Growth, Change Taking its Toll on Creative Industry

Take a few minutes and scroll through your phone and email directory or if you’re old- fashioned, your rolodex.

We had some idle time a few weekends ago and decided we’d clean ours up.

It reminded us of a segment of Seals where Jason (David Boreanaz) scrolls through the names of team members he had lost during his years of service.

Okay, it was different because the folks’ phone numbers we deleted weren’t deceased; but if they had used a company phone, we’d simply get an “I’m sorry, this phone is no longer in service.”

Hollywood used to be a different sort of place where A-List producers, directors and actors were almost expected to be different, and their idiosyncrasies were overlooked/tolerated.

Deliver solid ticket sales and things were sorta okay.

The same was somewhat true for people who delivered solid Nielsen ratings for their TV shows.

Early on TV wasn’t really considered acting rather a place holder until you found a real acting job, but that changed over time when families had those folks come into their homes week after week and they became old friends.

Throughout the years, the movie/TV producers, directors, actors and crews drove through the gates of studios that made Hollywood Hollywood – Gaumont – 1895, Pathe – 1896, Nordisk – 1906, Universal – 1912, Paramount – 1912, Disney – 1923, Warner Bros – 1923 and others.

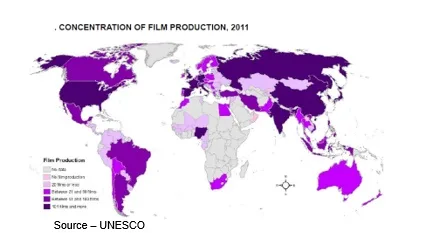

Each country in Europe had its own unique studios; and in the early 1900s, the industry was in great shape pioneering technological and content innovations. The advances enabled the European industry to capture up to 60 percent of the U.S. market.

Asian cinema – often referred to as East Asia, Southeast Asia, South Asia and similar country segments – were entertainment worlds unto themselves. Well, until the Golden Age which began following WW II when U.S. producers began shooting in remote locations and people around the globe began to enjoy the cult appeal of the Asian projects.

Everything was going smoothly with local studios producing films and TV shows for audiences in 195 countries. And when folks lusted for even more variety, the art theaters showed international fare with captions or poorly dubbed soundtracks.

Theaters’ initial classless TV ruining the motion picture industry quickly faded and studios found a secondary market for their content libraries – pedal them to TV networks to show them (with ads) to people who would watch them when the TV folks decided they wanted to put them on the schedule.

Sure, techie kids have begun watching videos of other kids doing stuff from around the globe for nothing, but it was totally unprofessional and normal people would never stoop to that level.

Then, Reed Hastings got tired of paying for the postage to send red envelope DVDs of movies to people to watch at home and in 2007 and he decided Netflix would stream movies and TV shows to subscribers over the Internet.

Suddenly, there was a ripple in the universe.

Families liked the anytime, any screen viewing and ad-free content. As the Netflix streaming audience grew, another tech company – Amazon – added films and shows to its at-home delivery program.

Initially, just another source of income, studios soon realized that going direct to the consumer meant they were closer to their customers than studios were and could make more money so they cut off their content supply.

It was a minor inconvenience to the streamers, but they had something studios and TV distributors didn’t…detailed information on what people wanted to watch; and how much time they spent with various content, as well as when, how and where they wanted to enjoy their entertainment.

So, they went right to the source, signing contracts directly with the best creators in the industry.

Their investments and circulation around the globe grew. Between 2015 and last September, Netflix has produced 2,489 original titles and the second-place streamer had produced 420. The two became great homes for content creators, producers and independent operations.

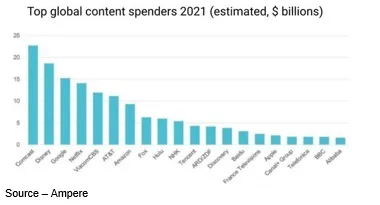

Netflix is now the fourth-largest investor in professional video content ($14B) behind linear TV and theatrical film firms – Comcast ($22.7B), Disney (18.6B) – and Google’s $15B for online content.

While ticket sales have continued to slide since 2002, theaters maintained their profits by charging more and concession sales.

The magical hold on the content creation world was suddenly in disarray and the lowly streaming folks were suddenly taking away their audiences.

The streamers were delivering first-class content that actually deserved trophy honors from film festivals and award contests since they were done by titled producers, directors and actors.

People liked them so much they were subscribing to the services.

With theaters not providing anything to the studio’s bottom line, the majors made the strategic move to sell content to streaming services or start their own direct-to-customer service.

And other tech players jumped into the pond – Apple, Tencent, iQIYI, Youku, ALTBalaji, Rakuten, and others with strong online customer bases.

In other words, everyone took the leap into the new content world, including one of the telephone guys until they discovered constant investment in new content was required and you couldn’t call your own shots on when, where you were going to release new stuff.

The biggest hand-off was when AT&T “volunteered” to merge its WarnerMedia with Discovery for $40B plus.

Rather than dirty their hands, they let CEO David Zaslav make the necessary staff adjustments to streamline the new scripted and unscripted company to reallocate content spending and realize certain cost savings.

The whole idea, according to the new management, is to focus on streaming synergies instead of overspending which will also mean getting the new managers acquainted with Warner’s former A-List creators who now have a broad list of proven content distributors to work with.

However, before he was presented with the Warner “opportunity,” Zaslav said, “We don’t do red carpet. We don’t do Hollywood stars. We pretty much don’t have actors. We have authentic talent. We focus on strong brands, passionate audiences and real-life entertainment.”

Am pretty sure he’ll change his mind in the years ahead.

Of course, they are far from the first to adjust to the new market.

Disney has a solid track record of acquisitions including Miramax (1993), ABC (1996), Pixar (2006), Marvel (2009), Fox (2019), Star India as well as investments in a number of international production and distribution organizations.

Amazon undertook a major content-centric deal by acquiring MGM with some heavy-duty franchise names – Bond, Rocky, Pink Panther, Stargate and more. In addition, they also got their hands on some seasoned content industry executives.

Netflix, the streaming industry leader, has chosen to develop deep relationships with video content creators in the 190 plus countries it streams content in to develop stronger relationships with governments and local subscribers.

As Moffett Nathanson’s Michael Nathanson recently said, “To date, we have yet to see evidence of any media company being able to compete with Netflix and the other major streaming services without spending a lot more on content.”

Okay that’s changed a little recently but…

To stay ahead of the competition, Netflix has taken a deep dive into the second most popular streaming business – gaming – with the purchase of Night School, Next Games and Boss Fight.

Worldwide consolidation of independent producers will stay strong this year as the demand for films and TV shows continues.

Reese Witherspoon’s Hello Sunshine was sold to Blackstone for $900M, Creative Artists bought out it’s talent competitor ICM and South Korea’s CJ Entertainment bought an 80 percent stake in Endeavor Content.

In addition, there are dozens of deals that slide under the radar around the globe.

Streaming today is led by a handful of top-tier providers and smaller providers may need to decide whether they want to compete as content aggregators or become pure creators selling original content to the leading services.

Only a few providers are big enough to compete globally as content investment is projected to top $230B this year.

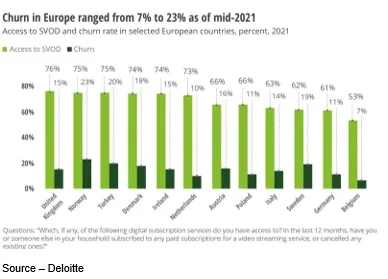

The major challenge for all streaming services is subscription churn – people adding/cancelling services.

The key for all of the folks in the new entertainment arena is managing subscription costs and developing/delivering new, exciting and unique content to keep subscribers happy or to get them to return.

Understanding, interpreting, and using subscriber data properly is becoming vital to streamers.

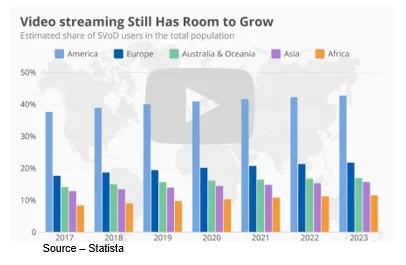

The enticing note though for the industry is there are still a lot of people around the globe who haven’t cut their pay TV service. While many households have both pay and subscription TV, more than 58 percent of the TV households still rely on day/time viewing.

Streaming subscription services reached 1.3B globally last year and are expected to grow 2.5 percent through 2025 at the expense of Pay TV.

The key is the winners will be those who continue to invest in content that appeals to and attracts customers around the globe because every consumer is important.

The key is the winners will be those who continue to invest in content that appeals to and attracts customers around the globe because every consumer is important.

None of them want to lose any subscriber for long so, the smart services will continue to invest in content.

Whether it’s a local, regional or global service; every viewer is important to streaming services.

As Lilly (The Coyote) said in Army of the Dead, “I’ve never left anyone I didn’t have to, or who didn’t deserve it.”

With all of the pressure on streamers and content creators, some will be left behind.

Oh, and don’t worry about testing to see if our phone number still works.

It’s the nice thing about being a consultant. We use our own phone so if you call … we’ll answer.

# # #

Andy Marken – [email protected] – is an author of more than 700 articles on management, marketing, communications, industry trends in media & entertainment, consumer electronics, software, and applications. An internationally recognized marketing/communications consultant with a broad range of technical and industry expertise especially in storage, storage management and film/video production fields; he has an extended range of relationships with business, industry trade press, online media, and industry analysts/consultants.