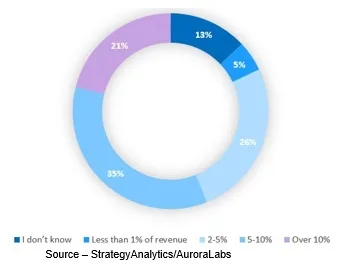

According to Basich, the challenge for automakers will be finding the right mix of free and paid connected services that car owners want. He noted that in the largest vehicle markets – China, Europe, US – the majority of automakers are equipping vehicles with cellular modems.

Annual embedded cellular modem shipments in cars will reach an estimated 73.4M units by 2029.

“Automakers, such as Stellantis and Volkswagen, expect to generate significant revenue from connected services. 5G will provide more opportunities for automakers to leverage connectivity as they make the transition across their vehicle lineups.”

Of course, since your next vehicle will likely be a mobile multi-sensor, multi-flash storage device that’s 5G connected, all of that data shouldn’t go to waste. Providers across the board are already examining how to help vehicle producers transition to service providers.

“Vehicle manufacturers are already considering a range of downloadable features that can become future revenue generators not unlike today’s smart TVs and smartphones,” Basich predicted.

“Tesla is an excellent example of an automaker that delivers system and application updates OTA (over the air),” he noted. “When 5G is reliably available, traffic will move more smoothly and safely. There will be more infotainment options so you can store content in the vehicle’s flash memory or stream it live.”

Constantly updated and personalized, people will once again agree with Charlie Watson in Bumblebee when he said, “It’s about my car. It’s really important.”

Folks may even begin having feelings for their cars like Watson did when he said, “He’s more human than you’ll ever be!”

# # #

Andy Marken – [email protected] – is an author of more than 700 articles on management, marketing, communications, industry trends in media & entertainment, consumer electronics, software and applications. Internationally recognized marketing/communications consultant with a broad range of technical and industry expertise especially in storage, storage management and film/video production fields. Extended range of relationships with business, industry trade press, online media and industry analysts/consultants.