Sometimes You Have to Destroy to Build

So far, WBD’s (Warner Bros Discovery) boss, David Zaslav, has relied heavily on the entertainment company’s past to move his deeply leveraged organization into tomorrow and that could be a good thing or … who knows.

He cancelled a number of DC projects, including Batgirl; borrowing from Orson Wells’ famous Paul Masson winery’s line (https://tinyurl.com/ywpatb4h) and telling financial and industry analysts, “We are not going to release any film before it’s ready…”

It may work better for movies/shows than it did for wine because even after years of making wine for the masses for nearly 100 years, the winery finally turned off the spigot to become a conferencing, events center.

However, Zaslav isn’t counting on a well-turned phrase to help him make the cobbled together entertainment entities – movie/TV studios, cable/linear TV networks and promising D2C (direct to customer) AVOD/SVOD streaming service – into a smooth running/profitable viewer-centric organization that can quickly pay down its $43B merger load and more than justify his hefty $246M salary.

Killing off Batgirl and a few other projects gave the company a nice little tax write-off of $825M and reinforced the concept that they were going to build a DC Cinematic Universe that could equal Disney’s Marvel Cinematic Universe.

To prove it, he brought on an industry heavyweight, former Disney film chief Alan Horn, to help develop a 10-year plan.

His plan?

Closely follow Disney … build the biggest entertainment organizations in history focused on quality.

Lead … follow … or get outta the way!

Of course, financial analysts, investors and the viewing public don’t care much about 10 years from now or even next year. They care about next quarter’s numbers and shows/movies available now.

That’s tough … and getting tougher.

Back before Zaslav took control of the new company, Warner’s CEO Jason Kilar focused the company’s future on HBO Max moving theatrical content to day/date theatrical/streaming release and irritating just about everyone in Hollywood while not particularly impressing potential streaming subscribers.

Kilar’s “all in” approach versus true consumer/project value did enable filmmakers and theater owners to understand that regardless of the genre, there are theater movies and small screen movies … they’re both professional but different.

New installments in their favorite – Jamie Lee Curtis’s Halloween Kills, Daniel Craig’s No Time To Die, Venom: Let There be Carnage, Spider-Man: No Way Home, Jurassic World: Domain, and Top Gun: Maverick – proved that broad, high in-demand franchises could get folks out of their homes and into a theater with a bunch of other people.

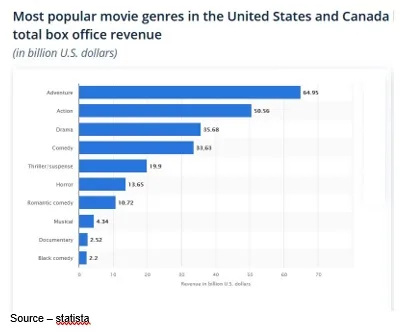

Action, adventure, superhero and thriller/horror films are box office winners for studios and theatres and that’s not about to change.

What has changed, thanks to Netflix, Amazon Prime, and Apple TV+, has been the increased quality/value people around the globe expect in the films they invest in – subscription and time.

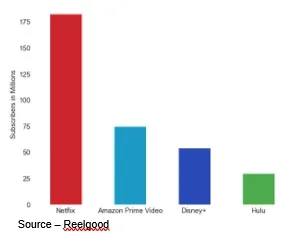

Netflix’s momentary subscription loss shows that US subscriptions have stalled, and that growth lies elsewhere around the globe and with a range of growth of viewing options – subscription and FAST.

With the rapid proliferation of new D2C services and intensive competition – especially in the Americas – sustained subscriber growth should have been anticipated by everyone without a sustained/increased spend in content.

In addition to reluctantly adding FAST options, Netflix has shifted its focus on localized content – Europe, APAC, LatAm, Africa – where anywhere, anytime viewing interest is growing.

Product reseller/delivery service Amazon and hardware/software/service Apple continue to grow in the home/personal entertainment arena based on a different set of rules.

Amazon Prime Video continues to have about 200M subscribers for its range of delivery service, video/game/publication services as well as its FreeTV library offerings.

While still well behind Netflix with true streaming subscribers only, Amazon continues to hold a strong position in the premium home-delivery entertainment market with a 4 percent US subscription growth over the past 12 months, according to Antenna Research.

Apple continued to focus on quality vs. quantity for its Apple TV + service, resulting in more than 52 Emmy award nominations over 13 titles such as Ted Lasso and Severance. The focus has helped the company increase its streaming/news/fitness/music/gaming subscriptions by more than 130M in the past year to 860M plus globally.

Despite the uncertain economy and crowded streaming arena, Disney, Paramount and even Peacock (NBCUniversal) are all well positioned to be major personal/home entertainment providers with significant libraries, subscription and FAST viewing options and growing national/international audience.

Bob Chapek couldn’t have taken the helm of entertainment icon Walt Disney Co. at a worse time (2020). Despite some missteps – Scarlett Johansson/Black Widow Disney+ release, Don’t Say Gay, a forced Florida move and the abrupt/public firing of TV division boss Peter Rice – he managed to keep the Mouse House on the rails.

Disney+, Hulu (80 percent owned by Disney) and India’s Disney+ Hotstar have more than 184.2M global subscribers. With new SVOD/AVOD pricing and rich content libraries, there are plenty of opportunities to achieve its goal of 260M plus subscribers by 2024.

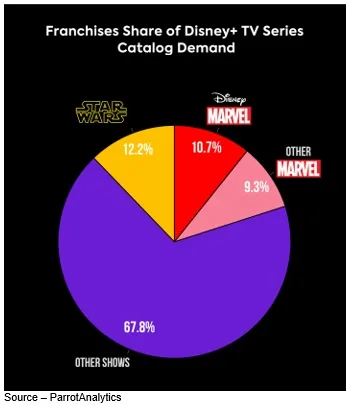

The company’s rich content stream from Marvel Studios, Pixar, Lucasfilm, Muppets Studio and National Geographic is supported by a powerful and profitable marketing/merchandising activity that produces more than $56B in annual worldwide sales.

Paramount Global’s Paramount + and Comcast’s NBCUniversal Peacock only add to feeling that the new TV is a lot like the old TV.

With more than 43M Paramount+ subscribers, 64M monthly Pluto TV (free) subscribers and 27M plus premium Showtime subscribers, it has plenty of potential for global growth if it can streamline its service offerings into a single, multi-level offering.

Peacock already offers premium, AVOD and FAST service with more than 13M subscribers plus an added 15M plus monthly average users and extensive NBC/Universal libraries. It’s parent company, Comcast, is the world’s largest broadband/cable company, which also owns Europe’s Sky pay-tv service with more than 12.7M customers.

It should also be noted that Comcast, Peacock’s parent, has extensive experience in helping marketers target and monetize their advertising.

While traditional pay-tv is admittedly declining in the Americas, home entertainment companies will be focusing most of their attention on creating more streaming-first content and strengthening their discovery/recommendation/delivery backoffice systems and tools so they can capture and retain more people for longer periods of time.

The big six (Netflix, Disney+, Amazon Prime, Paramount +, Peacock and WBD) as well as an estimated 200 global and regional video services will be turning their attention to going beyond the early adopters and reaching more of the nearly 1.1B plus potential global viewers.

In other words, the future of TV is starting to look a lot like old-fashioned television … confusing.

The majors will have to have a strong mix of movies, scripted/unscripted shows, news and sports or bundled national/regional relationships.

As bad and confused as the core streaming is, the business of subscriptions and ad growth remains strong across the industry. But the common ground for the entire content industry is the development and nurturing of franchises across key genres – action/adventure, animation, children, drama, etc.

Disney has done an excellent job with its Marvel Studios, Star Wars and Pixar action/adventure and fantasy franchises across theatrical films, Disney +, comics and games.

CBS/Paramount +, NBC/Peacock have done this successfully for years with long-running TV series including CBS’s shows/spinoffs – NCIS, CSI, Blue Bloods, FBI and unscripted reality shows; NBC’s shows/spinoffs – Yellowstone, Law & Order and all the Chicago series.

The younger streaming first contenders have yet to hit the formula with 91 percent of Netflix projects being non-franchise series and 90 plus percent of Amazon’s titles being non-franchise. But this will change as their national, international libraries grow.

Walk the line

While these are being established with audiences around the globe, Zaslav must play the hand he’s been dealt across the company’s studio business (film/TV studios), linear TV networks (Discovery, HBO), and the firm’s evolving/fluctuating streaming service(s) HBO Max and Discovery +.

Despite its ongoing impairments and development/production write-offs; WBD wants Marvel to become a major franchise studio with billion-dollar hits without having to invest in a roster of A-, B-, C-level characters that audiences simply must see.

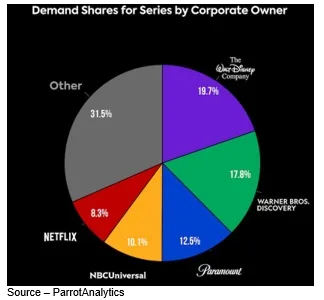

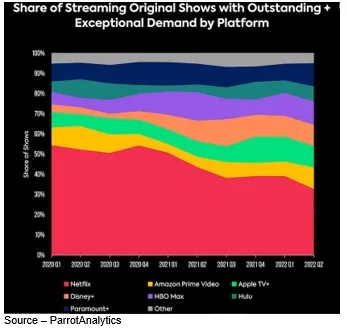

In the already overloaded – and active – streaming market, Netflix already has a 19.5 percent demand share, Disney+ and Hulu have a 19 and 19.2 percent respectively, Paramount+ and Amazon Prime Video each have 8.2 percent while the slow starting Apple TV + has experienced a 10 percent demand share and Peacock a 2 percent (US only) demand share.

While WBD has set 2023/24 as its formal launch date for the new HBO Max/Discovery + services, consumers have already shown signs that they are willing to pay for three to four streaming services in this content rich market.

This becomes an area of concern in the fast-growing APAC streaming region where WBD services won’t be available for two years

The situation is particularly egregious in the wider Asia region, which is currently the world’s fastest-growing streaming market, but where the new improved WBD-iteration of HBO Max will not be available for another two years.

In Europe the company runs the risk of alienating content suppliers where Netflix and Amazon are moving aggressively with local production and rapidly expanding services.

While the company has an aggressive goal of 130M subscribers/viewers by 2025, Zaslav must optimize WBD’s under-managed assets, integrate complex organizations into a single unit and aggressively reduce overhead and headcount all without cannibalizing its cash-flow positive businesses.

To produce this commercially, technologically and financially viable entity, WBD’s Zaslav has already indicated that WMD will focus on balancing its debt obligations, tightening its content spend belt and making significant executive/staff adjustments to minimize redundancies.

In plain English, that means significant layoffs for its executives and staff to minimize redundancies within WBD, HBO/HBO Max and Discovery+ with a harder line separation between the scripted and unscripted content operations.

While this is being planned/developed by Zaslav’s new management team, resumes are being updated, agents put on speed dial by the most qualified members of the organizations and headhunters are on the prowl.

While this is being planned/developed by Zaslav’s new management team, resumes are being updated, agents put on speed dial by the most qualified members of the organizations and headhunters are on the prowl.

Because as Dan observed in The Old Man, “Sometimes there are things that you don’t get to know before the curtain comes down.” And added, “Rich folks don’t explain S***”

# # #

Andy Marken – [email protected] – is an author of more than 700 articles on management, marketing, communications, industry trends in media & entertainment, consumer electronics, software, and applications. An internationally recognized marketing/communications consultant with a broad range of technical and industry expertise especially in storage, storage management and film/video production fields; he has an extended range of relationships with business, industry trade press, online media, and industry analysts/consultants.