Your Kids Make D2C Service Switching Difficult

We get really confused when industry experts say:

- People are cutting their cord because of the high cost and “unwanted” content

- Folks are jumping to streamers for the “original” content

- Guys/gals are moving to OTT for the unique content

- Gen Zs/millennials are going to switch services for their “old” favorites – The Office, Friends, Big Bang Theory

Have you looked at your Internet plus four-five OTT service bills?

Yeah, and the cost will probably rise faster than your old cable bundle bill.

Watching all the stuff they offer?

Kiddie shows don’t do much for our teenagers or us. Wife dislikes horror shows and sci-fi, so don’t get to watch them very often. And for peace in the household, we watch what they watch.

Original or unique means it’s different than what we usually watch; and if it’s different enough, we probably don’t want to watch it.

If people like original/unique, why do they move for the old stuff?

Admit it, you changed because folks are talking about saving big bucks by dropping the old guy and picking up the new kid at the office, at the club, on the plane/train, everywhere.

You picked your services (assuming you’re a parent) because the kids wanted it.

Our daughter had to see baby Yoda, so we signed up for Disney +. Then there were the sighted twins and Apple TV + joined the list.

Fortunately, our son grew up with Star Wars, and Mando, Cara make a great team.

Of course, they both like others from the two services as well as shows on Netflix, Hulu and Amazon Prime (which doesn’t really count because of free delivery).

We also added Tubi because it has a growing list of free (ad-supported) movies/tv shows.

IMBd is another great place to browse for free content, thanks to Amazon purchasing them.

And, according to Deloitte, which reported there are more than 300 streaming video services available in the US and 1K plus globally, our selection only scratched the surface.

The only thing that really sets the D2C services apart is original (different) content.

In other words. we shaved our cable to D2C because the family wanted to watch their content on their terms – when, where and on their preferred screen.

That’s a great convenience and our total cost – right now – is less than our old all-inclusive cable service bill which rose steadily over the past few years compared to inflation.

We just about choked when a Comcast spokesperson told Consumer Reports that they try to hold costs down, but prices increase because consumers demand certain programming.

The last we heard, they charge both sides – consumer and network – and take a little out of the middle – 16-20 minutes out of every hour are devoted to ads.

And to make their annual numbers with people bailing on their service, they are “forced” to charge more for the fixed day/time viewing.

Fortunately for all of us, the spokesperson added that the company will continue to make investments which have included NBCUniversal and Britain’s Sky Communications to give customers more for their money.

We shaved the cable and added the services with our eyes wide open because we realize streaming isn’t going to magically get cheaper as more people subscribe.

We found it humorous when NYU business professor Peter Newman said, “There’s always the threat that once they hook you, they’ll raise the prices later.”

M&E expert Allan McLennan, PADEM Media Group’s Chief Executive, emphasized that streaming is a rather new phenomenon for providers and consumers.

“Right now, everyone – technology, media and telecom players – is riding the wave to get as many consumers as possible to add their service to their growing library of streaming services,” he said.

“Over the next two years we’ll see a lot of millennial and Gen Z subscription churn as people switch from one special offer to another and creatively figure out how to watch as much as possible for as little as possible,” McLennan commented.

However, he did say that the change has brought M&E companies closer to their customers than ever before, which could work to the advantage of both parties.

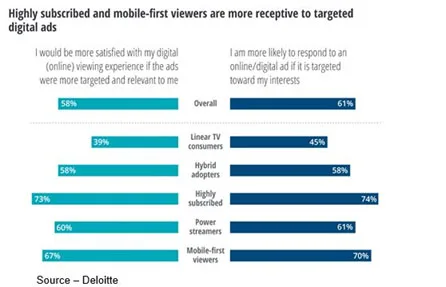

“Some people simply do not want their content interrupted and they are willing to pay more to have it ad free,” McLennan said. “Others want maximum choice and availability while still other subscribers will be willing to accept ads for a discount in the service cost.

“Ad acceptance will improve as people begin to realize that ad space will be reduced from 16-20 minutes down to 8 and the ads will be more personalized,” McLennan added. “And personalization will improve with experience.”

Another option, which is certainly available to Apple and others, is offering the full range of sensory services – video, music, reading, gaming – in a gotta’ have bundle.

Music streaming had an increase of 58 percent last year to 41 percent, 39 percent of US consumers already subscribe to gaming services and 41 percent play video games daily/weekly.

Nothing is more logical than offering multiple services at a bundled price, making it very hard to leave.

All of that is well and good for satisfying the “older” audiences but the major emphasis this year is on delivering real, complete, family friendly content … stuff the little kids will want to watch so more mature viewers can enjoy exciting films/shows after the little ones have been put to bed.

It seemed logical that Alphabet’s YouTube could have a special dedicated, age-appropriate channel – YouTube Kids – and have an inside track to capturing a huge global market.

The idea has been a total bust!

Instead of young, innocent material to enjoy, it has been flooded with conspiracy videos; obviously disturbing clips; and to put it simply, terrible content.

With 500 hours of video uploaded every second, you just know there are going to be wierdos and kinkies out there wanting to expose your kids to stuff that even their dogs turn their backsides to … yeah, that bad.

They keep working on their parental controls but if mom/dad must be there to check every video they click on, they’d much rather pay a few bucks here and there for trustworthy services that serve up content kids want to watch and that parents want them to watch!

In addition, they paid $170M last year for targeting ads at little kids and harvesting data on children.

Social media sites just can’t seem to resist!

One of the biggest frustrations Netflix subscribers have is that personal favorites will suddenly disappear from the schedule, often because the contract period is over, and the studio has other plans for the show.

That’s sorta’ understandable by an adult or Gen Zer, but a toddler?

Not so much!

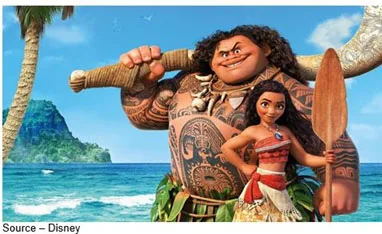

When Disney decided it was time for Moana to come home in December, they knew it wasn’t going to be a happy Christmas.

Fortunately, Hastings and team were planning ahead, even before Iger and the Disney folks were planning their launch.

Worldwide, there are about 127.35M households (83.09M in the US) with an average of 3.4 people per family (2.6 in US). As of mid-last year, 26 percent of the world’s population was Gen Alpha, under 15 years of age.

Just as parents don’t want their youngsters to be exposed to unseemly stuff, if you offer them entertainment kids gotta’ have, they’ll sign in a heartbeat.

Nearly 60 percent of Netflix customers (about 83M households), watch kid and family content which is why the company invested heavily in showrunners, producers and creative folks from DreamWorks Animation and other studios around Hollywood.

To help kids forget about Moana (fortunately, they have a short attention span) they unleashed Klaus, Kid Cosmic, Ghee Happy and a pipeline of content for the younger audience.

With a major focus on international growth, animation will play a key role in capturing new customers in the 192 countries where Netflix has a presence.

Alan Wolk, co-founder of TVREV noted that animation is critical to the firm’s growth plans because films can be easily dubbed into local languages and the stories often transcend geographic barriers.

Ted Sandos, Netflix’s chief content officer, has noted that the complete family fare is important because shows for children help the company build trust in the firm’s content which, in turn, builds habits as well as long-term subscriptions and localized recommendations to other parents.

Sandos is optimistic that new animated series like The Boss Baby: Back in Business and preschool show The Mighty Little Bheem will produce significant international growth.

It’s an approach that has been proven very successful for Disney, which offers access to more than 500 titles like Sleeping Beauty and Moana as well as a growing roster of kid-friendly movies and series.

Disney+ is placing special emphasis on family content, with nothing higher than a 13-years age rating.

Folks looking for some of the more mature content can add Hulu to their bundle; and while you’re at it, add ESPN to throw dad a bone … the threesome won’t cost much and everyone in the family will be happy.

While Apple TV+ admittedly has a lean lineup of content right now, the company also knows it has a global potential viewing market of more than 100M customers and has planned for kid viewers at the outset with Snoopy in Space and several other kid shows.

As Ampere so aptly pointed out, there’s no “new” money in the world and the adjusted family income hasn’t increased in recent years; so, families are willing to shift their entertainment expenditure from the cable bundles to the flexibility and versatility of D2C content distribution.

With the kids helping parents choose the early services (Netflix, Apple TV +, Disney +) and families taking advantage of the “added benefits” of Amazon Prime as well as the free viewing options such as Tubi TV or Pluto TV, you have to wonder how much more “entertainment convenience” consumers are willing to “take advantage of.”

Parents will probably find it difficult to switch services for themselves when kids are involved.

Parents will probably find it difficult to switch services for themselves when kids are involved.

The Gen Alphas will look up at mom and dad and repeat Andrea Vogel’s statement, “Lloyd, please don’t ruin my childhood.”

Maybe you can do it, but we sure can’t!

# # #

Andy Marken – [email protected] – has authored more than 600 articles on management, marketing, communications, industry trends in media & entertainment, consumer electronics, software and applications. He is an internationally recognized marketing/communications consultant with a broad range of technical and industry expertise–especially in storage, storage management and film/video production fields. And has an extended range of relationships with business, industry trade press, online media and industry analysts/consultants.