Theaters Still Belong in the Entertainment Mix

At least there’s one thing you can’t blame on Covid … the dismantling and reassembly of the entertainment industry.

Fox …gone. ICM…gone. MGM…gone. Disney…evolving. Warner Bros/Discovery …who knows. NBCUniversal…Peacock. ViacomCBS…Paramount.

Names that have been around for up to 110 years with huge libraries of content refocused on putting out a steady flow of new streaming stuff to satisfy stay-at-home viewers, shareholders and Wall Street.

That doesn’t mean that theatrical/cinema/movie theater releases are dying or disappearing.

Nope!

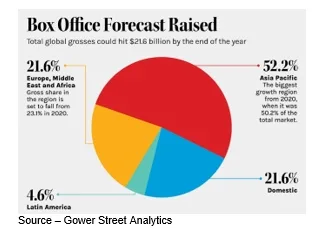

In fact, the 208,000 screens worldwide are on course to rake in $21.6B this year.

That’s down 12 percent from 2019 but still …

Of course, that income is split with studio/theater owners and increasingly with power producers and talent, so studios are obviously a little careful as to which projects they release to theaters with a theatrical window.

If studios aren’t sure or if their streaming service needs “a little boost,” it will be a day/date release.

If they’re pretty sure of the project, and theater owners push back, the film will get a 45-day theatrical window.

If the producers and talent draw a hard line in the sand, the film with a mega budget and mega ticket sales potential will have a 120 +/- day theatrical release window.

You know, like the long-awaited/anticipated Top Gun: Maverick and December’s Avatar: The Way of Water.

Both Cruise and Cameron are perhaps the two most universally recognized vestiges of the old Hollywood.

Almost ironically, Top Gun surpassed Cameron’s Titanic in domestic ticket sales but doesn’t come close to Cameron’s 2009 Avatar, which tops the global list with $2.8+B global ticket sales.

Avatar was actually released twice to take the crown back from Avengers: Endgame but Disney didn’t mind since they owned both properties.

The Way of Water may not surpass the original in ticket sales when it’s released in December, but Disney and theaters around the globe anticipate a lot of seats in seats during its run.

However, even the best power-wielders are having a tough time as technologists and number crunchers shape the new industry.

M&E has changed a lot in the past five years, and the past two years only accelerated that change.

The infrastructure has been crumbled, reshaped/focused and sold off piece by piece as a new Hollywood/Nollywood/Bollywood/Chinawood/Netflixwood deals with the new balance of quality, budget, viewer potential and corporate interest.

It’s not good … it’s not bad … it’s different.

Since there’s no going back to the “good ol days” or “normal,” let’s reshape a new industry that includes theaters, streamers, pay TV and “others” as equals.

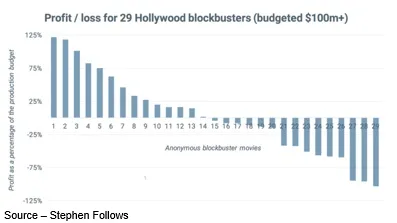

Tentpoles, as well as franchise and sequel projects, will still be made.

They just make bean counters nervous because the financial commitment is high while turning a profit is as scary for them as John Carpenter’s 1980 The Fog.

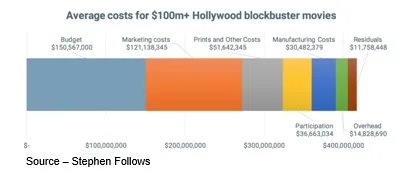

By almost any definition, a tentpole isn’t cheap.

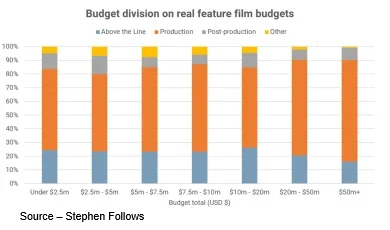

Britain’s Stephen Follows has done an excellent job of spelling out how film project budgets are developed (and explode) as well as how they make money.

Spoiler … Hollywood accountants are the real creatives in the industry.

The project budget includes all of the above the line folks – writers, producers, directors, actors. Then there’s the below the line stuff – shooters, crew, travel, housing, physical/mental healthcare folks – film work/workers.

Then there’s post-production magicians who turn raw footage into something industry folks hope people will want to watch.

Finally, there’s “other” which includes insurance, financing, overhead, you know … other.

Of course, stuff happens. Especially when above the line folks want changes … even after the final cut.

That’s probably why the average Hollywood blockbuster was nearly $20M over budget.

But not to worry because accountants at studios such as Paramount, Universal, Lionsgate, Sony, Legendary and especially Disney have become masters at squeezing every penny out of a project, including merchandising.

For movie house owners including AMC (11,000 screens), China’s Wanda (1,657 screens), Cineworld (9,500 screens) and the others, it’s all about getting all of the gotta-see films first for as long as possible to put seats into seats and sell greasy popcorn, drinks and concession stuff.

Except for the tentpoles of tentpoles, studios and theater chains have come to an uneasy agreement that 45 days is a good theatrical window.

After that the studios make the content available on their streaming service, airlines, DVD disc sales and ultimately, to the fading pay TV folks.

In uncertain times – think the last few years – you skip all that as Disney’s Bob Chapek did and decide you’ll release Scarlett Johansson’s Black Widow theatrical-only opening on the same day you release it to Disney+ subscribers.

He forgot to check her contract and the fact that she was an MCU (Marvel Cinematic Universe) Avenger.

The move boosted Disney+ subscriptions but dampened ticket sales and Johansson’s backend payout.

The deadly Araneae got her revenge and lawyers everywhere rewrote their Alist contracts.

Theater owners couldn’t have been happier.

The problem for studios is that it’s expensive to produce a blockbuster, it’s expensive to market it (they pick up the tab) and profit isn’t assured for them since they have to split the ticket sales 50/50 with popcorn sellers.

So sometimes it’s better for studios to go direct to their streaming service to add subscribers and provide them with content that will keep them around longer.

Or, you can do what WBD’s David Zaslav did with Batgirl.

Simply tuck the project in the back corner of the film vault and take a huge tax write-off.

Then tell folks you know quality and that you’re going to focus on following Disney’s 10-year creative business plan playbook.

Somehow, following doesn’t make you a leader but …

Who knows, they might get as lucky as Lionsgate and stumble into a killer film franchise like John Wick.

Since 2014, Keanu Reeves and a host of kill or be killed folks have built a terrific action thriller following for John.

We’re looking forward to seeing who fights who in Chapter 4 next year and Chapter 5 after that.

As if that wasn’t enough, we’re even going get a prequel (The Continental) next year that we can watch on our NBCUniversal Peacock streaming service–at home.

And therein lies the problem for theaters.

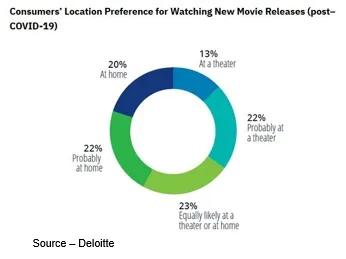

Consumers have the choice of going to the movie or staying home to watch something new, different on their screens. They’re habits.

Once you shift one of your habits, it takes a whole lot of deliberate thinking/action to go back.

NATO’s (North American Theater Organization) CEO John Fithian, AMC’s Adam Aron, Cinemark’s Sean Gamble and every theater owner and movie aficionado/cheerleader have been wildly enthusiastic about how folks crammed into theaters for Top Gun: Maverick, Minions, Dr. Strange, Jurassic World, Nope, Bullet Train, Thor and a few others all experienced record ticket sales despite pricier tickets and more expensive concessions.

But the chain has been broken.

The Gen Z/Millennials (11-25, 26-41) folks are coming back–just not as often because they’ve got good options.

They’re interested in getting out for the right film – adventure, sci-fi, horror, action, family/animation – but there are fewer choices because studios also have options.

Global content spend had double digit growth last year to more than $200B; and Ampere projects investment this year will surpass $230B.

But most of that investment is allocated to meet their streaming service’s requirements.

Theaters, studios and content creators have to work together to develop/deliver projects that demand strong theatrical visibility.

Theaters, studios and content creators have to work together to develop/deliver projects that demand strong theatrical visibility.

Learning from the industry’s past is important but as Lil McDougal said to Vic Edwards in The Last Movie Star, “Why can’t you just live in the present, and stop looking in the rearview mirror?”

Tomorrow offers challenges and opportunities for the industry to deliver movie experiences that are satisfying for everyone.

# # #

Andy Marken – [email protected] – is an author of more than 700 articles on management, marketing, communications, industry trends in media & entertainment, consumer electronics, software and applications. An internationally recognized marketing/communications consultant with a broad range of technical and industry expertise especially in storage, storage management and film/video production fields; he has an extended range of relationships with business, industry trade press, online media and industry analysts/consultants.