DTC Winners Need Quality, Quantity, Focus

People learn it in Marketing 101 – don’t mention your competition in your pitch and certainly don’t knock them.

When you do you make the prospect think, “Gee, maybe I should take a closer look at them.” or worse, “Darn, hadn’t even considered them … ‘till now.”

And yet, the boss just can’t seem to keep from poking fun at the competition; or worse, saying they’re not even in the company’s marketplace.

You know:

Apple is like a mutant virus, escaping from the traditional structure of the PC industry, but the industry will still eventually build up immunity – Stan Shih, Acer

Google’s not a real company. It’s a house of cards – Steve Ballmer, Microsoft

Television won’t be able to hold onto any market it captures after the first six months. People will soon get tired of staring at a plywood box every night – Daryl Zanuck, 20th Century Fox

We think HBO is a very, unique asset of–in fact, as you think about where HBO fits, I think of Netflix kind of as the Walmart of SVOD, HBO is kind of Tiffany. It’s a very premium, high-end brand for premium content – Randall Stephenson, AT&T

Neither Redbox nor Netflix are even on the radar screen in terms of competition – Jim Keyes, Blockbuster

What the hell does the Nano do? Who listens to 1,000 songs? – Ed Zander, Motorola

There is no reason anyone would want a computer in their home – Ken Olsen, DEC

Netflix is a little bit like, is the Albanian army going to take over the world – Jeff Bewkes, Times Warner

The notion that [companies like Netflix] are replacing broadcast TV may not be quite accurate. I think we need a little bit of perspective when we talk about the impact of Netflix – Alan Wurtzel, NBCU

If you’re not afraid of someone … give ‘em a sign!

If you’re not afraid of someone … give ‘em a sign!

Okay, so Netflix is the big gorilla in the room when it comes to streaming content.

They may not have invented it, but they did perfect it and they’ve been expanding it around the globe, proving that if you have the right amount of data and know how to use it, you can introduce content critics may dislike but viewers can’t get enough of.

You also prove the stuff that’s made in the U.S. is liked by folks in France, Japan, Australia and Peru—heck, just about all of the 190 countries where they have subscribers.

Some country officials thought they’d “penalize” Netflix by saying a certain percentage – say 30 percent – of the content they show in the country had to be made in their country.

Holy cow!

People in the U.S. and Canada actually like the video stories from Mexico, India, Italy and New Zealand … anywhere when they’re properly dubbed or are close-captioned.

It’s natural for folks in the M&E industry to keep a close eye on Netflix but they aren’t alone in the expanding global streaming market and there are opportunities for niche players as well.

The industry was a reluctant partner with Netflix ever since they broke the home entertainment mold – get a red envelope DVD in your mailbox or go to the corner store for your rental or wait a year for the network to schedule it.

In 2007, they launched streaming video to your PC then OTT to your smart TV and finally, to our kids’ smartphone.

Since then, they’ve been investing (heavily) in scripts, content and global expansion.

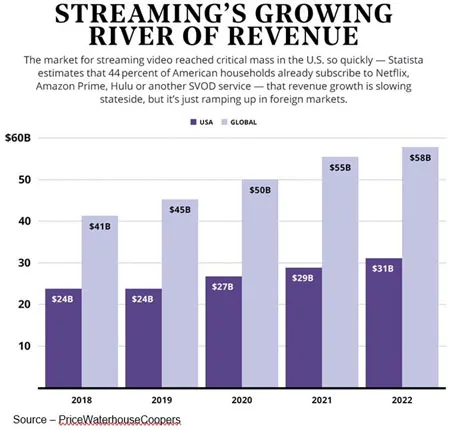

They not only upset the natural order of things; but together, they turned OTT into a huge and growing global market – $30B in 2015 and an estimated $65B in 2021.

While the demand for high-quality, paid-for video service delivered OTT is growing in every corner of the globe; the U.S. continues to be largest, growing from $8.3B in 2015 to an estimated $23B in 2021.

China added $6.3B in revenue and viewing in the country will quintuple by 2021.

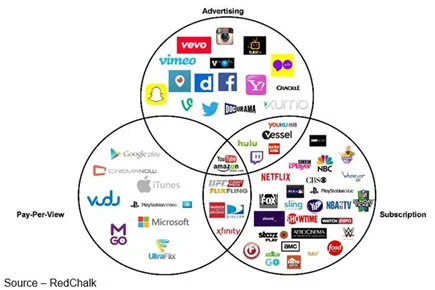

Of course, Netflix didn’t overturn the cable and studio system all by itself. It had the help of FAANG (Facebook, Apple, Amazon, Netflix, Google) and BAT (Baidu, Alibaba, Tencent) as well as new entrants including networks like HBO, Hulu CBS, ABC and BBC.

You know, anyone who was looking for closer relationships with viewers went DTC (direct to consumer).

Of course, AT&T’s Stephenson had to crow about one of the jewels he got in the Time Warner merger … HBO.

However, the timing of his verbal positioning at IBC could have been a little better.

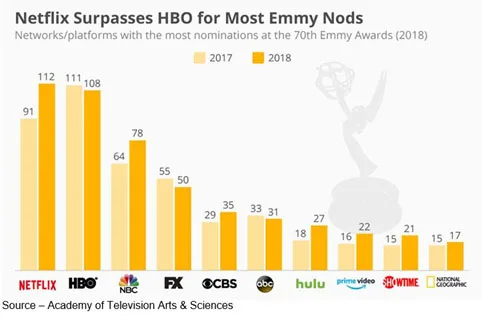

Walmart (Netflix) racked up more Emmy nominations than Tiffany (HBO) in this year’s award competition.

That hurt the old ego!

Then, when the awards were announced, the premiere cabler and streaming giant tied for the number of Emmy’s they took home – 23 each.

Even before that – right after the merger – John Stankey, WarnerMedia CEO, told HBO it needs to be more profitable and change direction.

That’s difficult because Netflix spends 4X what HBO does for fresh content.

Regardless, Stankey and Stephenson want to focus the brand on battling Netflix globally for subscribers. Or, put differently – deliver quantity, not quality.

Netflix has 130M subscribers in 190 countries while HBO’s numbers are more difficult to determine because many are part of cable bundles in the Americas and not really well known globally.

Not overly concerned, Netflix has a different goal … it’s lusting after an Oscar this year.

Alfonso Cuarón’s Roma may just be its ticket to ride … great reviews and eye-watering photography. The Oscar-winning director of Gravity is a Spanish-language story about child-care workers in Mexico in the ‘70s and covers all of the bases – race, class, feminism and U.S.-Mexico relations.

Roma’s Oscar race is a melodrama all by itself because Netflix lusts for industry recognition, even as it dislikes the conventional movie business.

The feeling is a little bit mutual, but studios are still happy to have Netflix pay them to produce their streaming offerings.

This go-around, Netflix is even considering a limited theatrical release (one of the selection criteria) while still placing special emphasis on its streaming subscribers.

Cuarón feels Netflix is getting an unfair rap in this issue. “Everyone focuses on Netflix, but no one looks at the other side: the exhibitors,” he said, referring to the industry term for theater owners. “They’re living in the ’90s. They need to be in the present.”

If Roma can take home an Oscar, it opens the door for other filmmakers and stars who want to be in contention for an Oscar but still want to work outside Hollywood’s conventional studios.

In addition, Netflix has two other Oscar contenders – The Ballad of Buster Scruggs and 22 July.

But one of the ‘90s folks is more than ready, willing and able to be in the present!

Disney came to play.

First, Bob Igor cut Netflix and ended the streaming relationship saying they were going to set up their own DTC channel.

Igor has a rich library and a solid set of studio efforts that we’re certain folks around the globe would like to have sent direct to them.

In addition, he and his team live and breathe content … and technology.

And come on, who doesn’t like Mickey, Bambi, Snow White and the Marvel crusaders?

To prove he was serious, Igor scooped up 21st Century Fox entertainment.

The move doubles Disney’s size/clout and gives it enough content and international assets to attract subscribers … everywhere.

Combined, the company owns 7 out of 10 highest-grossing films and accounts for roughly one-third of the U.S. studios revenues.

The big question is, what happens to Hulu?

It’s a great streamer with a strong following and a steady focus on what viewers want. The problem is it’s jointly owned by Comcast, Fox, Disney and Turner (AT&T).

Time will tell.

Despite all of the attention on the big hitters the global hunger for streaming content seems almost insatiable.

That means it is possible for organizations to not focus on the 7.7B people on the planet, just the 5, 10, 20M people who want something special, unique, different.

In the packed IBC niche streaming service sessions, they discussed how distinctiveness can work in their favor if they don’t lose sight of the unique entertainment needs of the audience.

There are folks out there who have – AVOD or SVOD – Netflix, Amazon, Disney, etc.; but don’t want to spend hours browsing and then simply settle for something to watch.

What is missing in the fire hose service offerings are things like award-winning foreign language drama; local market curated films/series; horror, sci-fi, comedy, romance, documentaries and historical content.

You know, a single place you can go to and know BAM! you can binge to your heart’s content.

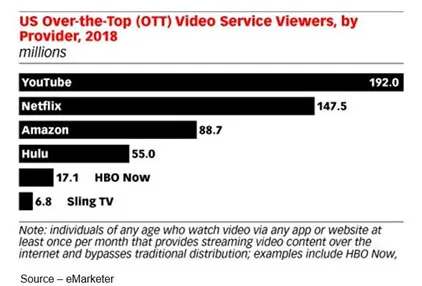

If AT&T’s Stephenson is looking for a Walmart (other than a Walmart that is working on a streaming service), he should really keep a wary eye on YouTube.

YouTube’s parent, Google, is the ad placement king that is making a bundle from Gen Z, teen and tween viewers. They enjoy watching a broad spectrum of short/long video — unpackaging, game play, makeup/lifestyle, guy/gal stuff and dumb/dangerous stuff mixed in with good content like the TED channel.

YouTube has billions of folks logging in every month to watch a sliver of the 300 hours of content uploaded every minute.

And if you’re wondering where you can find VR content, they have hundreds of thousands of hours of content just waiting for people to immerse themselves in.

Most of the stuff is watched on smartphones but they also have 180M hours of viewing on the TV every day as well.

They could easily become the bloated bundle of the OTT world.

And if kids start out with that as their DTC service of choice, we personally hope someone will tell them as Nolan told Irisa, “Yeah, I taught you that, you really have to stop listening to me. I’m an idiot.”

And if kids start out with that as their DTC service of choice, we personally hope someone will tell them as Nolan told Irisa, “Yeah, I taught you that, you really have to stop listening to me. I’m an idiot.”

There’s just too much good/great content being developed by experienced video storytelling pros.

We’d sure hate to see them miss it.

# # #