People Like to See Different Content Different Ways

If you listen to the theater folks (AMC’s Adam Aron, Rich Gelfond and the bosses of the other nearly 200,000 cinema screens around the globe), the worst is behind us. People of all ages are once again returning to the theater. Ticket sales are projected to surpass sales of 2019 for 2022.

Okay, so attendance was off in 2019 compared to the previous year(s). In fact, attendance has been on a downward trend since 2016; but it’s up this year–if the project is good, if it’s a superhero/sequel/slasher flick and if it’s given a decent theatrical window.

The news here is that the movie business is beginning to get back to the old “normal” with studios lining up one big release after another. They have a big load of projects that were created to take advantage of the full cinematic experience – darkened room, huge screen, totally immersive sound.

Oh yeah, they also have a ton of cash tied up in two years’ worth of good, bad and so-so stuff.

So, we have good reason to be thankful for folks starting to return to the theaters. The problem is there are a lot fewer returning, and certainly less than the numbers before.

The brutal fact is if you’re a studio with a tentpole production, you’ve already invested a lot of money … and you’d like to turn a profit. But right now, you’re not going to get mom, dad and the 2.5 kids back in the seats. At least for the time being.

So, who’s your target audience? Younger moviegoers! The younger film set (67 percent, 18-34) are hungry for superhero’s (Spiderman, Batman) and scary stuff (Scream, Moribus, Halloween) as well as feel-good stories (Sonic, Turning Red, Bob’s Burgers).

Yes, it’s mostly guys, but young females are also ready to see a good movie (53 percent male, 47 percent female), according to Nash Information Services.

as you can from theatrical play and then the follow-on viewing sources.

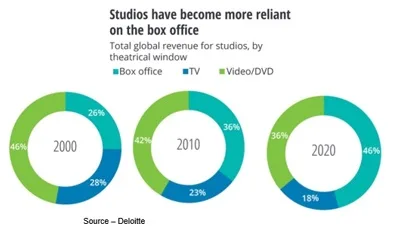

The only way that’s possible for blockbuster films to turn a profit is by showing their films first in theaters and then scheduling them in their streaming service or dividing up regional streaming/TV rights with other folks.

One thing is for certain in today’s theatrical market is that turning a profit has gotten tougher.

Obviously, Tom Cruise is never going to allow Paramount to release Top Gun: Maverick on streaming simultaneously with the theatrical release, but few A-Listers have that kind of muscle.

Lana Wachowski’s/Keanu Reeves’ fourth in The Matrix franchise only brought in $150M+ thanks to Jason Kilar’s decision for day/date release with theaters and HBO Max. The result was rampant piracy and people around the globe watched it free–even before it opened in many countries.

Studios like Sony, MGM and Lionsgate are in a tougher position because they don’t have a streaming service to use as a movie house alternative or means of reinforcing weak theater showings.

Their options are limited to negotiating theatrical windows, selling country/area streaming/release rights and hoping for the best. Or, they can keep the video story on the shelf and wait for cinema attendance to get better.

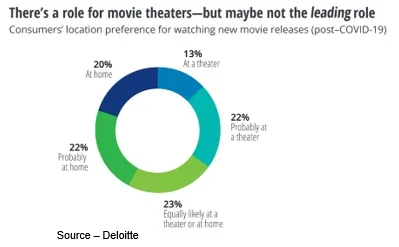

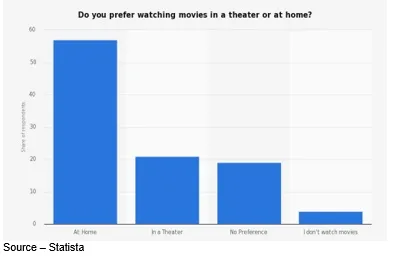

While there is growing enthusiasm to return to in-theater movies, the widespread availability of films (especially original content) at home has produced a fundamental entertainment shift.

While there continues to be a strong preference to seeing a movie the first time in a theater with friends and surrounded by strangers, people have become more comfortable with the convenience of viewing films at home where they can pause, rewind, fast-forward.

No one kicks your seat, texts, disturbs you with disruptive talking and the popcorn is probably better or at least cheaper, in addition, you can watch part of the movie, stop and switch to another movie without leaving your seat.

Yes, it is more convenient.

But … it’s different, especially when it comes to fully monetizing content which studios discovered the hard way last year.

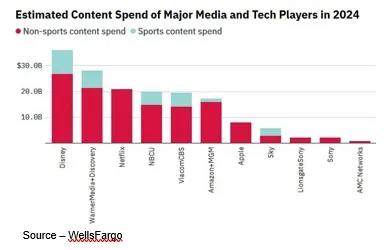

Born streamers like Netflix, Amazon, Apple, Youku, Tencent, iQiyi and others invested “modest” sums ($5M – $40M) on a steady stream of original shows/movies to attract/retain subscribers.

Studios –Disney (Marvel Studios, Pixar, Disney Animation, 20th Century, Searchlight), Warner (New Line, Warner Animation, Castle Rock, DC), ViacomCBS (Paramount), Comcast (Universal) and others–invested in tentpole ($50 – $100M+) projects, trusting they would cover/recover their investments from ticket sales around the globe and then add profits/subscribers to their subscription services.

Unfortunately, same-day theater/streamer films or small theatrical window films paved the way for immediate pirated copies resulting in distribution-choking ticket sales such as Warner’s Dune, Matrix, Space Jam, Suicide Squad; Disney’s Black Widow.

don’t have that added burden.

In addition, studio/streamers have had to keep pace with new, different, unique content to keep subscribers and attract new subscribers.

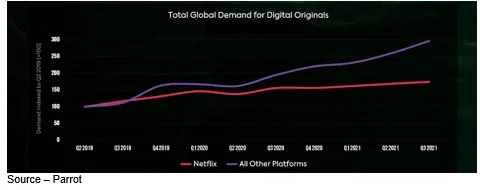

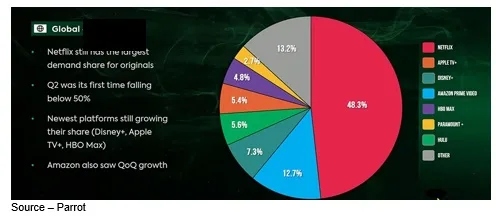

According to Hub Research, Netflix now reigns as the single most common destination for new show discovery, named by 35 per cent of viewers.

Hub executives noted that back in 2013 when Netflix called House of Cards as a Netflix Original, they positioned the service and project as more interesting and more valuable.

Netflix became a destination not a passing fancy.

to people around the globe.

to people around the globe.

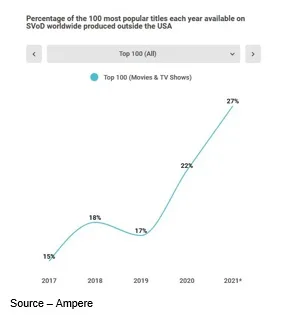

“Netflix is certainly the anchor tenant for providing programming in the U.S. and the global streaming video marketplace,” said Allan McLennan, CEP/Media, Head of M&E North America, Atos. “They led the way to recognizing the need to diversify their content offerings which enabled them to expand into and penetrate different markets with local content from those regions’ independent production companies.

“As an added benefit, they quickly found that certain regional content isn’t always entirely regional but has global appeal and reach as Squid Game, Money Heist, Lupin and Japanese anime have shown,” he noted.

But McLennan feels that one Netflix scheduling move could have had a more subtle, more important impact on the subscribers’ need to retain the service as their prime source for unique, original content.

“Three years ago, the majority of the Netflix releases were made on Fridays, just ahead of the weekend viewing,” he said. “Last year, 50+ percent of the new material was released mid-week. Now they’re releasing (and canceling) several projects each week due to their monitoring engagement rates. Consequently, subscribers to their service are motivated to watch and stay connected multiple times a week in order to not miss the next big viewing hit. A programmer’s differentiator”

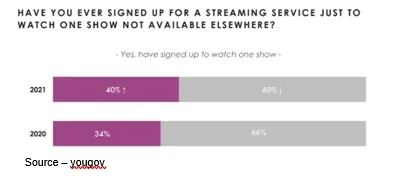

The challenge has become that the constant stream from all of the services has compelled individuals and families to spend more for their home entertainment because searching for new, unique content has become a challenge.

As a result, Hub and other home entertainment analysts report that viewers have increased their subscriptions to an average of six to seven services over the last eighteen months.

While $10-$15 a month per service is recognized as being affordable, the combined rate of $70-$150 per month is starting to force families to rethink their home entertainment options.

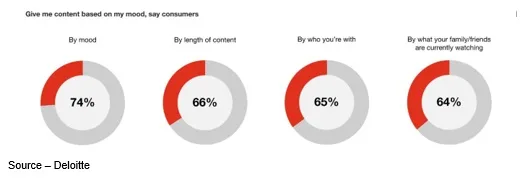

“New content will continue take center stage for subscribers,” McLennan noted, “But we believe the technically savvy services will be more subtle. Netflix, Amazon and Apple are already moving aggressively to refine and strengthen their recommendation engines. The better they can categorize and personalize show/movie recommendations for each subscriber, the better job they will do in reducing churn/subscriber turnover.”

understands the subtilties, the better it will do in meeting people’s viewing needs.

Even with the depth and breadth of subscriber information that streamers now compile, being precise in their recommendations based on all of the variables won’t be an easy task. Netflix has publicly admitted that “personalization is hard,” as viewing environments are “non-stationary, context-dependent and mood-dependent.”

The challenge for studio streamers will be in developing projects that meet the needs of their younger theater-attending audience in addition to appealing to the demographic which is happy to stay at home and watch ever-changing “unique” streaming content.

and original content. They focus on their audience to help them grow.

Despite a slight stumble in 2021, Disney is perhaps still best positioned to take advantage of its global image and footprint to get people back in theater seats, meet the at-home desires of their 200M+ global subscribers and expand its streaming base.

Even though the merger of WarnerBros/Discovery is moving along smoothly, they’re facing a headwind as Zaslav and his new team simultaneously streamline/refocus the organization and follow through with their commitment to expand their investment in content and services.

At the same time, they and studio streamers – Comcast NBCUniversal (Peacock), ViacomCBS (Paramount+), HBO (Max), BBC/ITV BritBox, AMC/Acorn, Docurama and others – are being closely scrutinized by governmental agencies such as the DOJ (Department of Justice) and FTC (Federal Trade Commission) to ensure M&A activity doesn’t lead to unfair market concentration and threaten or unfairly bar new and potential competitors.

Maybe we don’t need all 5K of the streaming services or the 200K movie screens around the globe; but the more of them that stay in business, the more opportunities A-Listers and indie content producers will have to entertain us with stuff on the screen.

No one can predict which show/film is going to put seats in seats … certainly not government officials or Wall Street’s M&A folks.

No one can predict which show/film is going to put seats in seats … certainly not government officials or Wall Street’s M&A folks.

The situation is precisely why, in Without Remorse, John Kelly said, “I’ll show them what a pawn can do to a king,”

# # #

Andy Marken – [email protected] – is an author of more than 700 articles on management, marketing, communications, industry trends in media & entertainment, consumer electronics, software, and applications. An internationally recognized marketing/communications consultant with a broad range of technical and industry expertise especially in storage, storage management and film/video production fields; he has an extended range of relationships with business, industry trade press, online media, and industry analysts/consultants.