Don’t Kid Me…You Like Free!

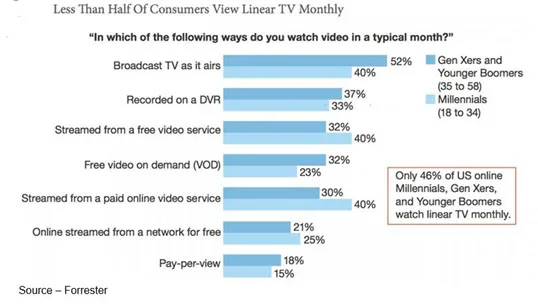

Despite what analysts say, TV viewing isn’t dropping like the proverbial rock to be replaced by Netflix, Amazon Prime, YouTube Red and OTT (over the top) TV.

Regardless of how content is distributed and consumed, people are still getting their video fix, whether it’s from the legacy or the new environment.

And frankly, they could give a rat’s behind where it comes from or who delivers it.

Take our daughter.

She swore off TV about a year ago and only watches (binging occasionally) Netflix and Amazon Prime and her free social media – Facebook, YouTube, Snapchat, etc.

The first two and the rest of the FAANG (Facebook, Amazon, Apple, Netflix, Google) and BAT (Baidu, Alibaba, Tencent) crowd buy content; don’t show ads and once the entertainment value is gone, the films/shows go into a vault … somewhere.

These streaming companies are spending serious money to grab “hot now” content to build audiences.

And it’s working!

They are sucking viewers away from appointment TV (a phrase introduced to me by a friend).

Last year, 22.2 million U.S. adults cut the cord on cable, satellite, or telco TV service–up 33 percent from the previous year.

That’s okay, it is what it is; but FAANG and BAT organization have had a negative effect on TV advertising.

nScreenMedia recently estimated that Netflix took 3-6B ad dollars per year off the table in TV ad revenues because of lost ad-supported TV viewing.

According to Colin Dixon U.S. Netflix subscribers are “deprived” from seeing 35 30-sec commercials a day, or nearly 2B ad views per day.

Missed ad views are estimated to be $139 per year per subscriber, or $7.6B.

Marketing and ad creatives needn’t worry though because ads didn’t totally disappear.

Nope, they followed you.

They’re being repurposed in the new wave digital market – Google, Facebook, YouTube, Snapchat, Twitter, LinkedIn where you visit to share stuff with a few hundred thousand of your close personal friends.

Social media sounds so altruistic; but it’s really nothing more than a thinly veiled different set of ad platforms so they can afford to give you the service free.

While Google doesn’t break out YouTube earnings from the rest of its sales/profits, an executive at R.W. Baird recently estimated that the video site is probably a $15B business.

Not bad for “free” entertainment that also gives them a steady stream of your personal information.

A lot of the online informational entertainment is done by quasi-famous, sometimes questionable, folks who followers sorta’/kinda’ believe actually use, adore certain products.

But the networks like NBC, CBS and others around the globe have gotten tired of apologizing that their median audience just keeps getting older and older, while the young crowd is apparently abandoning them for the new streaming services.

Bob Greenblatt, NBC chairman, and his team found that while Nielsen ratings (measurement of TV viewers) reported that the audience was down 10 percent for the last season, it only told part of the story.

Data from CNBC, NBC.com, NBC app, VOD and Hulu showed that 47 percent of the revenue from pilot episodes actually came through digital views.

In other words, broadcasters could hold onto their traditional (albeit aging) appointment TV viewers and capture the younger OTT crowd whose viewing habits didn’t depend on clock, calendar, location, screen — TV, computer, tablet, smartphone.

After examining all of the data closely, NBC found viewers hadn’t “abandoned” them but simply watched shows on their own schedules.

For the Winter Olympics in South Korea, NBC focused on total audience delivery – reaching broadcast, cable, streaming viewers.

Nielsen said the Olympics audience had disappeared.

However, the network found a more invested and involved audience – 35 percent viewing online – especially with the addition of Snapchat short videos and highlights.

In other words, it’s not just about viewership, it’s a whole new business model

The IOC (International Olympic Committee) reported that:

- They have aired 14 percent more programming from PyeongChang, compared to the Sochi Games

- 90 per cent of the viewers are using another device in addition to or instead of while watching the Games

Because of the new way of looking at the TV audience, industry executives are finding that digital content will be double that aired on TV – two parts digital, one part appointment TV.

It turns out cord-cutting, cord-shaving and cord-never is breathing new life and opportunities into existing and new broadcasters and outlets.

It also has the potential to accelerate professional video production and delivery opportunities and change.

Historically, broadcast industry technology change was driven by the industry.

The pervasive nature of mobile technology and the desire to view content anywhere finally makes the consumer the driving force in technology change.

Content consumers could care less if there’s a valid business model or even if the required infrastructure can produce a positive ROI.

They simply want content at their fingertips 24/7; and despite what the Netflixs of the world have led us to believe, they want it free.

The fat cat has left the stage and providers have to do more with less.

The fat cat has left the stage and providers have to do more with less.

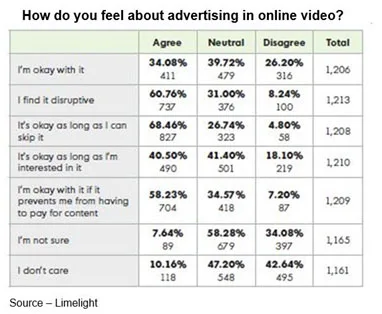

Cisco expects video to represent 80 percent of the internet traffic by 2019; and conventual wisdom – especially citing Netflix growth as proof – is that consumers don’t like TV ads, which is why so many have begun using ad blockers.

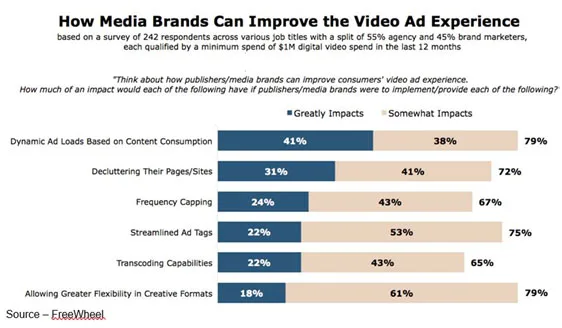

But according to a recent study by Hub, they don’t like the way ads are delivered.

Peter Fondulas, Hub principal, recently said, “Consumers welcome ads that are targeted at their interests and product needs. Interestingly, they don’t have privacy concerns when the ads are based on past purchases.”

Despite the dominance of Google and Facebook in digital advertising and Amazon’s rapid rise in the subscription streaming arena, it’s only logical that they open up a new “opportunity” for content providers, advertisers and themselves.

And later this year, Amazon will begin offering ad-supported streaming channels in the Americas just as they already do in Europe and other countries, giving consumers options – subscriptions to top networks like HBO, Showtime, CBS All Access or ad-supported channels at a fee below (far below) the cable service provider you cut, shaved or never had.

The ad-supported program could make Amazon an even bigger deal for streaming media providers, content producers and marketers.

Me? I prefer to “pay” by watching the commercials and would watch more closely if the ad was directed at my interests rather the masses.

Certainly, Google (YouTube), Facebook and Snapchat have the potential to become formidable ad-supported video channels; but they are social media/ad platforms first and entertainment, information and news channels second.

Almost anyone or anything can get posted/streamed on their sites and you can instantly go from an entertaining sit-com to inappropriate content for your kids (or you).

And if a company’s ad happens to appear pre, mid or post roll; what does that do to the brand value, image of the product or company?

Right!

Don’t forget that Amazon is equally data rich and probably has one of the greatest databases of people who buy stuff on the planet.

I’ve never met a CEO or CMO who didn’t complain about Amazon’s walled garden and the lack of information they share; but still, there’s a level of implied quality of the entertainment content they deliver because they derive income from the ads that appear and products sold.

It’s in their best interest – and the advertisers – to provide content people want to come back for again, rather than click away before the kids see it.

In addition to Amazon Europe’s Sky, Canal and other OTT services are offering consumers SVOD and AVOD options.

According to PCCW, China is rapidly becoming the Pacific Basin AVOD leader and will reap $4.9B in 2010. India will be in second place reaching 14.6M viewers, followed by Indonesia and Japan with 9.96M and 8.1M viewers respectively.

AVOD viewing leaders will include Tata, Vodafone, PT First Media, NTT DoCoMo, Alibaba, TenCent and Baidu.

The big problem is there is no consumer loyalty here and they don’t care about a specific delivery service. They simply want their free media; and they want simple, interoperable platforms.

The big hurdle is the service providers aren’t interested in interoperability.

It sounds nice, but that’s just not smart business!

So, AVOD providers will have to back into providing both content breadth and depth while advertisers will have to make more intelligent use of consumer data to reach viewers at the right time with the right message.

As Don Draper reminded us, “Technology is a glittering lure. But there is a rare occasion when the public can be engaged on a level beyond flash – if they have a sentimental bond with the product.”

As Don Draper reminded us, “Technology is a glittering lure. But there is a rare occasion when the public can be engaged on a level beyond flash – if they have a sentimental bond with the product.”

# # #